- Markets in anticipation mode for Wednesday’s tariff announcement

- US stock indices end March with losses, but the euro and gold make gains

- RBA keeps rates unchanged; Aussie gets a small boost

- Key US data today; all eyes on jobs-related prints

Uncertainty Hits Risk Appetite

Markets hate uncertainty as it clouds the outlook and forces them to make less-than-educated guesses about the future. In the current conditions, market uncertainty is complemented by the prospect of a full-blown tariff war, a period of stagflation, which is dreaded by central banks as they have to choose between price stability and a probable recession, and fears of a global economic slowdown.

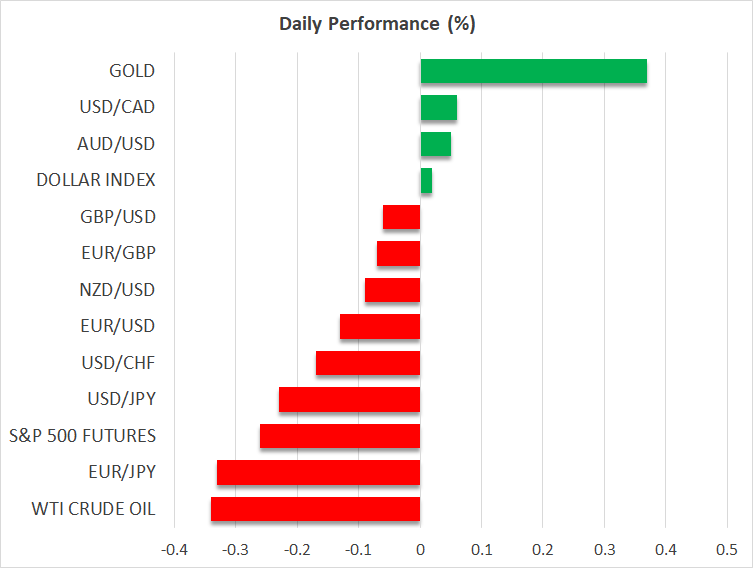

This situation is clearly reflected in US equities, with the Nasdaq 100 index leading the selloff in March and recording a monthly decline of 7.7%. This is the strongest monthly drop since December 2022 when the Fed’s tightening cycle was fueling concerns about an imminent recession in the US. European stock indices have fared better in March, partly because of the recent announcements regarding increased fiscal spending at both European and national levels.

Both Euro and Gold Record Sizeable Gains in March

The improved sentiment for the euro area is also reflected in the euro’s performance. Euro/dollar climbed by almost 450 pips in March, reversing the post-US presidential election move, despite strong expectations that it would test parity in early 2025. This is the strongest monthly performance for the euro since November 2022, with the dollar suffering across the board, despite its late-month recovery, as evidenced by the dollar index dropping 3% in March.

The US dollar’s underperformance fueled gold’s price action, with the precious metal climbing by 9.3% in March, which is the strongest monthly rise since March 2024. More interestingly, its rally in the first quarter of 2025 is the best on record, overcoming its performance in previous tumultuous market periods.

Markets Prepare for April 2 Announcement

Following last week’s car import tariffs, speculation is rife about the level and breadth of tariffs US President Trump is going to announce on Wednesday at 19:00 GMT. Despite Trump stating that “we are going to be nice” on tariffs, both the European Union and China are preparing for ‘multiple tariffs’. Even long-term allies, such as the UK and Japan could be targeted, though to a lesser extent than the aforementioned countries.

Central Banks Want Clarity; RBA Maintains Its Inflation Focus

Amidst these conditions, central banks are trying to formulate their rates strategy. Obviously, clarity matters, and Wednesday’s announcement could widely open the door for further rate cuts or allow certain central banks to maintain their current stance. The dilemma faced by most central bankers is whether to stay committed to meeting their inflation targets or boost the economy to avoid a recession.

The RBA has opted for the former, as it kept rates unchanged at today’s meeting, slightly boosting the Aussie against the dollar. The pause was expected, with the market now slightly favouring a rate cut at the May 20 gathering. RBA Governor Bullock was quite clear that no rate cut was discussed, as the Board’s top priority is to return inflation to target.

