Negative interest rates have flipped our global financial system upside down. Investors are now paying governments to lend them money.

And it seems no country is immune...

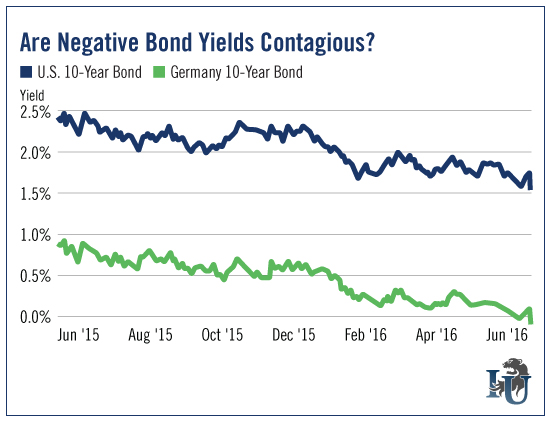

Last week, Germany - the eurozone’s economic powerhouse - became the newest member of the negative rate club when its 10-year bond yield dipped below 0%.

Is the U.S. next?

It’s a fair question. As we’ve seen, negative yields are contagious.

This week’s chart shows the yield of the 10-Year U.S. Treasury bond trending downward, right along with the German 10-Year After Thursday’s huge Brexit vote, the yield on Uncle Sam’s debt hit ultra-low territory... eclipsing even the lows hit in July 2012.

Over the past year, fear and uncertainty have driven U.S. Treasury yields lower and lower. Worries over a possible “Brexit” (more on that in a moment)... China’s economic woes... a worldwide slowdown... you name it.

In an extreme case of risk aversion, many investors have become willing to accept near-zero or even negative returns. They’re buying historically defensive debt, regardless of yield.

Others, though, are refusing to pay the government to loan it money. They have found ways to profit in spite of this negative interest rate environment... and, in some cases, they’re seeing impressive returns.

Real estate is one winning sector. In some negative rate environments, investors can get paid to borrow funds to purchase homes, buildings and other property. The Wall Street Journal recently reported on one homeowner in Denmark who received a 249 kroner ($38 equivalent) interest payment from his mortgage company. Here in the U.S., buyers flush with cash have driven real estate prices up.

With no end in sight to all this cheap money, more and more buyers are sure to enter the market. This will continue to drive prices higher. Real estate values have already moved north in parts of Europe and Japan. As rates stay low - or drop even further - the same will happen to property values in the U.S.

Investors have also taken a shine to gold. As Sean Brodrick has written, low interest rates have granted the metal a lower “carrying cost.”

Gold is up nearly 19% this year. In Japan, a pioneer of longer-term negative interest rates, gold’s uptick is even more pronounced. Its largest gold retailer said sales were up 35% year over year in the first quarter.

The reason? Negative interest rates. In a no-interest-rate world, it doesn’t matter that gold doesn’t pay a coupon. So investors have turned to gold bars as safe places to store their cash, pushing prices up.

Income-hungry investors, meanwhile, are pouring into high-quality dividend stocks. The S&P 500 Dividends Aristocrats Index - tracked by the ProShares S&P 500 Dividend Aristocrats (NYSE:NOBL) - is up nearly 10% year to date. Compare that to the S&P 500’s 3.14% rise.

As global bond yields go increasingly negative, the hunt for reliable dividends will only intensify.

But remember: Just because the negative interest rate contagion has infected many of the world’s economies... it doesn’t mean you have to settle for negative returns.

Given yesterday’s news that Britain will leave the EU, it’s unlikely the Fed will raise interest rates in the near term. Bond yields will remain low. So, it’s important that you take protective measures now.

As I said, right now investors are pouring into gold, sending prices soaring.