Netflix Inc. (NASDAQ:NFLX) recently announced another major push in the European video streaming market with its first Polish original series that is expected to release next year. The yet-to-be named eight episode series will be directed by Oscar-nominated Agnieszka Holland along with Kasia Adamik.

This is a big move in our view owing to the fact that Holland had previously teamed up with Netflix for several episodes of House of Cards. The series turned out to be one of the key growth drivers for the company.

The latest series will be produced by Kennedy/Marshall Company and The House Media Company. Jurassic World producer, Frank Marshall and House of Cards producer, Robert Zotnowski are the executive producers of the series. Polish producer Andrzej Beszta, Maciej Musial, Joshua Long, and Agnieszka Holland are the other executive producers.

The streaming giant also announced that it is collaborating with Australian Broadcasting Corporation (ABC) on a new six-hour international political thriller named Pine Gap, which will be produced by Screentime. Per Variety, the series will be shot across various locations in South Australia and the Northern Territory starting 2018.

The drama series will be created by one of Australia’s leading screenwriter Greg Haddrick along with co-writer Felicity Packard. Lisa Scott and Felicity Packard will be producing the series. Screentime’s Bob Campbell, Rory Callaghan and Greg Haddrick, and Sally Riley and Kym Goldsworthy of ABC are the other executive producers.

Additionally, Netflix has also garnered the support of South Australian Film Corporation and the state government for this project. Screen Territory will also be providing financial support to the project in the form of a grant.

Earlier this month, the company also teamed up with Academy Award winning director Damien Chazelle for a new series, The Eddy, which will be shot in Paris and have French and Arabic dialogues apart from English.

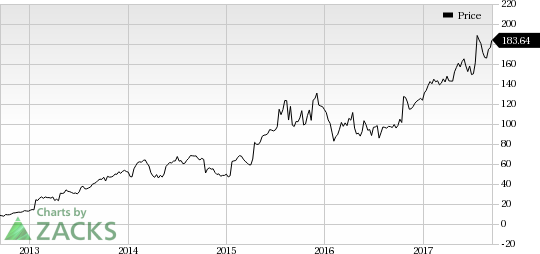

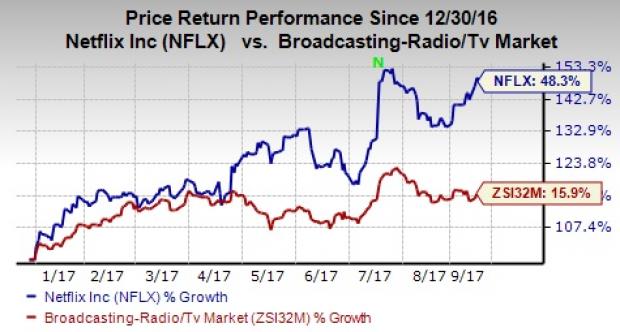

Notably, Shares of Netflix have gained 48.3% year to date, significantly outperforming the industry’s15.9% rally.

Should it Focus on International Growth or Control Spending?

Although international expansion and content additions resulted in cost escalations in the form of technology investments and marketing expenses, Netflix’s strengthening international original content portfolio has been the key growth driver in recent times. The company has been doing really well in North America, Latin America and Europe. Although it is expanding in India and Japan, it has a lot of room for expansion in other Asian markets. In order to grow in the Asian market, which has very good prospects, the company needs to expand regional programming.

The company’s expanding original content portfolio and improving penetration in international markets were the key catalysts behind its strong performance last year. Netflix remains confident about adding more and more subscribers as the trend of Internet TV/binge viewing catches up fast. Notably, rapid international expansion has paid off for Netflix, with the company adding substantially more subscribers than what it expected over the last quarter.

The company has a whopping budget of $6 billion (2017) and $7 billion (2018) for original content. Such enormous spending can dent the company’s profitability in the near term but we believe that Netflix’s expanding international content portfolio will rapidly drive subscriber growth that will further boost the stock in the rest of full-year 2017.

Per media reports, these sky high budgets have already raised serious concerns among investors. At a recent conference in New York, Netflix’s CFO David Wells expressed his concern over the need to control the company’s spending. He did add that there will be “diminishing returns” when Netflix’s user base and its contents reach a saturation point. But for now, in order to make a dominant position in the global market and reach out to a larger audience, such an investment will prove beneficial. As a result, spending $20 million per episode isn’t out of the realm of possibility.

Per Research firm MarketsandMarkets, the video streaming industry is anticipated to grow from $3.25 billion in 2017 to $7.50 billion by 2022, at a compound annual growth rate (CAGR) of 18.2%.

We believe that Netflix will have to maintain such high production budgets for now as it tries to capture a global audience. Further, Netflix also has to keep up with competition from other established players like Amazon (NASDAQ:AMZN) Prime, Hulu and Time Warner’s HBO. Reportedly, Amazon will be spending $4.5 billion on content this year. Tech giant Apple (NASDAQ:AAPL) and social networking giant Facebook (NASDAQ:FB) also plan to invest $1 billion each in original content over the next year.

Zacks Rank

Netflix has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Original post