New York Forex Report: Despite pressure from another bumper figure in yesterday’s US crude Oil inventories, oil has managed to rally back so far today with equity markets trading higher also. Action is fairly volatile ahead of the G20 summit with China’s Shanghai Composite dropping 6% overnight. Moves of this type recently have prompted big risk-off days in markets but so far risk-sentiment remains resilient. Traders now look ahead to key data over the US session with US Durable Goods as well as speeches from Fed’s Williams & Lockhart.

EUR/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: ECB easing expectations continue to grow as January EuroZone CPI was weaker than expected printing 0.3% against an expected 0.4%. whilst core CPI remained unchanged.

Technical: While prior pivotal support at 1.1050/70 acts as intra day resistance bears target prior range support at 1.08. Only a close over 1.1150 eases immediate downside pressure.

Interbank Flows: Bids 1.0950 stops below. Offers 1.1150 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

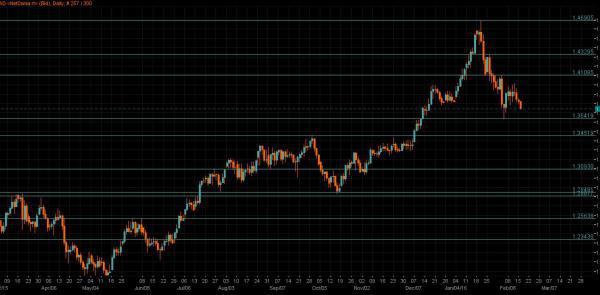

GBP/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: UK 4Q GDP printed in line with expectations, at 1.9% YoY and 0.5% QoQ, stemming the downside in Sterling for now.

Technical: While 1.4040/60 acts as resistance expect a continued grind lower for a test of the next major monthly downside objective at 1.37. Only a close over 1.4250 eases immediate downside pressure.

Interbank Flows: Bids 1.39 stops below. Offers 1.4040 stops above

Retail Sentiment: Bullish

Trading Take-away: Short

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: USD/JPY was a little firmer over the European morning as resilient risk-sentiment keeps JPY safe-haven demand tempered and USD enjoys better strength. Overnight BOJ Governor Kuroda commented that the BOJ were not intending to weaken JPY through their monetary easing policy.

Technical: 111 bids buffer the decline in USD/JPY setting up a potential double bottom base for a more meaningful corrective phase, confirmation of a broader correction will come with a close over 113.30. Failure at 111 opens psychological 110 as the next downside objective

Interbank Flows: Bids 111 offers below. Offers 113.50 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR/JPY has continued to correct higher over the European morning benefiting from a weaker JPY and managing to shrug off weak European inflation data

Technical: While 124.80 offers intra day resistance expect a continued grind lower to print fresh lows and test bids at the psychological 120 en route to a weekly downside objective at 118/117, only a close over 126.60 eases bearish bias.

Interbank Flows: Bids 122 stops below. Offers 124.50 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

AUD/USD

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Fundamental: Stronger Oil and resilient risk-sentiment have kept AUD supported over early European trading. Next key hurdle will be US data at 1330GMT.

Technical: Expected retest of offers above .7240 attracts near term profit taking. While .7150 supports intra day expect a test of range resistance at .7300. Only a failure at.7050 pivotal support threatens bullish bias

Interbank Flows: Bids .7150 stops below. Offers .7300 stops above

Retail Sentiment: Bullish

Trading Take-away: Neutral

USD/CAD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: The recovery in Oil so far today is weighing on USD/CAD heavily as markets shrug off yesterday’s US crude Oil inventories figure.

Technical: While USD/CAD trades sub 1.3850 downside pressure remains the driver with bears fully focused on a retest of 1.3630 bids ahead of 1.3530. A close over 1.3850 suggests a retest of 1.40 offers in broader range trade.

Interbank Flows: Bids 1.3630 stops below. Offers 1.3850 stops above

Retail Sentiment: Bullish

Trading Take-away: Short