Nike Stock Has Been More Volatile Than Usual

It's been a volatile stretch for Nike (NYSE:NKE), per its 60-day historical volatility of 30.4% – in the 100th annual percentile. The options market is expecting even more volatility for NKE shares after the athletic apparel retailer reports earnings after the market closes Thursday.

Specifically, Trade-Alert places the implied earnings deviation for Nike at 10.3% – more than double the 4.5% next-day move the stock has averaged over the past two years. Those earnings reactions have been equally positive and negative in the last eight quarters, with just post-earnings performances (11% one-day gains in June 2017 and 2018) large enough to exceed the move the options market is pricing in this time around.

At least some options traders are betting on NKE's post-earnings price action to resolve to the upside. The December 70 call has seen the biggest increase in open interest over the last two weeks and data suggests a number of these options were bought to open on Monday. If this is the case, the call buyers expect Nike to break out above $72.50 by expiration at the close this Friday, Dec. 21.

Meanwhile, short-term volatility expectations have ramped up ahead of earnings, as evidenced by the stock's 30-day at-the-money implied volatility (IV) of 38.9% – in the 99th annual percentile. Plus, the 30-day IV skew of 16.5% registers in the 89th percentile of its 12-month range, indicating short-term call premiums have rarely been cheaper, relative to puts.

Outside of the options pits, short sellers have been increasing their exposure to Nike. Short interest jumped 14.7% in the most recent reporting period, but the 11.59 million shares currently sold short account for just 0.9% of the equity's available float.

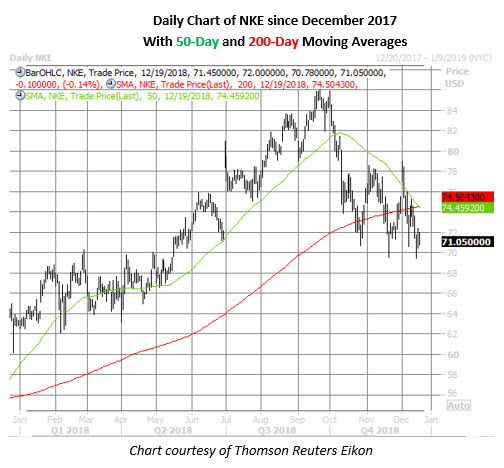

Looking at the charts, Nike shares topped out at a record high of $86.04 on Sept. 21, before pulling back dramatically in October alongside the broader equities market. And while the Dow stock has recently found a foothold near the $70 mark – a former layer of resistance that coincides with its +10% year-to-date return – its 50-day and 200-day moving averages just formed a death cross for the first time since October 2017.

On Wednesday, NKE stock was down 0.1% to trade at $71.05.