- Monday, 5 August significant sell-off in the Nikkei 225 has triggered a potential bullish key reversal inflection week.

- Citigroup Economic Surprise Index for Japan staged a positive turnaround on Monday, 5 August which suggests an improvement in macro data.

- The percentage of Nikkei 225 component stocks trading above their respective 200-day moving averages has reached an extremely low level; a potential capitulation of bearish pressure.

- Watch the 30,460 major key support on the Nikkei 225

This is a follow-up analysis of our prior report, “Nikkei 225: Bullish breakout with improved market breadth” published on 27 June 2024.

Since our last publication, the price actions of Japan’s Nikkei 225 have managed to stage the expected rally and hit a fresh all-time of 42,427 on 11 July 2024, just below the lower limit of 42,600/43,400 medium-term resistance zone.

In the recent two weeks, the Nikkei 225 has succumbed to significant waves of bearish pressure due to a concoction of adverse events; especially via systemic funds flow positioning that led to a disruptive unwinding of risk-on-carry trade strategies.

On Monday, 5 August, the Nikkei 225 plummeted by 12.40%; its worst daily performance since October 1987 “Black Monday” crash.

Also, its current 4-week max drawdown (highest to lowest) from the week of 8 July to 13 August stands at -26.60%, its worst 4-week drawdown since the outburst of the Covid-19 pandemic where it shed -31.30% from the week of 17 February 2020 to 16 March 2020.

Interestingly, 3 factors suggest that the climatic sell-off seen on Monday may have triggered a key bullish reversal inflection point for the Nikkei 225.

Fundamentals Have Improved in Japan

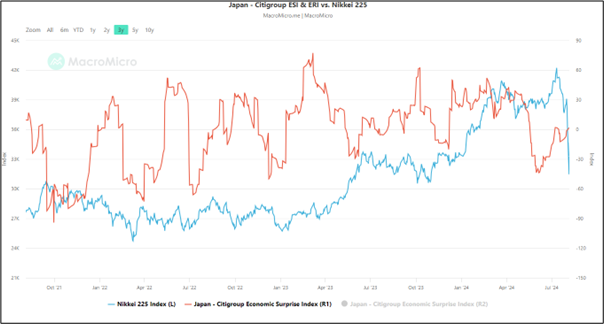

Fig 1: Japan Citigroup Economic Surprise Index as of 5 Aug 2024 (Source: MacroMicro)

The Citigroup Economic Surprise Index (ESI) for Japan has rebounded back to a positive level of 1.60 as of Monday, 5 August after it dipped and remained in negative territory since 16 July (see Fig 1).

The ESI is the sum of the difference between the actual value of various economic data and their consensus forecasts. If the Index is greater than zero, it means that the actual values of these economic data on the aggregate are generally better than expected.

Hence a turnaround of the ESI from negative to positive is considered a potential catalyst to support a strengthening of the Nikkei 225.

Nikkei 225 Component Stocks Above 200-Day Moving Averages Hit An Extremely Low Condition

