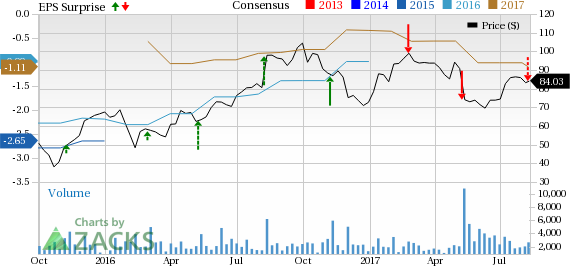

Nevro Corp. (NYSE:NVRO) reported second-quarter 2017 loss per share of 40 cents, comparing unfavorably with a loss of 27 cents per share in the year-ago quarter. This figure was also much wider than the Zacks Consensus Estimate of a loss of 29 cents.

Revenues in the reported quarter however, rose a stupendous 41% year over year to $78 million, exceeding the Zacks Consensus Estimate of $74 million. This solid result was primarily backed by a continued global adoption of the company’s HF10 therapy.

On a geographic basis, second-quarter revenues in the U.S. (representing 66.3% of total sales) grossed $63 million, up 55% from the year-ago quarter figure. Also, international sales (33.7% of total sales) advanced 1% year over year (up 4% at constant exchange rate or CER) to $15 million.

Per the company, international growth was moderate on capitation constraints. However, it expects the full-year international growth to be in the range of high-single to low-double digits.

Operational Update

Nevro’s second-quarter gross margin was 69.1%, reflecting a huge 306 basis point (bps) expansion year over year on account of a 47.4% rise in gross profit. Per the company, fundamental cost improvement resulted in margin expansion for the company.

Research and development expenses totaled $9.5 million, up 16.7%, while sales, general and administrative expenses amounted to $54.3 million, a 58.2% surge year over year. Operating loss in the reported quarter came in at $9.9 million, wider than the operating loss of $5.9 million in the prior-year quarter.

Financial Update

Nevro exited the second quarter of 2017 with cash and cash equivalents of $263.3 million compared with $276.3 million at the end of the first quarter.

Guidance

Nevro reiterates its 2017 revenue guidance in the range of $310-$320 million. The current Zacks Consensus Estimate of $314.3 million remains within this projected range.

Our Take

Nevro exited the second quarter 2017 on a mixed note. While the company’s worldwide revenues exceeded the Zacks Consensus Estimate, loss per share remained widely below the Zacks Consensus Estimate. Although, the year-over-year comparison of earnings was unfavorable, the company witnessed strong growth in the U.S. The company is putting efforts in product innovation through research and development. However, escalating costs and expenses affected margins.

Zacks Rank & Key Picks

Nevro currently carries a Zacks Rank #3 (Hold). Some of the better-ranked medical stocks are Edwards Lifesciences Corp. (NYSE:EW) , INSYS Therapeutics, Inc. (NASDAQ:INSY) and Align Technology, Inc. (NASDAQ:ALGN) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Edwards Lifesciences’ second-quarter 2017 adjusted earnings soared a stupendous 42.1% year over year, primarily driven by strong sales growth at the company’s transcatheter heart valves business. The stock has gained around 5.1% surprise over the last three months.

INSYS Therapeutics’ gross profit margin was 91% in the second quarter of 2017, flat year over year.

Align Technology’s second-quarter 2017 adjusted EPS of 85 cents were up a substantial 37.1% year over year. Revenues climbed 32.3% year over year to $356.5 million. The stock has surged roughly 28.3% over the last three months.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today. Learn more >>

Nevro Corp. (NVRO): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Insys Therapeutics, Inc. (INSY): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

Original post

Zacks Investment Research