New York Forex Report: As we kick off a much quieter data week with no central bank events ahead the main story leading markets is the sharp sell-off in oil which comes on the back of data showing that the US oil rig count has risen for the first time this year having previously fallen for six consecutive months. Oil has been gathering steam to the upside recently as optimism for a production-freeze deal continues to support upside. Crude is now caught between $40 resistance and $38 support. Having begun the week with some initial strength, USD is now weakening again. Traders now look ahead to key US data towards the end of the week for likely directional stimulus.

EUR/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: The pair has opened the week on a calmer footing following last week’s post FED fallout with 1.1340 area continuing to provide supply with 1.1250s acting as support over the European morning. Little in way of key data releases today and for the rest of the week as we approach the Easter break so expect any signs of weight of positioning to provide the catalyst for directional sentiment.

Technical: Expect a further grind higher to test pivotal resistance at 1.1370 en route to the 1.1420 symmetry swing objective, while 1.1240 supports intraday. Only a close below 1.1050 eases immediate bullish pressure.

Interbank Flows: Bids 1.1250 stops below. Offers 1.14 stops above

Retail Sentiment: Bearish

Trading Take-away: Long

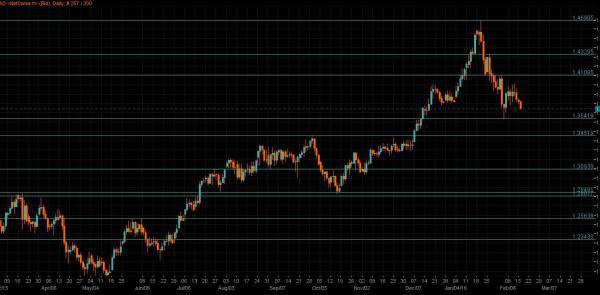

GBP/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: GBP’s rally failed to generate a weekly close above 1.4500, although the pair still trades relatively supported. Brexit concerns will likely stem further material upside heading into the holiday weekend, Brexit polls continues to generate a decent amount of headlines, recently more skewed in favour of leaving.

Technical: Close over 1.43 eases immediate downside pressure bulls now target a retest of offers and stops above 1.4668, bulls have the ball while 1.43 supports downside corrections.

Interbank Flows: Bids 1.43 stops below. Offers 1.4550 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: It’s a quiet start to the week with the Japan market on holiday, and there is a risk that this low-volatility nature could continue given the shortened Easter week as well (not to mention the lack of significant risk events). On that note, domestic flows could play a bigger role, and with fiscal year and month end looming, and amid a weak USD environment, market remains positioned for a move lower in the pair

Technical: Retest of bids sub 111 attracts profit taking, a sustained breach here will leave the psychological 110 exposed, intraday resistance is sited at 112.20 with a close over 113 required to neutralise the immediate downside threat.

Interbank Flows: Bids 110 offers below. Offers 112.50 stops above

Retail Sentiment: Bullish

Trading Take-away: Short

EUR/JPY

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: Reflecting lacklustre domestic demand, Japanese department store sales rebounded but rose a meagre 0.2% YoY in Feb (Jan: -1.9% YoY). This underscored BoJ efforts in keeping monetary policy accommodative to spur household consumption.

Technical: While 125 acts as support for the current advance expect a test of symmetry resistance at 128.15 as the immediate corrective objective. Failure at 124.50 suggest false upside break and opens retest of 123.

Interbank Flows: Bids 125 stops below. Offers 127.50 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

AUD/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Fundamental: The Aussie starts the week on a firm footing, seeing fresh demand kick in following a brief retracement lower on Friday. A weak USD provides upside support but tempered slightly by the sell-off in oil which has dampened risk appetite.

Technical: .7672 upside target achieved profit taking pull back should find fresh buyers at .7530/50 for the next upside leg to target .7729 next. Only a failure at.7400 support threatens near term bullish bias.

Interbank Flows: Bids .7590 stops below. Offers .7700 stops above

Retail Sentiment: Bearish

Trading Take-away: Long

USD/CAD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Despite weakness in oil, the Canadian Dollar holds firm as we head into the first US session of the week with price bolstered by Canadian retail sales figures of January, beating the markets’ expectations by more than three times. Markets believe the Bank of Canada (BoC) will hold the interest rate steady on the next policy meeting due to the strong manufacturing and retail sales figures released last week

Technical: AB=CD ultimate downside objective at 1.2966 achieved, while 1.3160 contains profit taking bears target 1.2680 as the next downside objective. Only a close over 1.34 negates immediate bearish bias.

Interbank Flows: Bids 1.2950 stops below. Offers 1.3150 stops above

Retail Sentiment: Bullish

Trading Take-away: Short