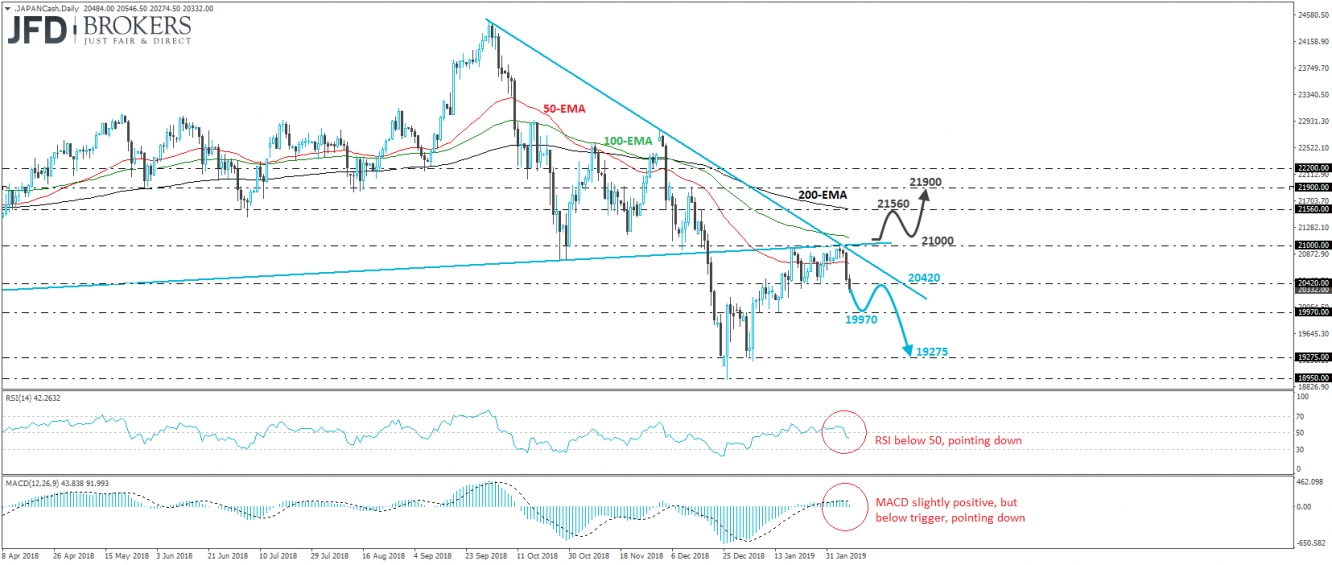

The Nikkei 225 cash index traded lower today, breaking below the support (now turned into resistance) barrier of 20420. The index entered a sliding mode this week after it tested the crossroads of the prior upside support line drawn from the low of March 23rd and the downside resistance line taken from the peak of October 1st. The crossroads coincided with the 21000 key barrier, which provided strong resistance on January 18th and was also a decent support on December 10th. Having all that in mind, we would consider the near-term outlook to be negative for now.

We believe that the break below 20420 may have opened the way towards the 19970 territory, marked by the lows of January 7th and 14th. If the bears are strong enough to overcome that zone, then we may see them adding to their positions, and perhaps driving the price towards the 19275 area, which is near the lows of January 2nd, 3rd, and 4th.

The RSI turned down and dipped back below its 50 line, while the MACD, although slightly positive, lies below its trigger line and looks able to obtain a negative sign soon. These momentum indicators suggest that the index is gaining negative speed, which supports the notion for some further declines, at least in the short run.

On the upside we would like to see a clear close above the aforementioned upside line taken from the low of March 23rd before we start examining whether the bulls have gained the upper hand. Such a move would also place the index above the 21000 key territory, that way confirming a higher high above the downside line drawn from the peak of October. Upside extensions towards the high of December 17th, at 21560, could then be possible, the break of which may allow Nikkei to travel further north, towards the 21900 area, near the peak of December 13th.