The dust is finally settling from the extended moves higher in gold, silver, and miners. We are taking this opportunity to reassess overall market conditions as intermediate cycle tops were confirmed in all three sectors this week. In my opinion, the odds of gold and silver prices falling to new lows later in 2016 have increased to about 65%. However, we won't know for sure until an intermediate cycle arrives (likely June) and then we will monitor how well prices rally from that low.

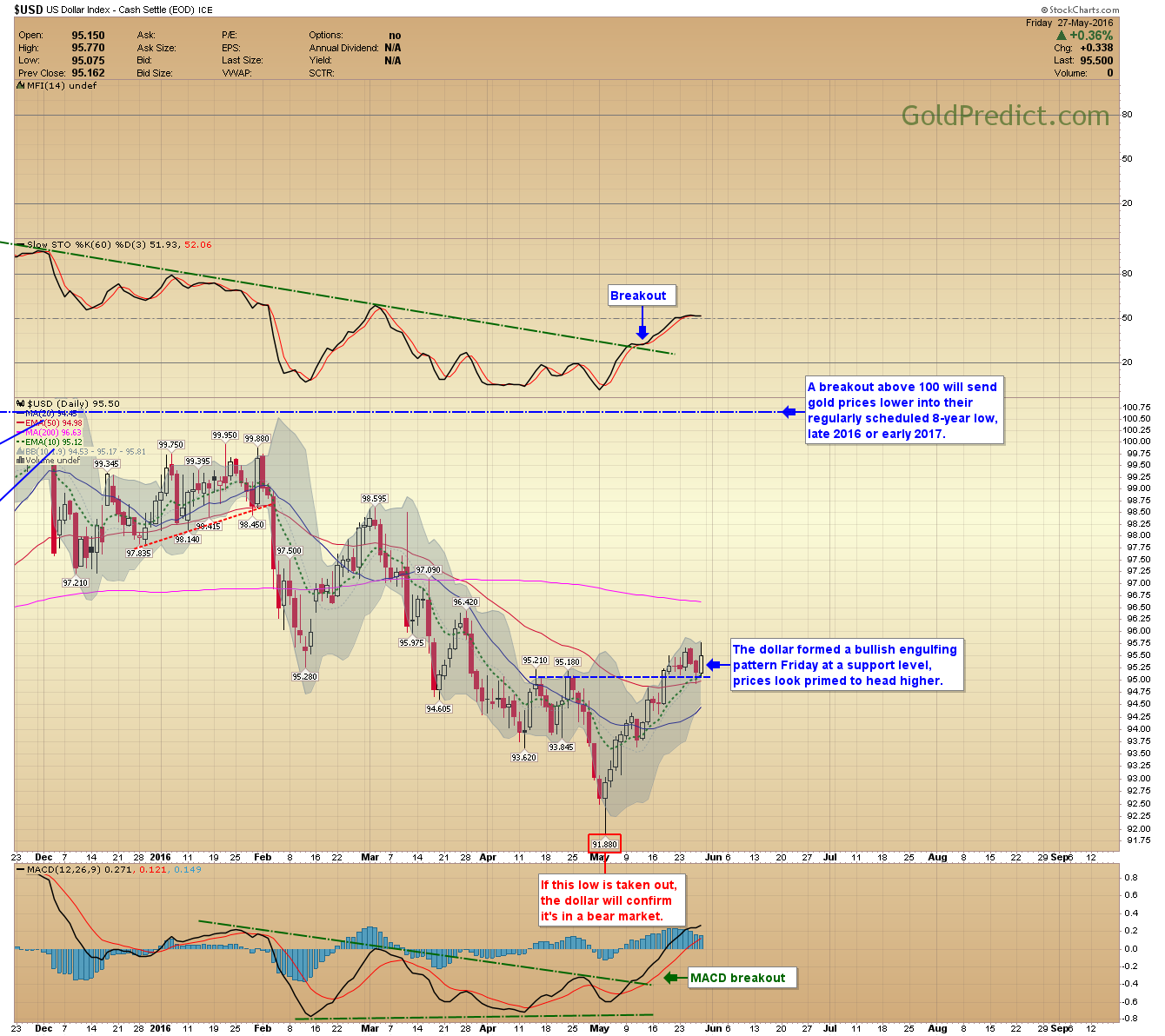

US DOLLAR DAILY - The dollar formed a bullish engulfing pattern Friday at a support level, prices look primed to head higher.

