Early bird Nike Inc (NYSE:NKE) will get a jump-start on this fall's earnings season this week, set to report its fiscal first-quarter earnings tomorrow after the close, Sept. 24. Ahead of the event, NKE options traders have come out of the woodwork in larger-than-normal numbers, with some eyeing a post-earnings pullback from the apparel giant.

Less than two hours into today's trading, almost 10,000 options have changed hands on NKE. This is three times what's typically seen at this point in the session, and volume pacing for the 96th percentile of its annual range. Specifically, the weekly 9/27 82- and 87.50-strike puts are active, with new positions being opened at both. This indicates options traders are targeting a sharp drop from NKE by the end of this week, when the options expire.

Looking at Nike's earnings history, the security has closed lower the day after earnings four times over the past eight quarters, including a 6.6% drop in March and a 1.3% fall last September. This time around, the options market is pricing in a one-day, post-earnings swing of 7.6%, regardless of direction, compared to an average post-earnings move of 3.9% over the past two years.

Short-term options traders are put-heavy on the Dow stock lately, based on the Schaeffer's put/call open interest ratio (SOIR) of 1.07. Not only does this show that put open interest in the front three-months' series of options outweighs call open interest, but the 70th annual percentile ranks shows such a put-skew is rare.

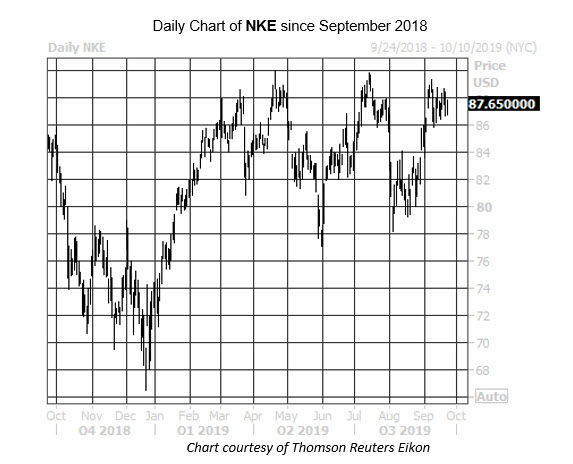

On the charts, Nike (NYSE:NKE) stock -- up 1.1% to trade at $87.65 at last check -- has spent the past month consolidating between the $86-$89 area. Just above here sits NKE's record high of $90 from April 18, but its also an area that turned away a rally in July. Year-over-year, the shares are clinging to their breakeven point.