Nektar Therapeutics (NASDAQ:NKTR) announced initiation of phase I/II PROPEL study to evaluate efficacy and safety of its lead immuno-oncology candidate, NKTR-214, in combination with Roche's (OTC:RHHBY) Tecentriq (atezolizumab) and Merck's (NYSE:MRK) Keytruda (pembrolizumab).

Notably, the checkpoint inhibitor, Tecentriq, is approved for the treatment of metastatic urothelial carcinoma in the United States and Keytruda was recently approved for refractory classical Hodgkin lymphoma (cHL) in both the United States and the EU.

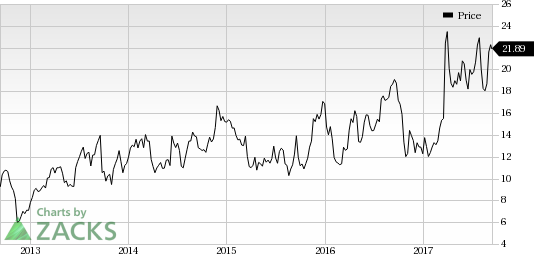

Nektar’s shares have significantly outperformed the industry so far this year. The stock has surged 78.2%, much above the broader industry’s 4% increase.

The PROPEL study complements Nektar’s ongoing PIVOT trial under which, NKTR-214 is being evaluated in combination with Bristol-Myers' (NYSE:BMY) Opdivo (nivolumab) across five tumor types (melanoma, kidney, colorectal, bladder and non-small cell lung cancer) and eight potential indications in phase I/II studies. The PROPEL study is aimed at establishing synergy of NKTR-214 when combined with either Tecentriqor Keytruda.

The study will be conducted into two separate arms with 30 patients in each. The first arm will evaluate the combination of NKTR-214 with Tecentriq dose regimen of every three weeks in patients adhering to approved treatment settings of Tecentriq, including patients with non-small cell lung cancer or bladder cancer. On the other hand, the second arm will assess dose regimen of NKTR-214 in combination with Keytruda per three weeks in approved treatment settings of Keytruda including patients with melanoma, non-small cell lung cancer or bladder cancer.

Per the company, these combination therapies could provide cancer patients suffering from multiple tumor types with new treatment options combined with approved checkpoint inhibitor therapies.

Apart from NKTR-214, another interesting candidate in the company’s portfolio is Onzeald, currently under accelerated assessment in the EU for treating adults with advanced breast cancer having brain metastases. However, in July 2017, Nektar filed a request for re-examination of the negative opinion adopted by CHMP on the same.

Meanwhile, Nektar initiated a randomized phase III confirmatory study (ATTAIN) on Onzeald, compared with single-agent chemotherapy of the physician’s choice in patients with advanced breast cancer having brain metastases shortly. Positive results from the study could support a regulatory filing in the United States.

Other pipeline candidates in the company’s portfolio include NKTR-181 (mu-opioid analgesic candidate for chronic pain conditions; phase III) and NKTR-358 (autoimmune disease; phase I).

Successful development and commercialization of these candidates will boost the company’s top line considering the lucrative markets they are targeting.

Zacks Rank

Nektar currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Merck & Company, Inc. (MRK): Free Stock Analysis Report

Nektar Therapeutics (NKTR): Free Stock Analysis Report

Original post

Zacks Investment Research