GOLD WEEKLY - Gold prices dropped far enough to close beneath both the 10-week and 20-week moving averages. On Balance Volume continues to drop.

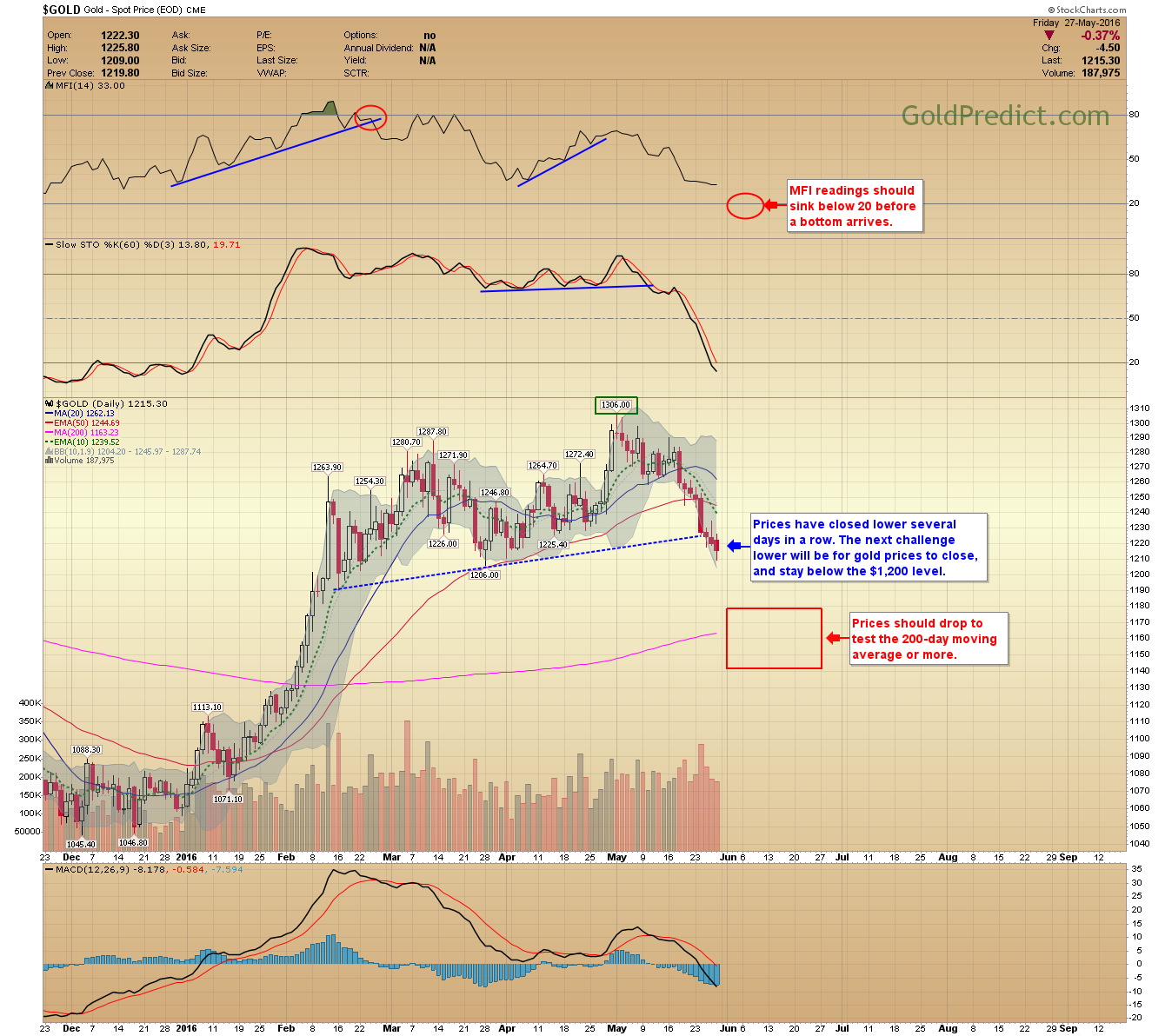

GOLD DAILY - Prices have closed lower several days in a row. The next challenge lower will be for gold prices to close, and stay below the $1,200 level.

