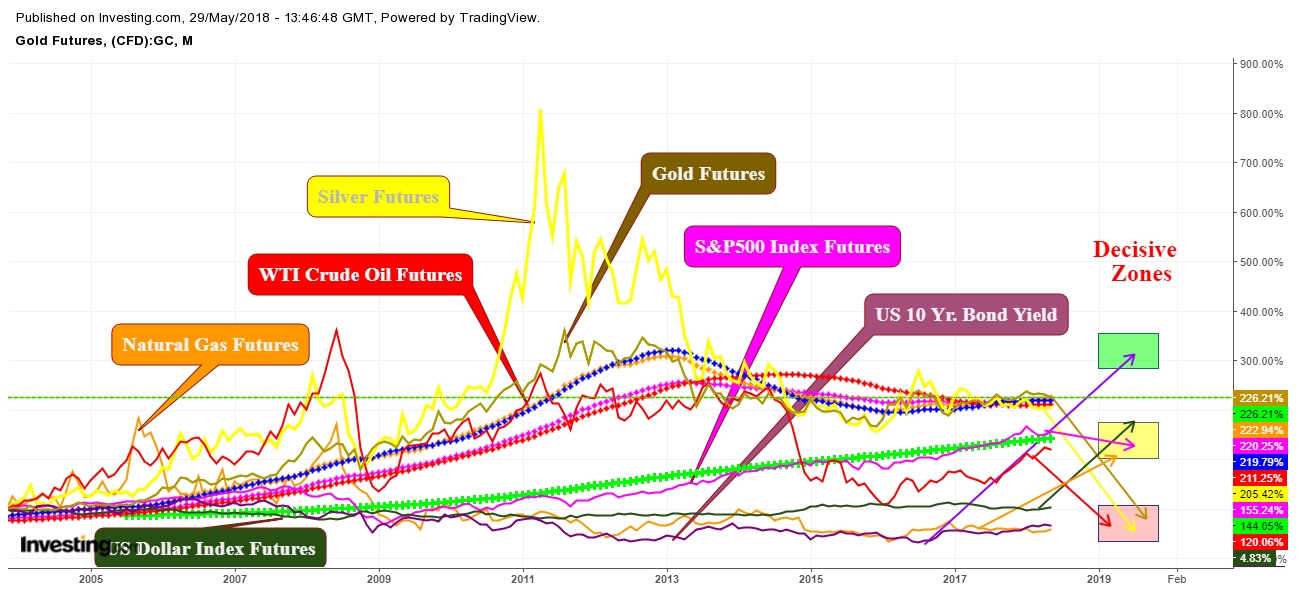

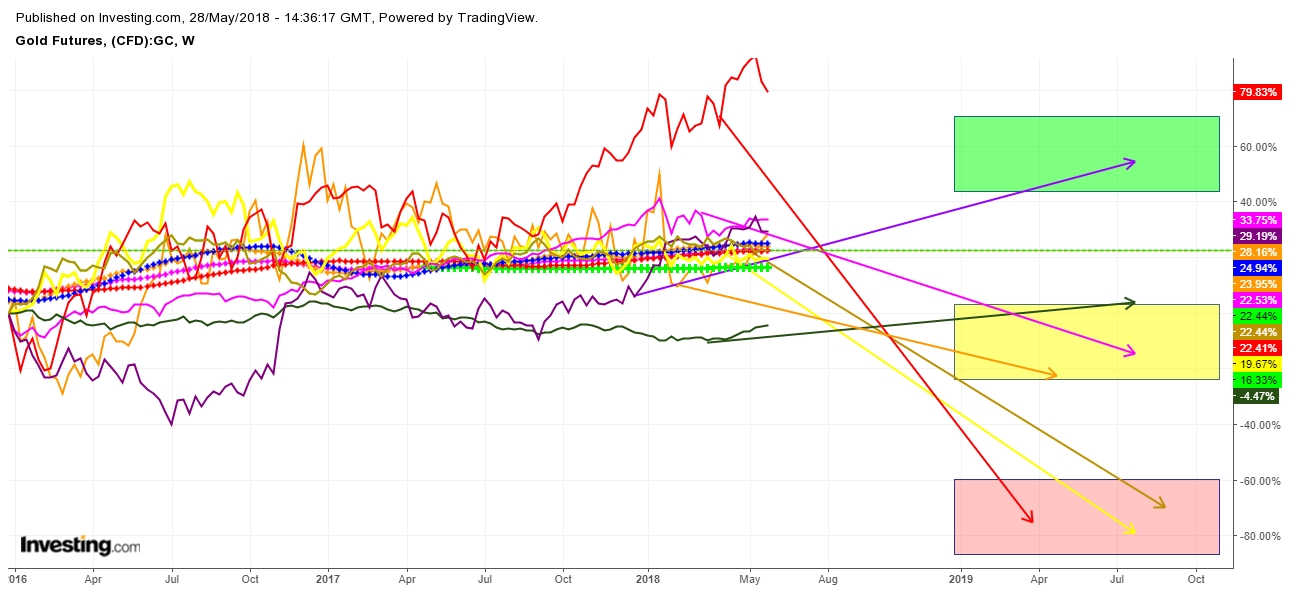

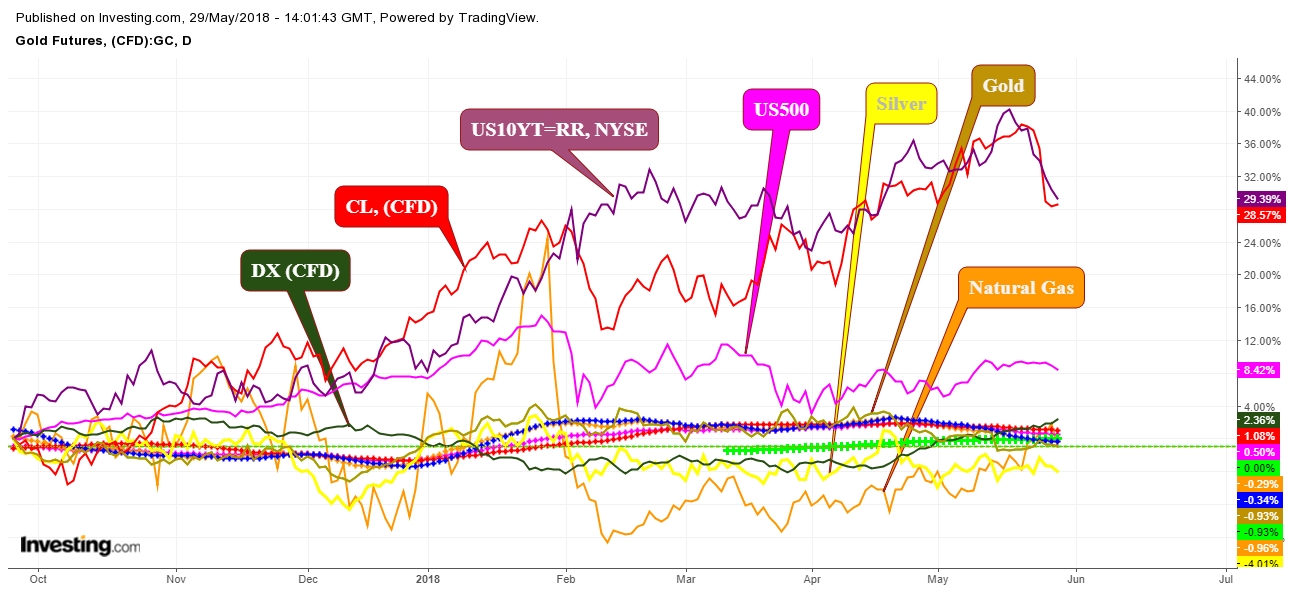

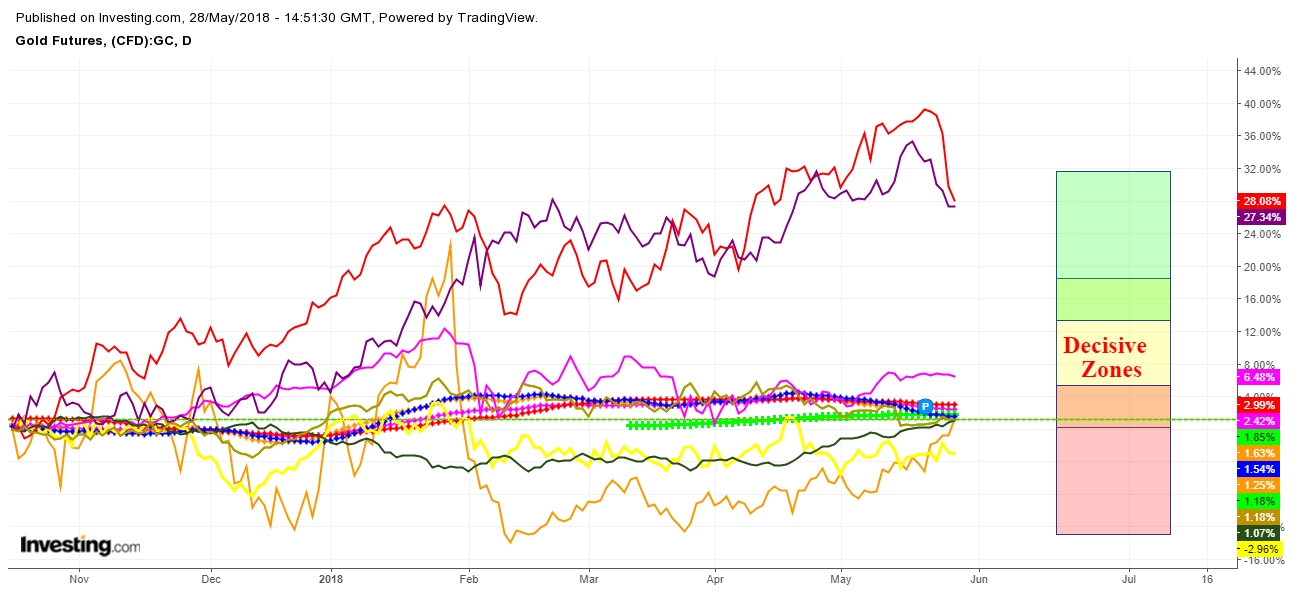

Global market swings point to geopolitical interference in the economic world. Bond markets appear to be driving equities after political instability in Italy increased, sparking a global stock selloff, which yielded a chain reaction of indecisiveness in other inter dependent commodity and forex markets.

I conclude that this instability will finally decide the long-term directional move of the different commodities. No doubt that the prevailing geopolitical moves may take a U-turn any time during the upcoming months, but the prevailing theory of the bully who tries to grab as much oil as possible to strengthen his economy regardless of the impact on other markets remains to be seen.

I expect the following directional moves in natural gas WTI crude oil, the USD, 10-year T-bill yields, S&P 500, as well as gold and silver.

For more information on the following charts, check out my

.Disclosure

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.