One of the largest activist investors in the world is taking on his biggest target yet. Nelson Peltz’s Trian Fund Management is seeking a board seat at Procter & Gamble Company (NYSE:PG). Now, the Consumer Staples giant is the largest company ever to face a proxy fight, signaling that size alone is no longer enough to keep activists away from poorly run companies.

Activist investors have a mixed track record when it comes to creating shareholder value, but Peltz appears to have found an ideal situation. P&G has lagged its competitors in recent years, Peltz has experience revitalizing consumer brands, and the stock trades at a discount to its peers.

Peltz has not yet released a detailed plan for P&G, but any reform of the company’s corporate structure should include a renewed focus on return on invested capital (ROIC). ROIC ranks as the most important metric for global investors and has demonstrable links to valuation. Linking executive compensation to ROIC could create immediate shareholder returns and drive a long-term commitment to the lean and disciplined corporate structure that Peltz wants P&G to adopt. This strategy should become part of the playbook for companies looking to avoid activist takeovers.

Procter & Gamble’s Underperformance

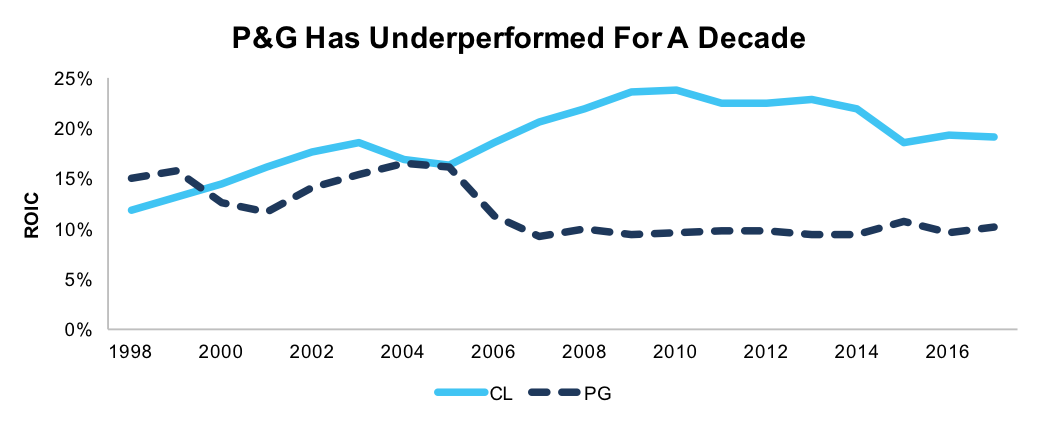

The best way to understand the recent failures of P&G’s management team is to compare the company to one of its largest competitors, the excellently run Colgate-Palmolive (CL). Figure 1 shows the ROIC earned by the two companies since 1998.

Figure 1: Colgate-Palmolive’s ROIC Strongly Outperforms P&G

Sources: New Constructs, LLC and company filings.

Through the late 1990’s and early 2000’s, the two companies earned similar ROIC’s, but that all changed with PG’s $54 billion acquisition of Gillette in 2005. The acquisition was a big blow to P&G’s ROIC from which the company has never recovered.

Since the acquisition, PG stock is up just 48% vs. 178% for CL and 142% for the Consumer Staples SPDR ETF (XLP). It’s surprising that the Gillette deal doesn’t find its way on to more lists of the worst corporate acquisitions.

Need To Focus On ROIC

The Gillette acquisition represents a classic case of executive incentives misaligned with shareholder interests. Buying Gillette helped P&G grow revenue and earnings per share significantly, which led to significant increases in bonuses for top executives, even as ROIC and shareholder return lagged peers.

These misaligned incentives also helped to create the “overly complex and bureaucratized corporate structure” that Peltz criticized. Excessive focus on sales growth and earnings per share pushes managers to invest in low return opportunities. As a result, you end up with a bloated organization that can’t maintain leadership in its value-creating products because it’s bogged down by bureaucracy and distracted by failed projects.

As Trian’s proxy statement points out, P&G’s volume growth has trailed its peers in four out of the past five years, which would indicate the company’s key brands are losing market share. The company states as much in its most recent 10-K by admitting it has lost market share in its Beauty, Grooming, Personal Health, Fabric & Home Care, Baby, Feminine, & Family Care segments over the past two years.

This declining market share points to a real systematic issue facing P&G. Its ROIC underperformance may have started with the Gillette acquisition, but that doesn’t tell the whole story. Even if we totally wiped that $54 billion in invested capital off the books, PG would still have an ROIC of ~18%, behind CL’s 19%. Notably, CL began tying executive compensation to ROIC in 2014.

P&G should follow in CL’s footsteps. Tying executive compensation to ROIC would not only prevent a repeat of the Gillette acquisition, it would also lay the groundwork for a more disciplined and efficient corporate structure.

This change in executive compensation wouldn’t just be good for shareholders, it would be in the best interests of management. General Motors (NYSE:GM) successfully held off an activist campaign in 2015 partly through a renewed emphasis on ROIC. If P&G is determined to keep Peltz off the board, a similar shift could help to placate shareholders.

Peltz’s Track Record

Peltz and Trian have a solid history of helping struggling consumer brands turn their fortunes around. In the late 90’s, Trian took over Snapple, a company that had lost 80% of its value in three years, and in another three years managed to restore a good portion of that lost value.

