Newmont Mining Corporation’s (NYSE:NEM) Tanami expansion project has achieved commercial production. The project is expected to lend support to the ongoing exploration and development of the mine’s prospective underground resources and boost gold production.

The project attained commercial production safely and is on schedule for an approved capital investment of $120 million. The expansion is expected increase gold production at Tanami by 80,000 ounces per year to 425,000-475,000 ounces of gold per year. It will also extend the mine life by three years and lower the all-in sustaining costs (AISC) to between $700 and $750 per ounce.

According to Newmont, the team working at Tanami has reduced costs by roughly two-thirds, more than doubled its gold production and improved resource confidence considerably. The expansion project offers robust returns of 35% at a gold price of $1,200.

About Tanami Project

The Tanami project includes construction of a second decline in the underground mine and incremental capacity in the processing plant. The second decline was completed in 2016. The processing plant expansion includes addition of a thickener, ball mill and gravity circuit to expand mill capacity from 2.3 to 2.6 million tons per annum and also improve recoveries.

Other Developments

The company has a strong track record for developing profitable projects. Over the last three years, Newmont has built new mines at Long Canyon and Merian and made profitable expansions at Cripple Creek & Victor and Tanami. The company announced three expansion projects this year, which are likely to improve profitability and extend the mine life at Twin Creeks and Ahafo. Further, the company also plans to complete an expansion at Northwest Exodus next year.

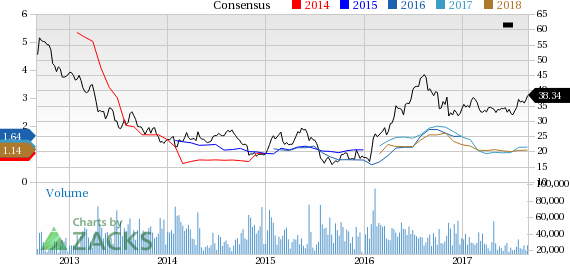

Price Performance

Shares of Newmont have moved up 11.8% in the last three months, outperforming the industry’s 8.2% gain.

Robust Q2 & Improved Outlook

Newmont posted net income from continuing operations of $192 million or 36 cents per share in second-quarter 2017, up from $14 million or 2 cents a share a year ago. Barring one-time items, adjusted earnings were 46 cents per share for the quarter, topping the Zacks Consensus Estimate of 28 cents.

Revenues of $1,875 million were up 12% from the year-ago quarter due to higher sales volume. The figure beat the Zacks Consensus Estimate of $1,786.8 million.

Newmont, during second-quarter call, revised its guidance of attributable gold production to the range of 5-5.4 million ounces for 2017 (up from 4.9-5.4 million ounces). Production at Long Canyon and Merian is anticipated to compensate the impact of declines at Yanacocha and Twin Creeks.

The company also revised its AISC guidance for 2017 and it now expects it to be between $900 and $950 per ounce (down from $940 and $1,000 per ounce expected earlier).

Zacks Rank & Stocks to Consider

Newmont currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are The Chemours Company (NYSE:CC) , Kronos Worldwide Inc. (NYSE:KRO) and Air Products and Chemicals, Inc. (NYSE:APD) .

Chemours currently sports a Zacks Rank #1 (Strong Buy) and has an expected long-term earnings growth rate of 15.5%. You can see the complete list of today’s Zacks Rank #1 stocks here.

Kronos presently flaunts a Zacks Rank #1and has an expected long-term earnings growth rate of 5%.

Air Products currently carries a Zacks Rank #2 (Buy) and has an expected long-term earnings growth rate of 12.1%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Newmont Mining Corporation (NEM): Free Stock Analysis Report

Original post