Focus Today Shifts to Data Prints

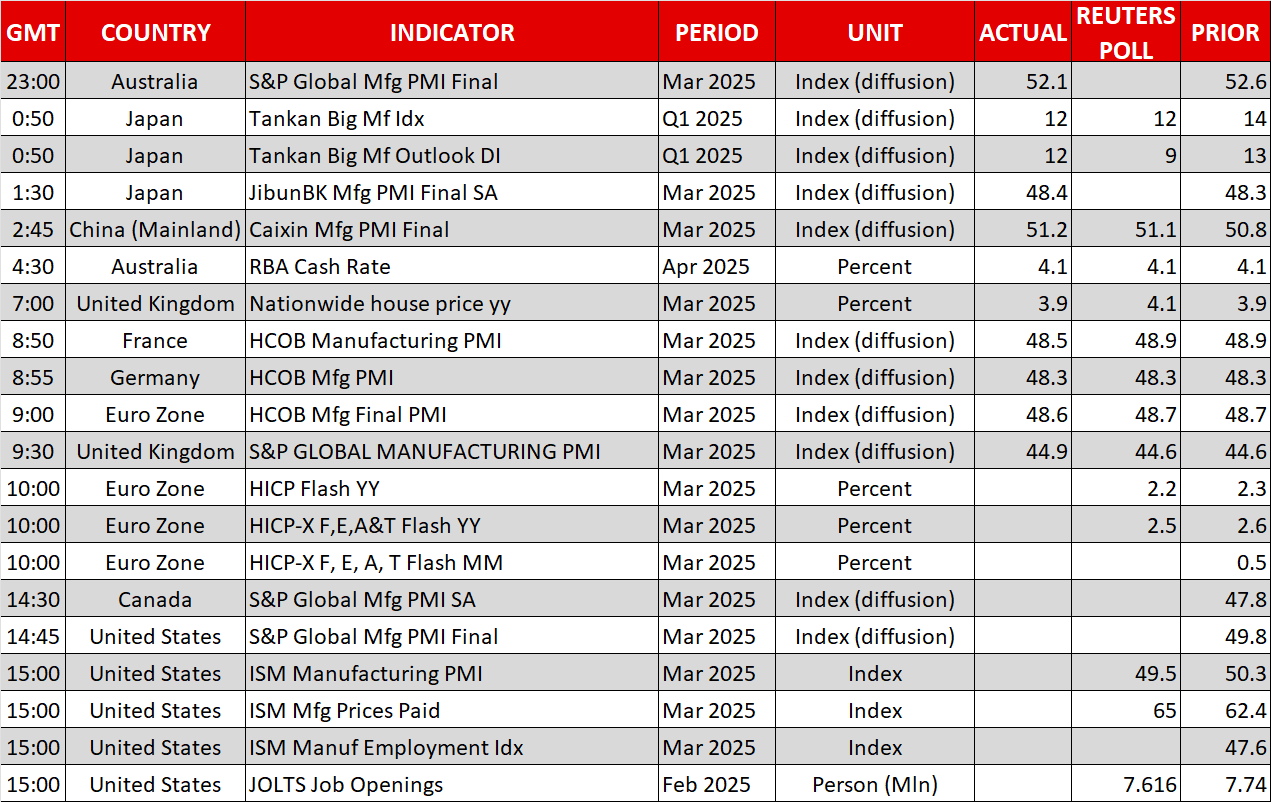

Wednesday’s tariff decisions are clearly overshadowing economic releases. However, in the US, the first batch of this week’s key data will be published today, with market participants ready to scrutinize the incoming labour market-related figures, and more specifically the employment sub-index of the ISM manufacturing survey and the JOLTS job opening number.

Notably, with ECB members publicly pondering the possibility of another rate cut at the April 17 meeting, the March Eurozone preliminary CPI print will most likely support the doves’ arguments at this juncture. On the political front, though, the focus is on France, where Marine Le Pen’s conviction is apparently barring her from being a candidate at the 2027 presidential elections.