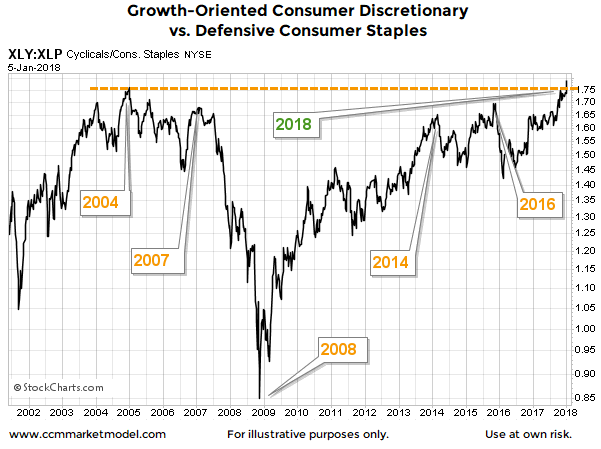

13-Year Consolidation

We have covered numerous long-term bullish breakouts in the equity markets over the past fourteen months. Last week, the ratio of consumer discretionary stocks (NYSE:XLY) relative to consumer staples (NYSE:XLP) broke above an area of resistance that has been in place for 13 years. When investors are confident about the economy and markets, they tend to prefer consumer discretionary/cyclical stocks over consumer staples.

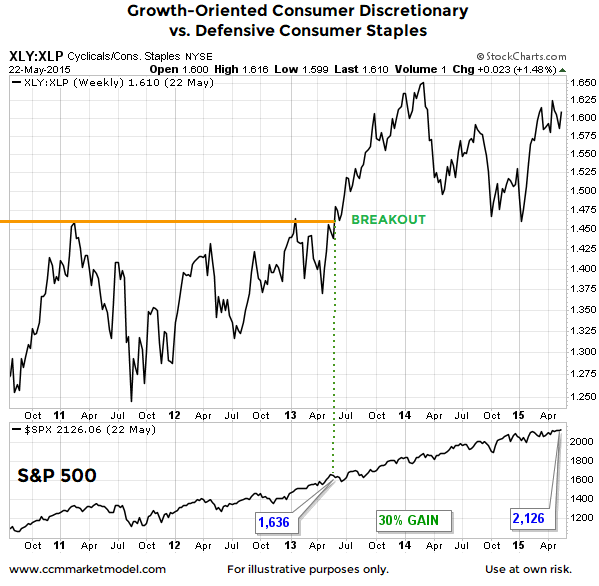

Historical Example

Market fractals tell us markets move in similar ways on multiple timeframes (short, intermediate, and long). After a two-year period of consolidation, the XLY/XLP ratio broke out in 2013, signaling an increasing appetite for economically-sensitive assets. After we could observe, measure, and record the breakout in 2013, the S&P 500 tacked on an additional 30% (see bottom portion of graph below).

Chess Masters, Fighter Pilots, And Stocks

This week's stock market video demonstrates how time-tested strategies leveraged by top chess players and fighter pilots can be used to manage risk and reward in the financial markets.

A Secondary Breakout

Last week's breakout in the XLY/XLP ratio is a secondary piece of evidence in the bull/bear equation that falls into the "interesting" rather than "critical" category. All things being equal, we prefer to see a healthy XLY/XLP ratio, but viewed in isolation, it is not a reason to alter our investment allocations in any way; that would also be the case if the recent breakout failed.

Aligns With Bullish Evidence

If we take a weight-of-the-evidence perspective, the XLY/XLP breakout aligns with the mountain of bullish evidence covered in the past 13 months.