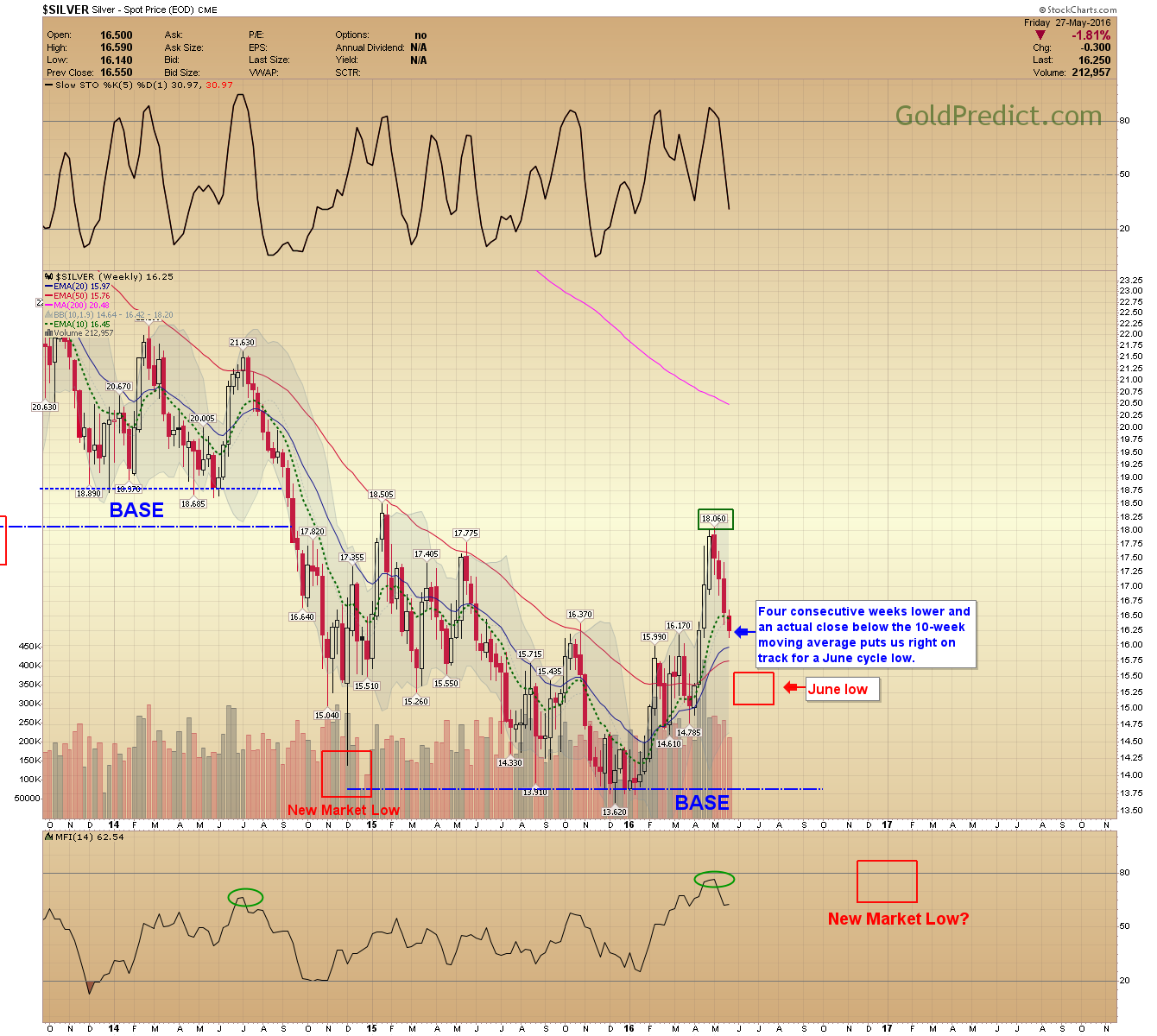

SILVER WEEKLY - Four consecutive weeks lower and the close below the 10-week moving average puts us right on track for a June cycle low.

