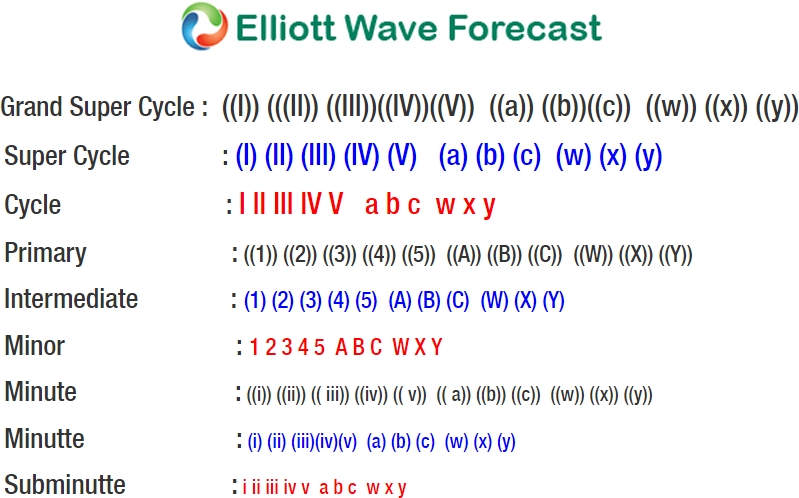

Short term Nifty Elliott Wave view suggests the rally to 9709.3 ended Intermediate wave (1), and the pullback to 9449.06 low ended Intermediate wave (2). Intermediate wave (3) is unfolding as an Elliott wave double three structure where Minor wave W of (3) is currently in progress towards 9894.8 – 9954.5.

Up from 6/30 low at 9449.06, Minor wave W of (3) is unfolding as an Elliott Wave double three structure where Minute wave ((w)) ended at 9700.7 and Minute wave ((x)) ended at 9642.65. Wave ((y)) is in progress also as a double three structure where Minutte wave (w) ended at 9830.05, and Minutte wave (x) pullback is proposed complete at 9778.85.

Near term focus is on 9894.8 – 9954.5 to complete Minor wave W and end cycle from 6/30 low. Afterwards, Index should pullback in Minor wave X in 3, 7, or 11 swing to correct cycle from 6/30 low before the rally resumes. We don’t like selling the Index and expect buyers to appear once wave X is complete provided pivot at 9449.06 stays intact.

NIFTY 1 Hour Elliott Wave Chart