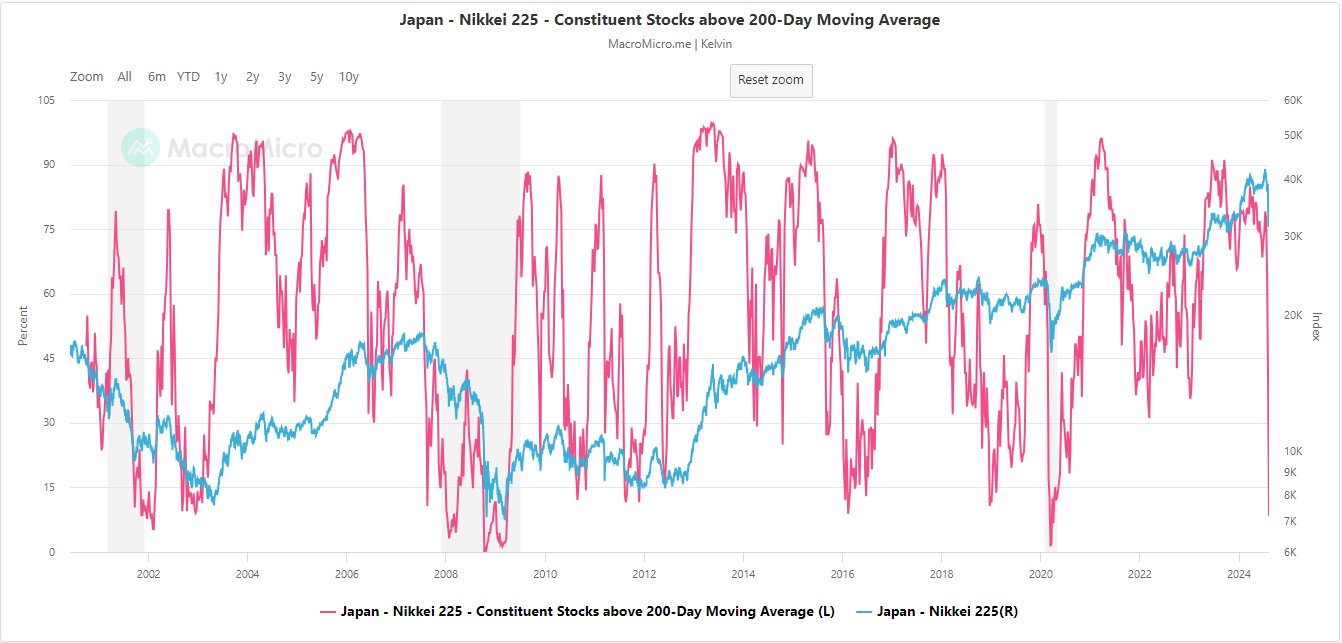

Fig 2: Percent of Nikkei 225 component stocks above 200-day MA as of 8 Aug 2024 (Source: MacroMicro)

Monday, 5 August bloodbath impacted almost all sectors and stocks in the Nikkei 225 as the percentage of its component stocks above their respective 200-day moving averages torpedoed to a low level of 8.44% (see Fig 2).

The current reading of 8.44% is its 8th-lowest level in the past 24 years; prior extreme low levels were recorded in March 2020 (1.33%), March 2009 (2.22%), October 2008 (1.71%), March 2008 (4.46%), January 2008 (3.14%), February 2002 (5.36%), and December 2001 (7.69%).

Also, such extremely low levels have coincided with prior bullish reversal inflection zones for the Nikkei 225.

Therefore, the current 8.44% level of Nikkei 225 component stocks that are trading above 200-day moving averages can be considered as an extreme bearish sentiment outlier, and from a contrary opinion perspective such behaviour may indicate a capitulation of the bearish pressure.

JGB Yield Curves Are Still In Steepening Mode

Fig 3: JGB yield curves major trends as of 8 Aug 2024 (Source: TradingView)

Since June 2022, the steepening of the Japanese Government Bond (JGB) yield curves, both the 10-year minus 2-year and 30-year minus 2-year have moved in direct tandem with the major uptrend phase of the Nikkei 225 (see Fig 3).

The past four weeks of push-down in the JGB yield spreads have started to stage bounces at their respective key medium-term support levels; 0.53% (10-year minus 2-year), and 1.66% (30-year minus 2-year).

Therefore, this set of Intermarket dynamics from the potential continuation of the steepening of the JGB yield curves may lead to a positive movement in the Nikkei 225.

Watch the 30,460 Major Key Support on the Nikkei 225

Fig 4: Nikkei 225 major trend as of 8 Aug 2024 (Source: TradingView)

The current price actions of the Nikkei 225 have started to shape an impending weekly bullish reversal “Hammer” candlestick pattern; considered a bullish key reversal week in the lens of technical analysis.

A clearance above 37,070 medium-term resistance (also the 200-day moving average) increases the odds of a medium-term recovery for the next medium-term resistance zone to come in at 42,600/43,400 (see Fig 4).

However, a weekly close below 30,460 long-term pivotal support invalidates the recovery scenario to kick start a potential multi-month corrective decline phase to expose the next major support at 25,770 in the first step.