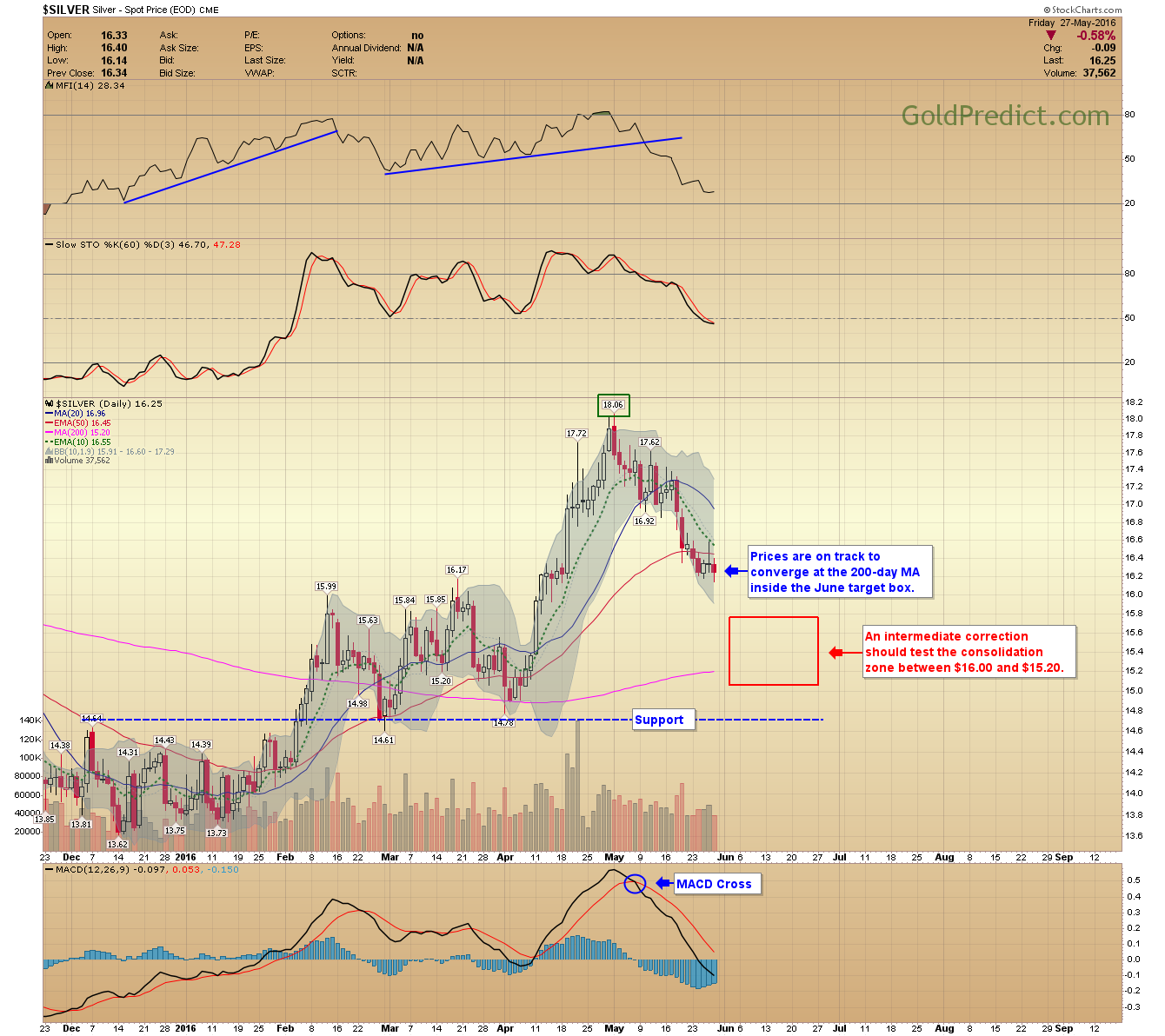

SILVER DAILY - Prices are on track to converge at the 200-day MA inside the June target box.

HUI WEEKLY - The HUI intermediate cycle topped just beneath the 200-week moving average, prices finally closed below the 10-week MA. Miners must drop further than metals to reach their individual target areas.

