Netflix Inc. (NASDAQ:NFLX) has won 20 Emmy Awards this year but unfortunately it failed to win the most prestigious Emmy Award for Outstanding Drama Series this time as well. The title was won by another big name in online video streaming, Hulu, for its drama series The Handmaid's Tale.

Netflix’s House of Cards, The Crown and Stranger Things were all nominated in the category. But Hulu won the award with its first and only nomination in the category.

Reportedly, Hulu is the first video streaming platform to win an award for the Outstanding Drama Series category at Emmy.

Hulu is jointly owned by The Walt Disney, 21st Century Fox and Comcast (NASDAQ:CMCSA) with Time Warner (NYSE:TWX) having a 10% stake in the company.

Time Warner’s HBO stole the show with 29 title wins at the 69th Emmy Awards, while Amazon (NASDAQ:AMZN) could win only two titles this season.

Are Netflix’s Efforts Paying Off?

Netflix is focusing on producing quality original content more than ever to increase as well as diversify its subscriber base. The company is taking a number of initiatives to establish itself as a leading content provider. Moreover, the company has whopping budgets of $6 billion (2017) and $7 billion (2018) for original content.

Notably, Netflix snapped up 91 Emmy nominations this year, which is almost double of what it earned in 2016. Hulu, on the other hand, had 18 nominations, substantially higher than two nominations that it managed last year.

Being nominated for and winning prestigious awards like Oscars and Emmy provides great brand visibility and helps to enhance the digital, streaming and DVD business for such series. Netflix’s chief content officer, Ted Sarandos was quoted saying, “To receive 91 nominations across 27 programs is a profound honor.”

Netflix’s tally of 20 Emmy Awards this year compared with nine won last year further reflects its strengthening content portfolio.

The company’s growing subscriber base is indicative of the fact that audiences are happy with its content. This is further evident from the latest survey conducted by RBC Capital Markets’ lead Internet analyst, Mark Mahaney. Per the survey, 36% of Netflix’s surveyed subscribers mentioned that “Netflix's content is improving over its already strong position.”

Additionally, 67% of subscribers were noted to be "extremely" or "very" satisfied with Netflix.

Subscriber growth has been the primary factor that helps Netflix to generate significant revenues. Moreover, the greatest advantage of Netflix is its growing dominance in the international market. Netflix plans to add more regional languages to make the service more appealing to its global customers. Hulu, on the other hand, caters to the U.S. market only and has no international presence.

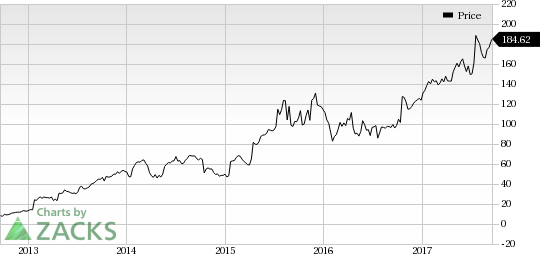

Notably, shares of Netflix have gained 49.1% year to date, significantly outperforming the industry’s 15.8% rally.

However, Hulu’s CEO Mike Hopkins recently announced that it plans to spend over $2.5 billion on content this year, higher than that of tech giants Apple (NASDAQ:AAPL) and Facebook (NASDAQ:FB) with a budget of $1 billion each on original content over the next year.

It remains to be seen whether Hulu plans to expand internationally, which, if it happens, will pose a concern for Netflix going ahead.

Zacks Rank

Currently, Netflix has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

4 Promising Stock Picks to Keep an Eye On

With news stories about computer hacking and identity theft becoming increasingly commonplace, the cybersecurity industry looks like a promising investment opportunity. But which stocks should you buy? Zacks just released Cybersecurity: An Investor’s Guide to Locking Down Profits to help answer this question.

This new Special Report gives you the information you need to make well-informed investment choices in this space. More importantly, it also highlights 4 cybersecurity picks with strong profit potential.

Get the new Investing Guide now>>

Time Warner Inc. (TWX): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Original post

Zacks Investment Research