The board of directors of New Jersey Resources (NYSE:NJR) approved an increase in the quarterly dividend rate by 6.9% to 27.25 cents, an effort to share more profits with investors. The company will now pay an annual dividend of $1.09 per share compared with $1.02 paid last year.

Long History of Dividend Payment

New Jersey Resources has a long history of dividend payment. It has been distributing dividends since 1952. The current hike marks the 24th increase in dividend in the last 22 years.

Shareholders on record as of Sep 22, will have the meatier dividend in their pockets on Oct 2, 2017. Based on the closing share price of $43.3 as of Sep 12, the increased payout translates to a dividend yield of 2.5%.

Strengths to Sustain Dividend

Solid performance and current positive growth projection of the company is going to support the dividend hike. New Jersey Resources’ dividend payout ratio goal is between 60% and 65%. Considering $1.7, the midpoint of the current earnings guidance for fiscal 2017, current payout ratio comes at 64.1%, which is near the high end of the expected payout ratio.

New Jersey Resources reported positive earnings surprises in two of the last four quarters with an average positive surprise of 632.7%. The company continues to benefit from strong customer growth. Its customers volume has increased 18% over the last four years.

New Jersey Resources continues to strengthen its infrastructure with an objective to serve its increasing customers more efficiently. It aims to invest nearly $450 million in three years to further strengthen its existing operations.

Solid returns from its regulated operation ensure steady earnings and dividend growth. The company’s regulated operation is expected to contribute nearly 60% to 75% of its earnings in fiscal 2017. The ongoing investment will help sustain the earnings contribution from the regulated segment.

The Zacks Consensus Estimate for earnings is $4.27 on revenues of $3.59 billion for 2017. The bottom line expected to improve 8.1% year over year and the top-line projection is 2.6% higher. For 2018, the Zacks Consensus Estimate for earnings is pegged at $4.49 on $3.72 billion revenues. While earnings represent a 5.2% rally, revenues reflect a 3.7% rise.

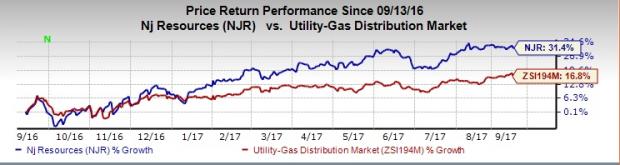

Price Movement

New Jersey Resources’ shares have rallied 31.4% in the last 12 months, outperforming the industry’s gain of 16.8%.

Zacks Rank & Other Stocks to Consider

The company has a Zacks Rank #2 (Buy). Some other stocks from the same sector worth considering are Pinnacle West Capital (NYSE:PNW) , CenterPoint Energy, Inc. (NYSE:CNP) and NRG Energy (NYSE:NRG) each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Pinnacle West delivered a four-quarter average positive surprise of nearly 15.5%. The company’s long-term earnings growth rate is pegged at 5.2%.

CenterPoint Energy delivered a four-quarter average positive surprise of 10.3%. The company’s long-term earnings growth rate is pegged at 4.3%.

NRG Energy delivered a four-quarter average positive surprise of 457%. The company’s 2017 Zacks Consensus Estimate went up 33.3% in the last 60 days.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market. Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

CenterPoint Energy, Inc. (CNP): Free Stock Analysis Report

Pinnacle West Capital Corporation (PNW): Free Stock Analysis Report

NRG Energy, Inc. (NRG): Free Stock Analysis Report

NewJersey Resources Corporation (NJR): Free Stock Analysis Report

Original post

Zacks Investment Research