Athletic footwear and apparel maker Nike Inc (NYSE:NKE) late Tuesday posted market-beating second quarter earnings results, as profit and revenue were better than expected, despite weakening margins.

The Beaverton, OR-based company reported Q2 EPS of $0.50, which was $0.07 better than the average Wall Street estimate of $0.43. Revenues rose 6.4% from last year to $8.18 billion, also beating analysts’ view of $8.09 billion.

Revenues for the Nike brand grew 8% to $7.7 billion in the latest period, helped mainly by strong growth in the Western Europe, Greater China and the Emerging Markets geographical areas. Revenues for Converse rose 5% from last year to $416 million, with the bulk of the growth coming from North America.

Gross margin fell 140 basis points to 44.2%, missing NKE’s 44.35% guidance. Margins were hampered by higher product costs, more discount sales, and foreign exchange effects.

Nike’s inventories also rose 9% to $5.0 billion, which it blamed on a “one percent increase in NIKE Brand wholesale unit inventories and increases in average product costs per unit primarily due to product mix, as well as higher inventories associated with growth in DTC.”

The company commented via press release:

“NIKE’s ability to attack the opportunities that consistently drive growth over the near and long term is what sets us apart,” said Mark Parker, Chairman, President and CEO, NIKE, Inc. “With industry-defining innovation platforms, highly anticipated signature basketball styles and more personalized retail experiences on the horizon, we are well-positioned to carry our momentum into the back half of the fiscal year and beyond.”

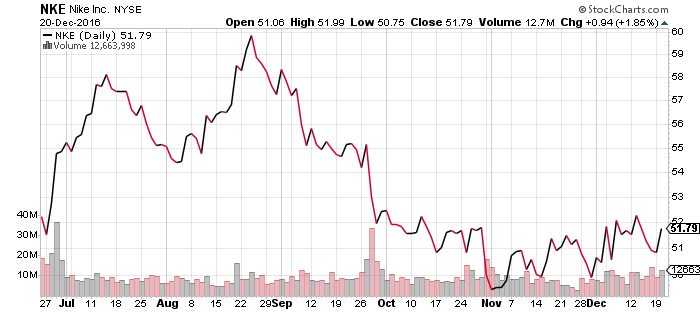

Nike shares rose $1.06 (+2.05%) tp $52.85 in after-hours trading Tuesday. Prior to today’s report, NKE had fallen 17.14% year-to-date, versus an +11.05% gain in the benchmark S&P 500 index during the same period.