Investing.com’s stocks of the week

Anyone following the US labor market this year (read: every trader) has been put through a wringer of emotions. Despite the longest government shutdown in the history of the country, job growth through the months of January and February was strong, with the US economy creating more than 200k jobs in each month. Just when traders thought the coast was clear, last month’s reading printed at just 20k, raising fresh concerns about the health of the US worker.

For what it’s worth, both February’s abnormally strong print and March’s peculiarly weak report may be influenced by seasonal and shutdown distortions, as the current 3-month average is 184k, roughly in line with the average over the last year and expectations for this month’s reading (180k). Traders have taken the apparent job-market volatility in stride, with US indices experiencing their strongest first quarter in decades and the US dollar holding near the middle of the FX relative performance charts year-to-date.

The Macroeconomic Backdrop

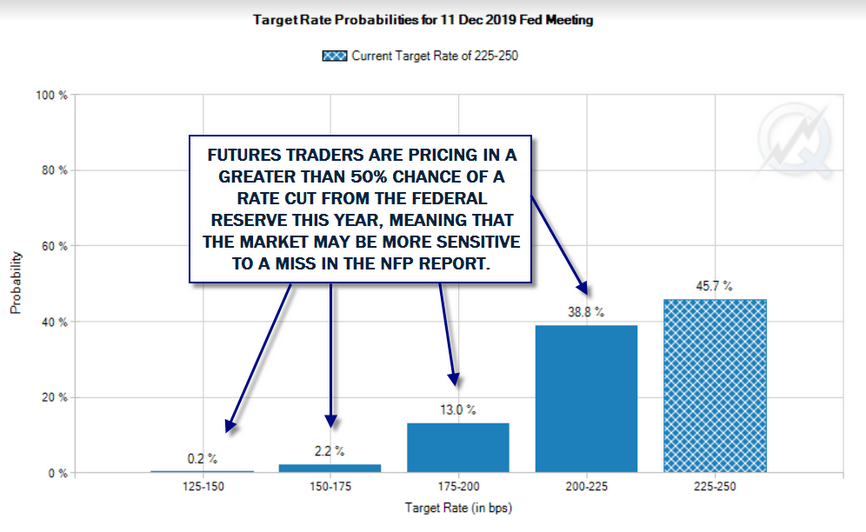

When it comes to the FX market, the primary way that the NFP report influences markets is through its impact on monetary policy. As we noted last month, the Federal Reserve has made a big dovish shift and the median member now doesn’t expect to raise interest rates whatsoever this year; markets have gone a step further and are now pricing in more than a 50% chance of an interest-rate cut from the Fed this year:

Source: CME FedWatch, FOREX.com

As a reminder, economists expect the report to show 180k in net new jobs, with the unemployment rate holding steady at 3.8% and average hourly earnings rising 0.3% m/m. Against this backdrop, traders may be more sensitive to a “miss” relative to the headline expectations than a stronger report.

Jobs Data Preceding NFP

Our typical leading indicators for Nonfarm Payrolls paint a mixed, but generally bullish picture:

- The ADP Employment report missed expectations, showing only 129k new jobs created (though the previous month’s reading was revised higher).

- The ISM Non-Manufacturing Survey employment component rose slightly to 55.9 (from 55.2).

- The ISM Manufacturing Survey employment component rose sharply to 57.5 (from 52.3).

- The 4-week moving average of initial unemployment claims fell to 213,500, near September’s 50-year low.

Forecast And Potential USD Reaction

With both ISM surveys and initial jobless claims pointing to a stronger headline reading (not to mention the potential for some “payback” after last month’s anomalously low figure), we lean toward a better-than-expected report, perhaps around the 200k figure.

Of course, with the Fed definitively on hold for the next six months, if not longer, the reaction in the US dollar could be limited, even if we see a stronger-than-anticipated reading. Likewise, the medium-term momentum in US stock indices is bullish, so stock traders may be inclined to interpret the jobs report as supportive of stocks, regardless of the exact reading. Finally, readers should note that the unemployment rate and wages reading will also influence how traders interpret the strength of the reading.