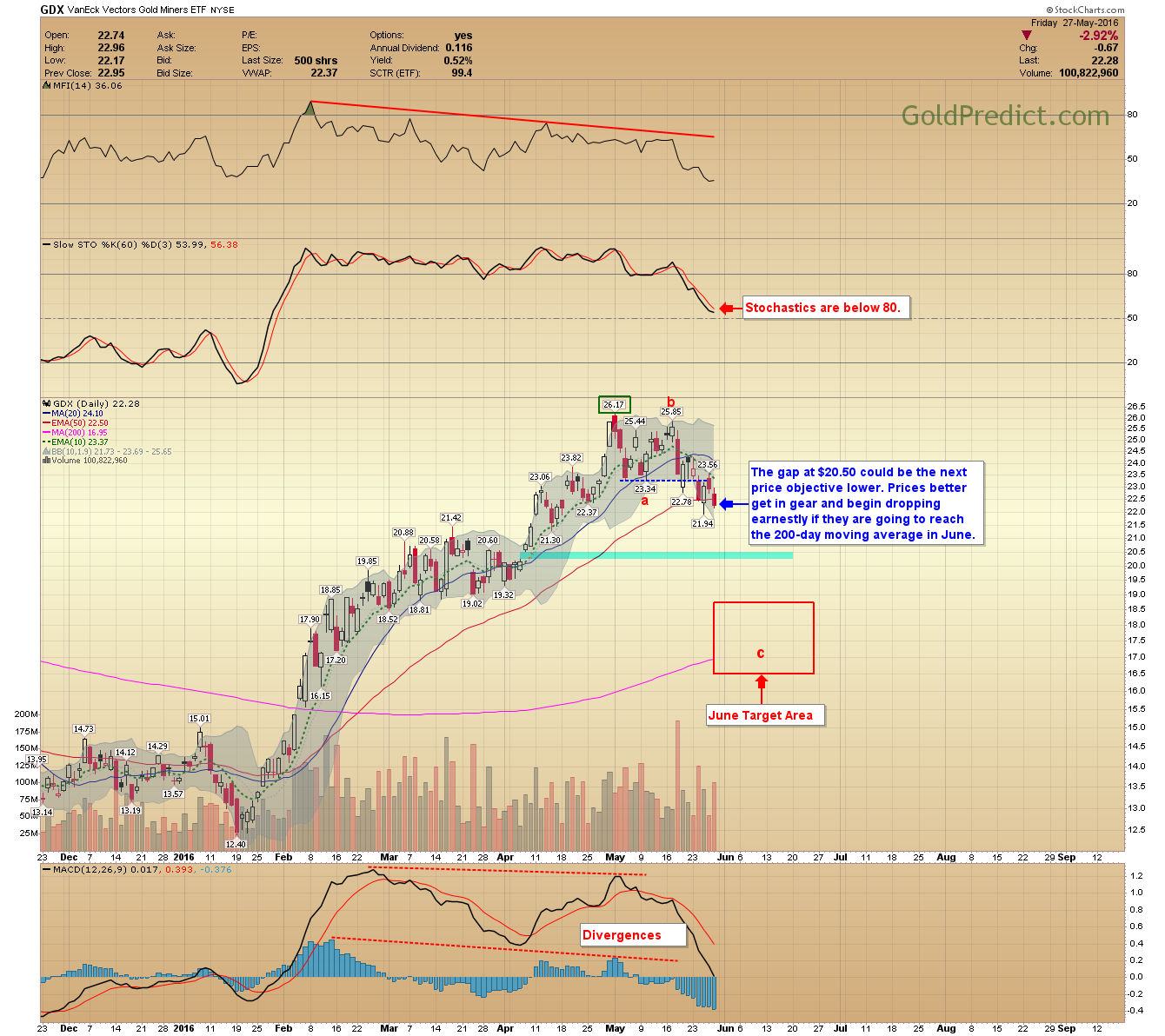

VanEck Vectors Gold Miners (NYSE:GDX) - The gap at $20.50 could be the next price objective. Prices better get in gear and begin dropping earnestly if they are going to reach the 200-day moving average in June.

