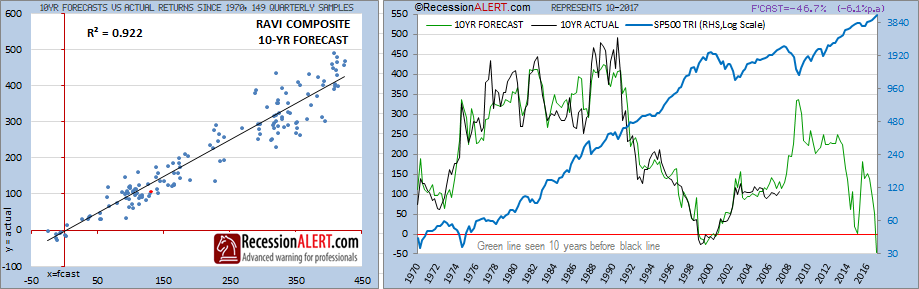

The RecessionALERT Valuation Index (RAVI) has been updated for 1Q17 and for the first time since 1999, is forecasting negative 10-year total returns for the S&P 500:

The chart on the right shows that the RAVI continues to forecast SP500 decade-ahead total returns with relative accuracy, especially when one considers that the green forecast line has data points that are seen 10 years before the black line depicting actual 10-year returns.

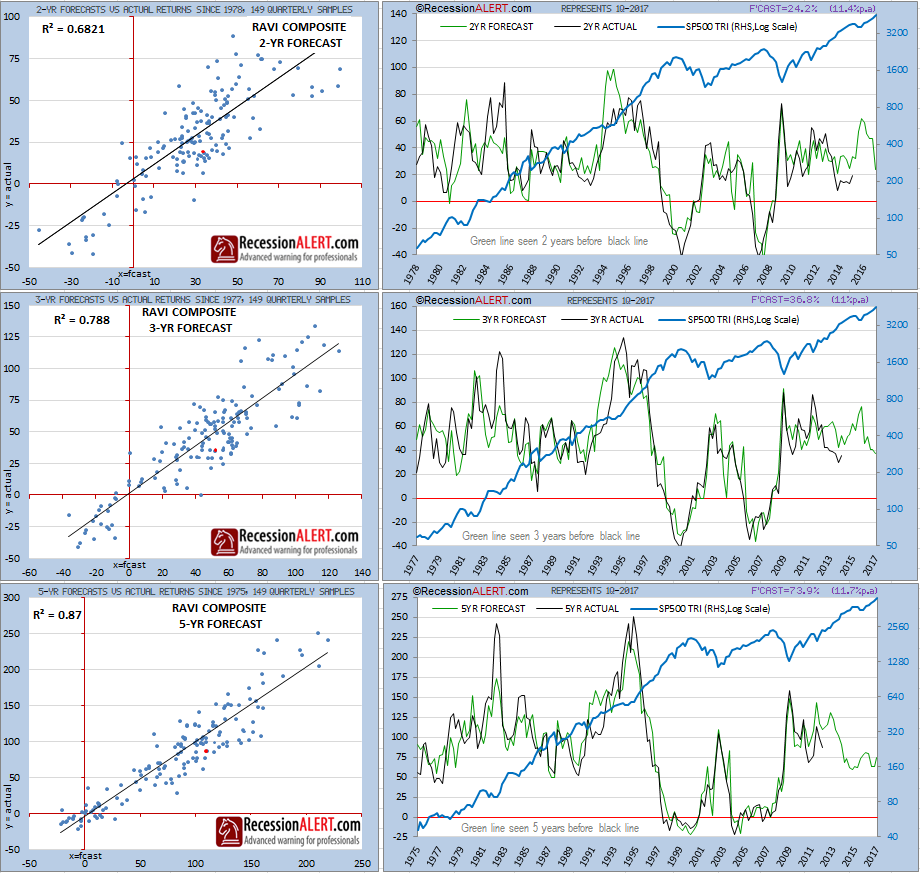

Now there have been a lot of valuation models predicting 10-year ahead negative returns but this does not mean one should be getting out the stock markets. One needs to review the short run (albeit less accurate) forecasts. As we can see below, these still hint at reasonable short run returns of the order of 11% per annum:

In March 2017, we used the 4Q16 RAVI forecast to predict returns for the SP500 to the end of 2017. Our low estimate was 2472, our median estimate was 2,565 and our high estimate was 2,718. As you can see from the RAVI daily tracker on top-right below, we have achieved the lower target and are 3.8% away from the median target and 10% away from the high target with some 5 months still to go:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI