New York Forex Report: Risk sentiment improved over early European trading today as reports emerged of possible Russian oil supply cut and Iran’s readiness to negotiate with Saudi Arabia. The correction in oil has fuelled a similar recovery in equities with the S&P 500 challenging last week’s lows and European equities trading back to similar levels. USD remains subdued as traders await Fed Chair Yellen who speaks later today (15:00 GMT).

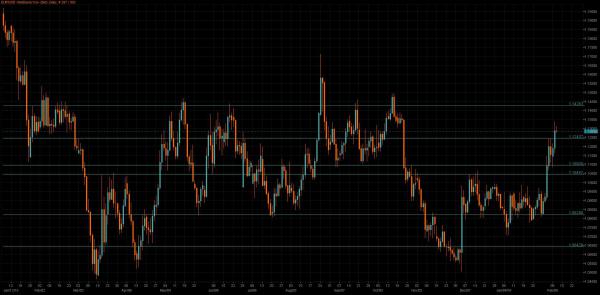

EUR/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR retraced some of yesterday’s gains as European equities recovered losses on improved risk appetite. Fed Chair Yellen’s testimony is key focus for the US session today.

Technical: While 1.1250/30 remains intact as support expect rotation through last weeks highs en route to test 1.14 symmetry objective. Below 1.1050 eases immediate upside pressure.

Interbank Flows: Bids 1.12 stops below. Offers 1.1350 stops above

Retail Sentiment: Bearish

Trading Take-away: Long

GBP/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: GBP drifted higher over the European morning despite a raft of weaker data: Dec Industrial and Manufacturing Production both printed below expectations. NIESR GDP estimate is the key domestic data release over the US session.

Technical: Testing base support of last weeks advance, failure at 1.4350 suggests false upside break and resets bearish trend to attack and break 1.40 as the primary downside objective. Over 1.45 re- establishes bullish bias and targets retest of last weeks highs.

Interbank Flows: Bids 1.4350 stops below. Offers 1.45 stops above.

Retail Sentiment: Neutral

Trading Take-away: Neutral

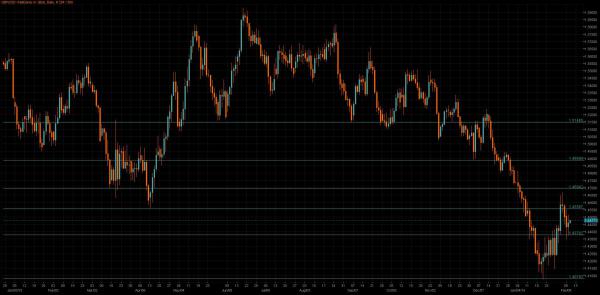

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Downside was tempered yesterday as possible BOJ intervention kept traders from pursuing a higher yen, though if equities roll over once more JPY is likely to be driven higher still.

Technical: USD/JPY trading at major neckline support again overnight. While 116.70 caps intraday upside reactions expects a grind lower to test 113.90 as the next downside objective.

Interbank Flows: Bids 114 offers below. Offers 116 stops above

Retail Sentiment: Bullish

Trading Take-away: Short

EUR/JPY

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: Choppy flows persist as risk-sentiment sustains a tentative recovery so far today, with JPY slightly softer so far. Notable however that even the dip in the 10Y JGB below 0% has failed to deter inflows from both overseas and domestic investors.

Technical: While 130.30 continues to cap upside reactions expect tests of 127.70 bids next, failure through this level opens 126 as the next downside objective. Only a close over 130 eases immediate downside pressure.

Interbank Flows: Bids 128 stops below. Offers 130.50 stops above.

Retail Sentiment: Bearish

Trading Take-away: Neutral

AUD/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: Consumer confidence in Australia rose to a 3 month high of 101.3 in Feb (Jan: 97.3). Assessment on family finances and current conditions improved the most. Housing data was equally upbeat with new home sales surging 6.0% MoM in Dec (Nov: -2.6%), snapping three straight monthly declines.

Technical: AUD tests and hold bids ahead of.6950 a failure of support here opens a retest of year to date lows. Only a close over .7150 eases immediate downside pressure

Interbank Flows: Bids .6950 stops below. Offers .7150 stops above.

Retail Sentiment: Bullish

Trading Take-away: Neutral

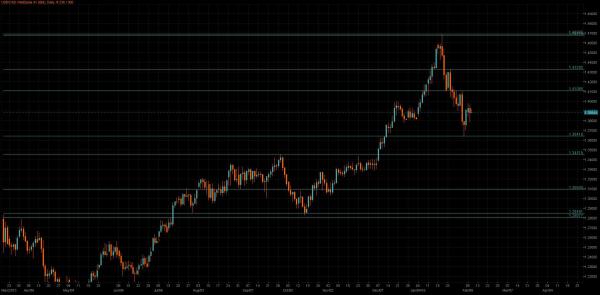

USD/CAD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: No tier one data for this week. USD/CAD will likely take its lead from the USD side of the equation today/tomorrow with Yellen’s testimony in front of the US congress. CAD traders will likely also have one eye on the commodity complex, as crude continues to probe bids at the year to date lows.

Technical: Anticipated 1.40 retest from below under way, while this area contains the upside reaction potential for bearish bias to resume, however while 1.38 supports there remains potential for a broader corrective phase with 1.4160 the next upside pivot.

Interbank Flows: Bids 1.3750 stops below. Offers 1.40 stops above

Retail Sentiment: Bearish

Trading Take-away: Neutral