Trian helped push Heinz to a similarly lucrative buyout and more recently it waged a large campaign against PepsiCo (NYSE:PEP). Although Peltz failed to convince the company to split up, his initiatives did spur an increase in ROIC from 9% to 11% even as rival Coca-Cola (KO) saw its ROIC decline.

Most importantly from our perspective, PEP began tying executive compensation to ROIC shortly after Peltz took his position in the stock. We don’t know if Peltz was responsible for this decision, but the fact that Trian’s white paper on the company highlighted its poor ROIC suggests he might have had a hand in it.

Either way, Peltz’s track record shows that he has the expertise in brand management, cost discipline, and capital allocation required to help PG end its recent run of underperformance.

Value Opportunity

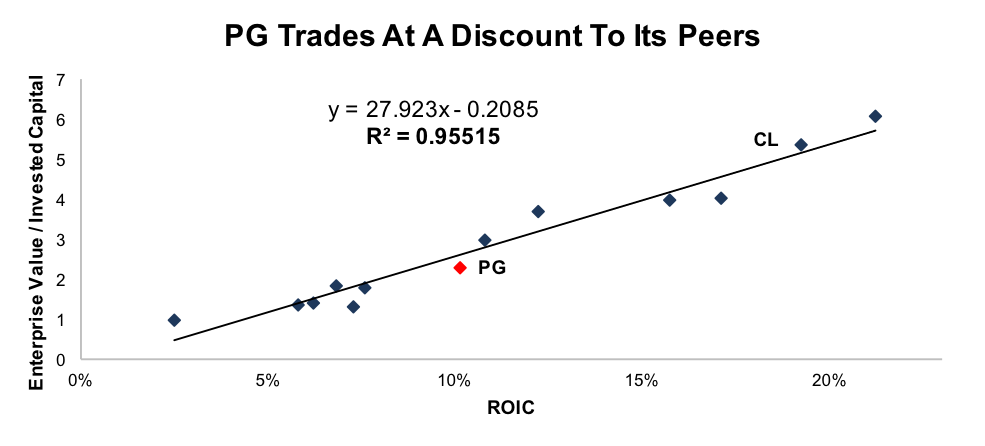

Unsurprisingly, given P&G’s underperformance, the stock trades at a discount to its peers. Figure 2 shows ROIC and enterprise value/invested capital (a cleaner version of price to book) for PG and twelve of its peers.[1]

Figure 2: ROIC Vs. Enterprise Value For Household Products Companies

Sources: New Constructs, LLC and company filings.

According to the equation in Figure 2, ROIC explains over 95% of the differences in valuation for these household products stocks and PG trades at a roughly 15% discount to its implied EV/IC.

Even if Peltz can’t bring any operational improvements, just convincing the market to value P&G at a level commensurate with its ROIC would create upside. If, on the other hand, Peltz can deliver tangible gains in sales and profitability, P&G could offer significant returns to investors.

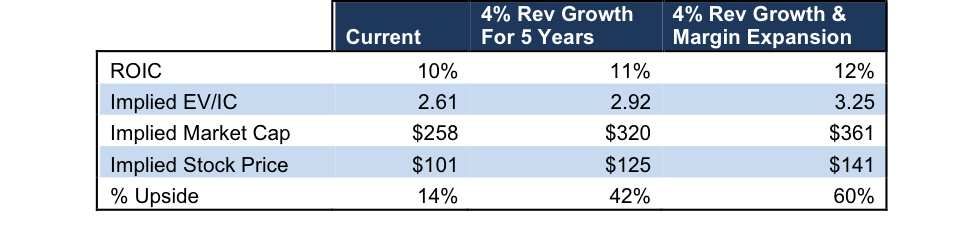

For example, Figure 3 shows the “% Upside” to P&G stock for a few relatively conservative scenarios. Column 2 shows 42% upside if P&G can grow revenue 4% for the next 5 years. Column 3 shows 60% upside if P&G’s cost cutting initiatives also succeed in increasing the company’s pretax margin from 22.5% to 25%.

Figure 3: Implied Valuation Scenarios

Sources: New Constructs, LLC and company filings

To drive this valuation gain, Trian and P&G will need to convince the market of the sustainability of its ROIC. The way to convince the market of one’s commitment to ROIC is the same as we’ve suggested many times:

- Link it to compensation

- Build into all capital allocation processes

- Show 100% support from the CEO

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

[1] Peers are Berry Plastics (Berry Global Group Inc (NYSE:BERY)), Central Garden & Pet Company (Central Garden & Pet Company (NASDAQ:CENT)), Church & Dwight (Church & Dwight Company Inc (NYSE:CHD)), Colgate-Palmolive (Colgate-Palmolive Company (NYSE:CL)), Clorox (Clorox Company (NYSE:CLX)), Edgewell Personal Care (Edgewell Personal Care Co (NYSE:EPC)), HRG Group (HRG Group Inc (NYSE:HRG)), Kimberly Clark (Kimberly-Clark Corporation (NYSE:KMB)), Oil-Dri Corporation (Oil-Dri Corporation Of America (NYSE:ODC)), Orchids Paper Products (Orchids Paper Products Company (NYSE:TIS)), Unilever (LON:ULVR) and WD-40 (WD-40 Company (NASDAQ:WDFC)).