New York Forex Report: The early European session today was notably quiet in the wake of yesterday’s Belgian attacks and an absence of key data. With European and US markets out on Friday flows are expected to be quiet. On the data front we have US New Home Sales and Crude Oil inventories at 1400GMT and 1430GMT respectively.

EUR/USD

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR/USD continues to drift lower weighed on by economic fears in the wake of yesterday’s attacks and a stronger US Dollar.

Technical: EUR is testing symmetry support in the 1.12 area a breach of yesterday low opens a move back to 1.1050 in broader range trade. While yesterday’s low survives on a closing basis expect a grind higher to retest last weeks highs

Interbank Flows: Bids 1.1150 stops below. Offers 1.14 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

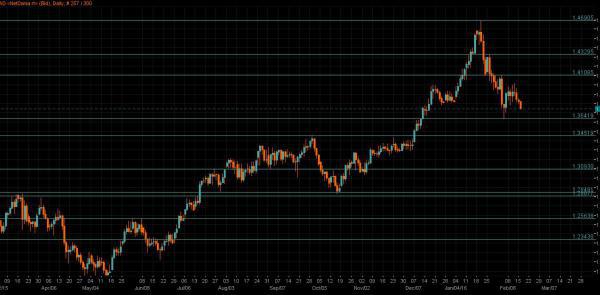

GBP/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Traders believe the attacks on Brussels’ airport and the metro train might influence more votes to favour Britain leaving the EU in a June referendum. Leaving the EU would hit growth and threaten the huge foreign investment flows Britain needs to fund its current account deficit, one of the biggest in the developed world at about 4% of national output.

Technical: Failure at 1.43 support opens downside symmetry objective at 1.4130, a breach of this level opens 1.4050 pivotal support.

Interbank Flows: Bids 1.4130 stops below. Offers 1.4300 stops above

Retail Sentiment: Bullish

Trading Take-away: Short

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: As markets stabilise in the aftermath of yesterday’s attacks, USD is on the front foot whilst JPY weakens slightly as the safe-haven bid diminishes.

Technical: Retest of bids sub 111 attracts profit taking, a sustained breach here will leave the psychological 110 exposed, intraday resistance is now sited at 112.88 with a close over 113 required to neutralise the immediate downside threat.

Interbank Flows: Bids 110 offers below. Offers 112.50 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

EUR/JPY

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Neutral

Fundamental: Japan’s Nikkei manufacturing PMI fell to 49.1 in March (Feb: 50.1), the first contraction since April 2015 amid decline in new orders and output, dragged by renewed weakness in exports oriented industries. The print overshadowed the upbeat but lagging all industry activity index, leading EUR/JPY higher.

Technical: Bids sub 125 supported the current advance to target a test of symmetry resistance at 128.15 as the immediate corrective objective. Failure at 124.50 suggests false upside break and opens retest of 123.

Interbank Flows: Bids 125 stops below. Offers 127.50 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

AUD/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Fundamental: AUD/USD trades a little softer over the European morning as USD gains lead the session. Rate still supported by upbeat comments from RBA governor Stevens. In his speech, he sounded rather positive about the domestic economy despite the recent slowdown in the Chinese economy and plunging commodity prices.

Technical: Buyers at .7550 are positioned and playing for the next upside leg to target .7729 next. Only a failure at.7400 support threatens near term bullish bias.

Interbank Flows: Bids .7550 stops below. Offers .7700 stops above

Retail Sentiment: Bearish

Trading Take-away: Long

USD/CAD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: USD/CAD flows remain choppy with Oil remaining supported at current levels but USD strengthening. Yesterday the Canadian government released its Federal Budget with the promise to spend more on infrastructure to boost growth, which is estimated to drive 0.5 percent of GDP growth.

Technical: AB=CD downside objective at 1.2966 achieved, while 1.3160 contains profit taking bears target 1.2680 as the next downside objective. Only a close over 1.34 negates immediate bearish bias.

Interbank Flows: Bids 1.3000 stops below. Offers 1.3150 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral