Nielsen Holdings plc (NYSE:NLSN) recently announced that it will start crediting Facebook (NASDAQ:FB) , Alphabet (NASDAQ:GOOGL) owned YouTube and Hulu distributed video content.

The measurement giant will do this through its Digital Content Ratings system launched in September last year. The system measures audience across digital content types - video, audio and text - for all connected devices and is fully comparable to TV ratings.

With the new move, both digital and TV publisher clients of Nielsen will be able to have a comprehensive view of the different ways their digital content is watched across these platforms. They can understand their audience in a better way and accordingly maximize the value of their content.

Publishers can now provide advertisers and agencies rich data about current media consumption trends, with comparable metrics, and help them make more informed decisions.

Jessica Hogue, senior vice president of product leadership at Nielsen stated, “These are three of the biggest and most meaningful platforms” for media companies and advertisers. She added “We believe what we are providing here are audience insight and intelligence that advertisers can have confidence in.”

We observe that Nielsen has lost 3.5% of its value year to date against 21.2% growth of its industry.

Our Take

The move underscores Nielsen’s strong position in viewership data and analytics across television, online and mobile screens. We believe that the move will help Nielsen expand its client base and boost its Watch segment revenues. The performance of the segment was particularly strong in the last quarter.

Revenues from this segment were $821 million (50% of total second quarter revenue), reflecting an increase of 10.3% year over year or 10.9% on a constant-currency basis.

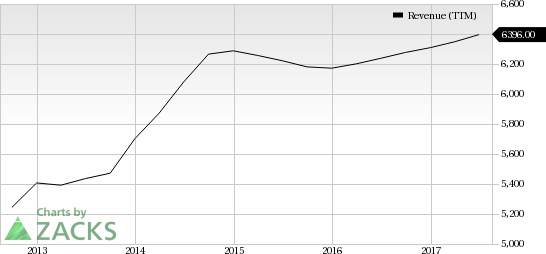

Nielsen N.V. Revenue (TTM)

The increase came on the back of continued strength in Audience Measurement and Marketing Effectiveness, which improved 15.5% and 16%, respectively, on a constant-currency basis. Excluding the acquisition of Gracenote, Watch revenues increased 4.3% or 4.7% on a constant-currency basis. (See More: Nielsen Q2 Earnings Grow Y/Y, Revenues Miss Estimates)

Zacks Rank

Currently, Nielsen is a Zacks Rank #5 (Strong Sell) stock.

A better-ranked stock in the wider technology sector is Advanced Energy Industries (NASDAQ:AEIS) with a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term expected earnings per share growth rate for Advanced Energy Industries isprojected to be 13%.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Nielsen N.V. (NLSN): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Advanced Energy Industries, Inc. (AEIS): Free Stock Analysis Report

Original post