Stocks rebounded yesterday, with the S&P 500 climbing by 90 bps, ahead of what will be another big data point and the last major data point until the CPI report. I am thankful. The run over the past week-and-a-half, along with earnings, has been tiring and, at times, rather stressful. So, with the release of the employment report and the ISM services report at 10 AM, the market will finally have a chance to figure out what the last two weeks have given us.

If yesterday’s productivity and unit labor cost showed anything, it is that productivity is non-existent, costs are increasing, and what we are seeing is an economy powered by rising prices. Because at the end of the day, today’s wage data is expected to rise by 4% y/y and by 0.3% m/m. If productivity in the first quarter was just 0.3% Q/Q SAAR, and wages are growing by around 4%, then does that imply a 3.5% to 4% inflation rate? It certainly sounds right based on the latest CPI data points.

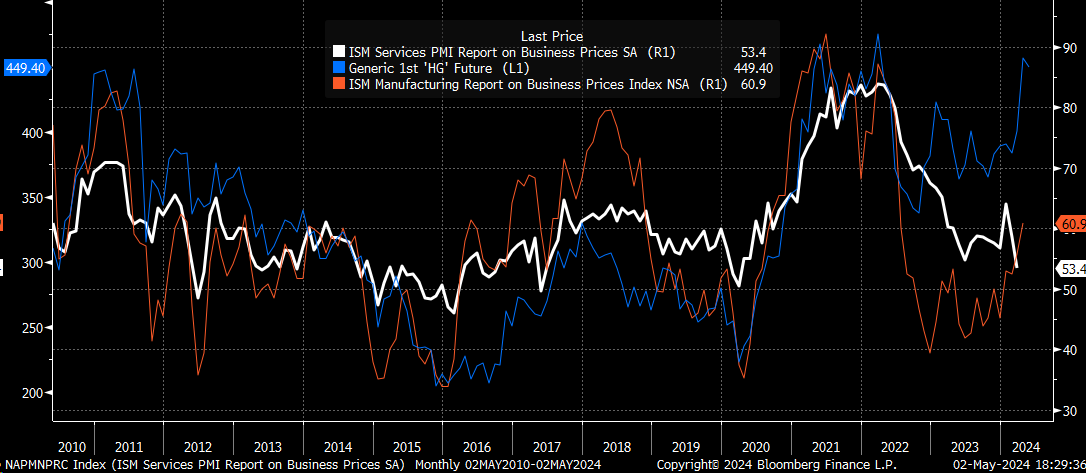

Jobs are expected to increase by 240,000 compared to last month’s 303,000, while the unemployment rate remains at 3.8%. Then, at 10 AM, ISM services are expected to increase to 52 from 51.4, while prices paid are expected to rise to 55 from 53.4.

The prices paid index took a big tumble last month, and it seemed highly unusual, so it will be interesting to see how much it bounces back in April. Generally, prices in copper, manufacturing, and services tend to move together, so the move lower last month was odd, and I would expect to see a bigger rebound this month. We will have to see.

Despite everything, the 10-year rate moved lower yesterday, and it was not what I expected. This week, we have had plenty of data to push the 10-year up, but it didn’t. I’m unsure if it is waiting for data today, but we will find out. If it doesn’t jump today, then the odds will rise; we will head back to 4.35% first, which would be disappointing.

The dollar also pulled back yesterday, and like the 10-year, there is no doubt whether it will continue higher or not. At this point, it will take a hot job report today to get the dollar moving up.