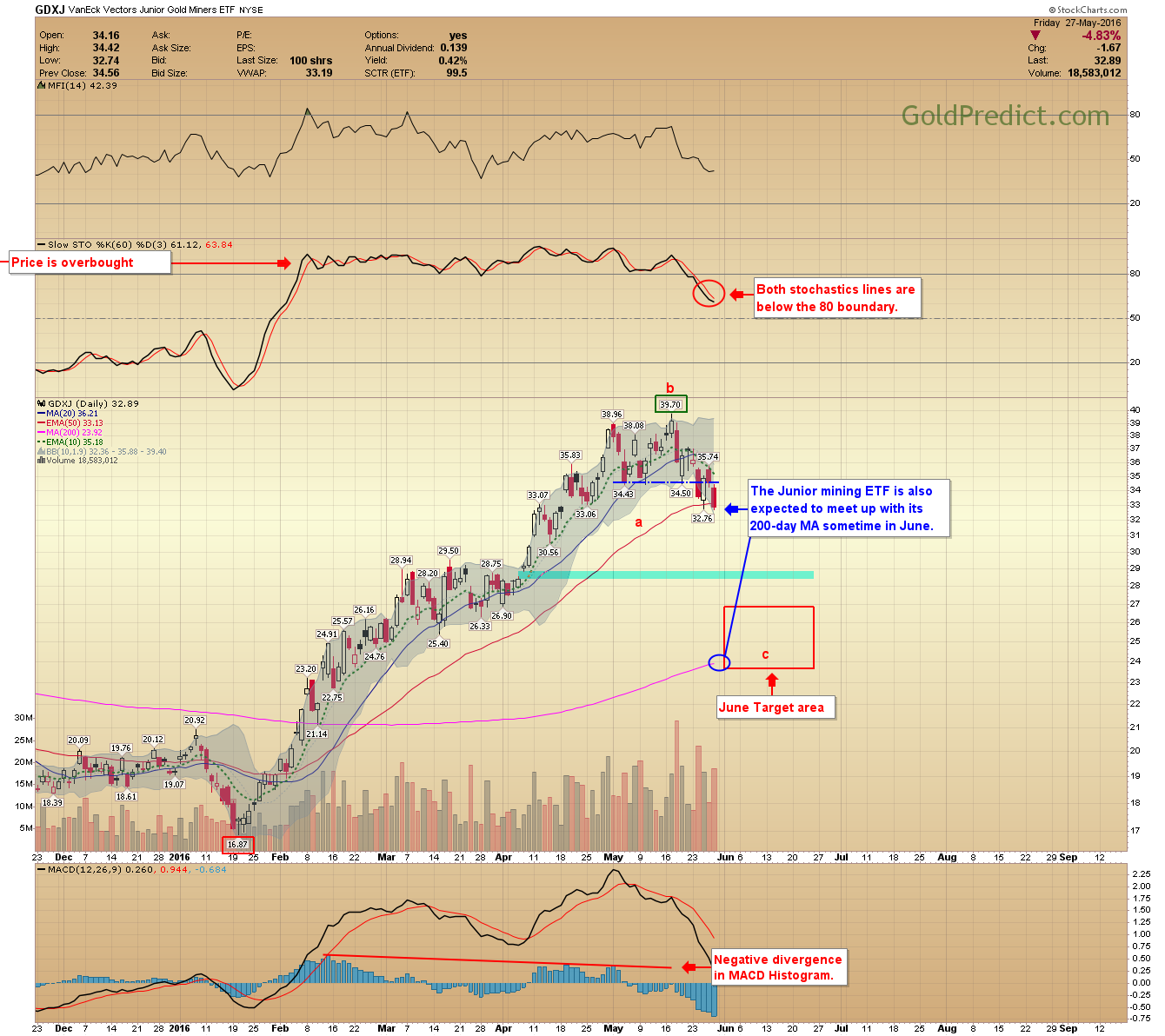

VanEck Vectors Junior Gold Miners (NYSE:GDXJ) - The Junior mining ETF is also expected to meet up with its 200-day MA sometime in June.

