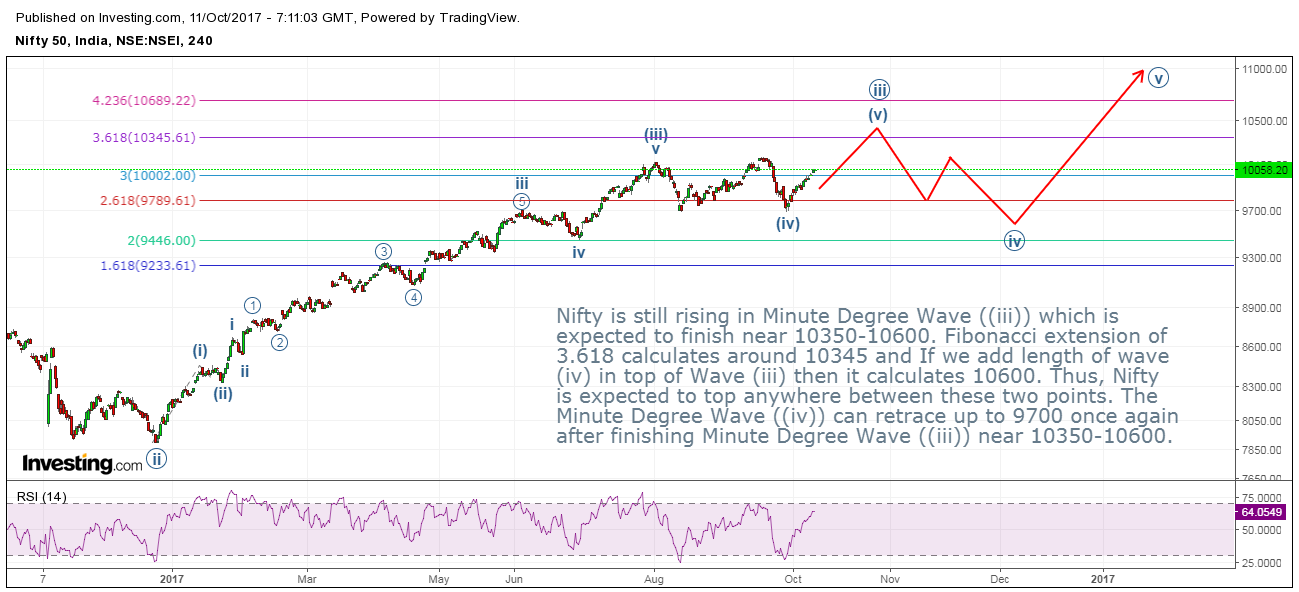

Nifty 50's near-term (1-2 months): Rising in a Minuette Degree Wave (v) of Minute Degree Wave ((iii)) - Target 10350-10600. Nifty is still rising in Minute Degree Wave ((iii)), which is expected to finish near 10350-10600. Fibonacci extension of 3.618 calculates around 10345 and If we add the length of wave (iv) in top of Wave (iii), then it calculates 10600. Thus, Nifty is expected to top anywhere between these two points. The Minute Degree Wave ((iv)) can retrace up to 9700 once again after finishing Minute Degree Wave ((iii)) near 10350-10600.

Nifty Short Term (6-8 months): Targeting above 11000 till July 2018: short-term trend in Nifty remains up, if we consider the period of 6-8 months. First it can move toward 10350-10600 within next 1-2 months and then retrace towards 9700-9500 for the next 2-3 months and again start rising toward 11000-11600 till July 2018. A significant top as intermediate degree wave (3), which started since December 2011 can conclude near 11000-11600 till July 2018. Thus, for short-term trader, every dip toward 9700-9500 is buying opportunity till Mid 2018.

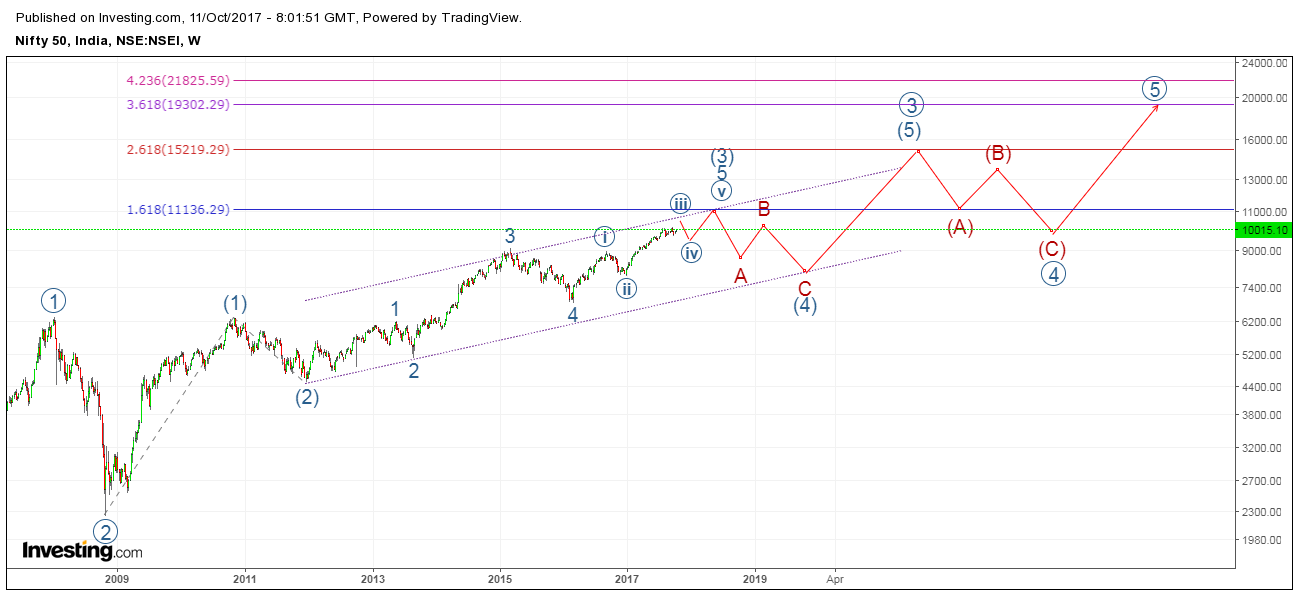

Nifty Long Term (3-5 years): Targeting above 13000-15000 till end of year 2022: The long-term trend in Nifty remains positive, which targets 13000-15000 till the end of year 2022. Moreover, if we take little longer time frame then, it may reach 19000 till the end of year 2027-2028. Thus, for long-term trader, there is huge buying opportunity for the next 10 years on every significant drop in the index.