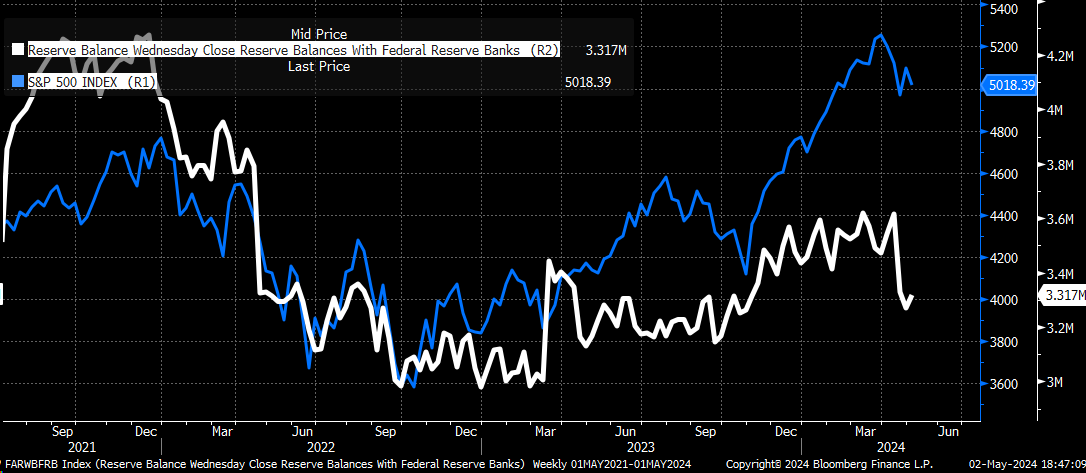

Reserve balances crept higher this week as the reverse repo and the TGA fell yesterday, allowing the reserves to rise. Reserves are still rather low at $3.3 trillion, and while they are likely to rebound some, I don’t think they will return to the highs we saw at the start of 2024. So, for now, we will have to continue to watch how Bitcoin trades to give us a sense of the liquidity flows.

The VIX 1D and the S&P 500 moved higher yesterday. However, after today’s job report, the VIX1D will probably crater again. So again, a move higher in the S&P 500, regardless of the data, seems probable given the implied volatility reset that will be needed. Once IV resets, the market will trade “normally” again.

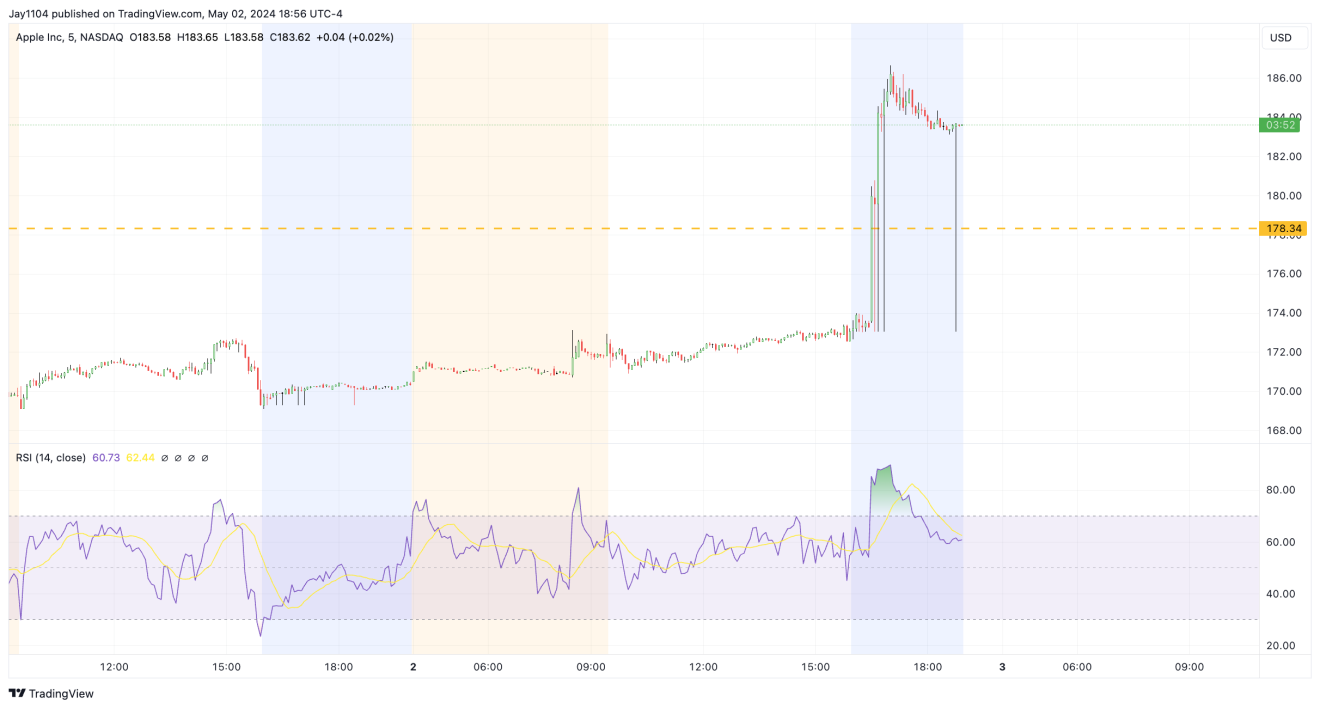

Finally, I noted yesterday that Apple (NASDAQ:AAPL) had a lot of gamma built up between $175 to $180 in the options, and that a move over $180 might be met by sellers once regular hours trading resumed on Friday. I have owned the stock for a long time, and the move higher in the share seems overdone to me. Additionally, the guidance was okay but nothing great, and it sounds like gross margins are a bit lite versus estimates. Also, when the company was probed by analysts on iPhone sales being down mid single digits, which would be more than expected, Tim and Luca got a little weird. So would I be surprised to see the stock trading back below $180 today, not at all.