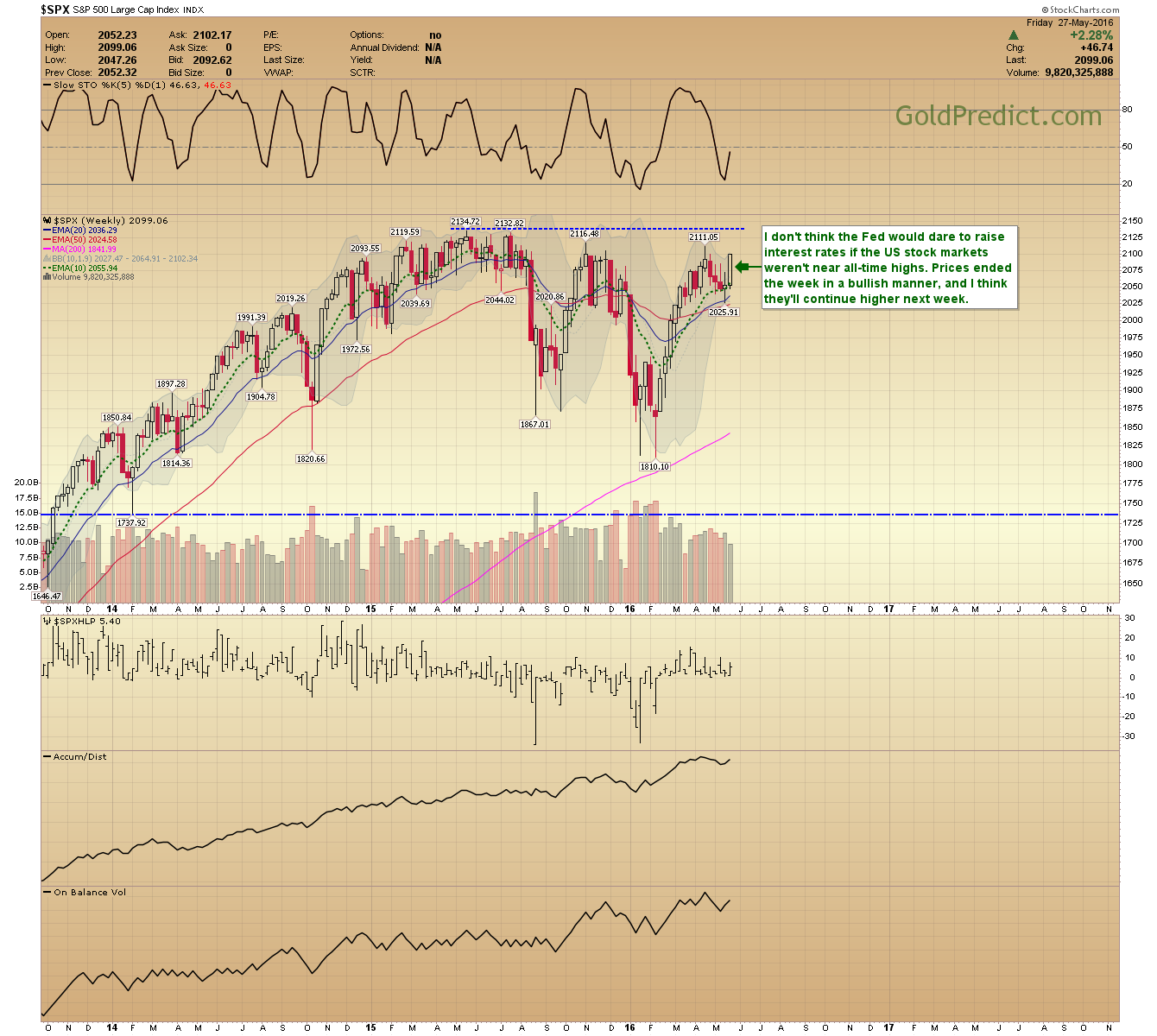

S&P 500 WEEKLY - I don't think the Fed would dare to raise interest rates if the US stock markets weren't near all-time highs. Prices ended the week in a bullish manner, and I think they'll continue higher next week.

WTIC WEEKLY - Oil prices are close to the $51.00 resistance level and nearing overbought MFI conditions, a correction is likely just around the corner.

Markets are closed Monday for Memorial day, and trading will resume Tuesday. The ADP employment numbers come out Thursday and will be a forerunner for the Friday Non-Farm payroll numbers. I'm getting the impression from Fed governors that a rate hike is likely in June. A better than average employment report will strengthen their hawkish stance.