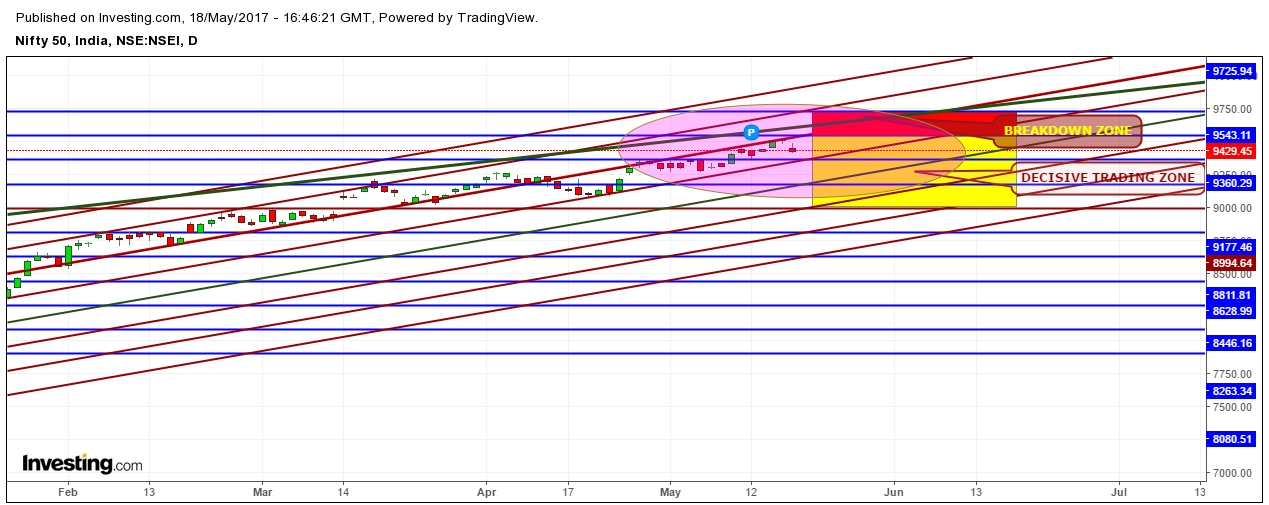

Nifty futures price felt a little jolt on May 18th, 2017 with a sudden appearance of a Gap Down in a daily chart during an uptrend journey, which has witnessed a convincing continuation since December 26th, 2016. On analysis of the movement of Nifty futures in different time zones, I find that the valuations of most of the shares are over stretched and most of them are in overbought territory. Secondly, I find the appearance of a same bearish hammer in a weekly chart, as appeared before a fall in September 2016.

If the historical movements of Nifty reappear in the weekly chart, it will definitely result in a nose dive move which historically comes without warning when hedge funds take any geo-political event as a good opportunity to book profit.

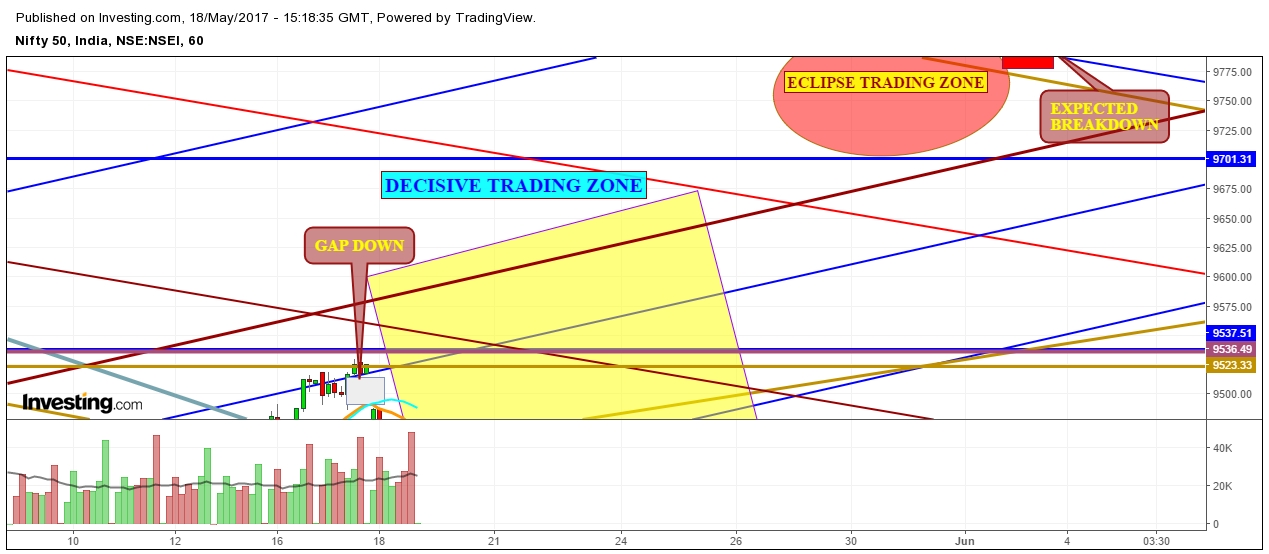

I find the movement of Nifty futures price in 1 Hr. chart needs to be kept under close watch along with geo-political turmoil which may prove hazardous for the Indian Indices. I conclude different trading zones in 1 Hr. chart which will reflect the upcoming moves in the days ahead. Any deviation of the Nifty futures price outward of these zones may be turned all equations in negative territory.

Have a Nice Trading Time.

Disclaimer: I do not have any position in Indian Indices. One may create a position at his or her own risk.