Analysts at Stifel Nicolaus on Wednesday issued a very bullish note on streaming-media giant Netflix (NASDAQ:NFLX), which it said will benefit from international expansion in 2017.

The firm reiterated its Buy rating and lifted its price target for NFLX to $150 from $140. That new target suggests a nearly 20% upside to the stock’s Tuesday closing price of $125.11.

Stifel noted that Netflix will enter 2017 with a dramatically deeper catalog of original content, and the company faces favorable year-over-year subscriber growth comparisons, due to one-time impacts related to its price un-grandfathering during 2016. Netflix had raised the price of its monthly service from $8 to $10 per month, but many of its long-term subscribers were grandfathered into the old price. Many of those subscribers then canceled when their monthly costs rose.

Some investors are modeling Netflix’s overall net subscriber additions to be lower in 2017 than 2016, which Stifel believes is an overreaction to temporary issues the company faced during 2016. The firm is still raising its 2017 net subscriber addition forecast by around 1.1 million, and expects Netflix to add slightly more subscribers than it did during 2016. That view might even be conservative, given the company’s compelling content slate in 2017, and the fact that Netflix now has a full year of experience in its youngest international markets.

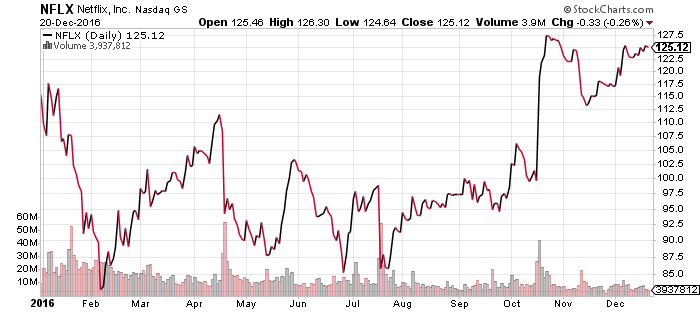

Netflix shares were mostly flat in premarket trading Wednesday. Year-to-date, NFLX has gained 9.39%, versus an 11.05% rise in the benchmark S&P 500 index during the same period.