The Utility sector is one of the most stable sectors for investment, as it deals with the basic services and is not affected by the vagaries of the economy. Regulated and domestic-focused utility companies are mature, fundamentally strong and focused on domestic and industrial usages.

Utility operation is capital intensive at the federal and state levels, and consistent investment is required to upgrade, maintain and replace older wears, electric poles and power stations to provide uninterrupted 24x7 services to its customers.

In this write up, we run a comparative analysis on two prominent electric power utilities — NextEra Energy, Inc (NYSE:NEE) and Southern Company (NYSE:SO) — to check which one is a better option for investment right now. Steady performance, stable earnings and cash flow enable these companies to reward their investors through regular dividends.

NextEra Energy, currently carrying a Zacks Rank #2 (Buy), has a market capitalization of $90.23 billion. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Southern Company, also carrying a Zacks Rank #2, has a market capitalization of $53.18 billion.

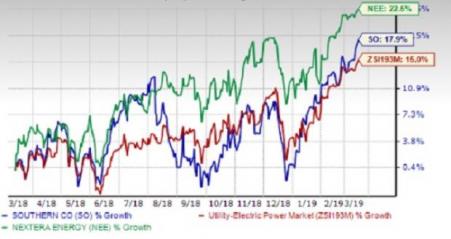

Price Performance

In the past 12 months, shares of NextEra Energy have gained 22.5%, while Southern Company’s shares have gained 17.9%. The industry has witnessed growth of 15% over the same period.

Long-Term Earnings Growth & Surprise Trend

NextEra Energy’s long-term (3-5 years) earnings growth rate is expected to improve 7.74% compared with 4.50% for Southern Company.

NextEra Energy outpaced the Zacks Consensus Estimate in three of the trailing four quarters, with an average positive earnings surprise of 2.52%. The company outpaced the Zacks Consensus Estimate in all the trailing four quarters, with an average positive earnings surprise of 7.85%.

Return on Equity (ROE)

ROE is a measure of a company’s efficiency in utilizing shareholder’s funds. ROE for the trailing 12 months for Southern Company and NextEra Energy is 11.39% and 10.01%, respectively. Both companies outperformed the industry’s ROE of 9.18%.

Debt-to-Capital Ratio

The debt-to-capital ratio is a good indicator of the financial position of a company. The indicator shows how much debt is used to run the business. NextEra Energy has a debt-to-capital ratio of 42.14% compared with the industry’s 50.71%. Meanwhile, Southern Company has a debt-to-capital ratio of 58.14%.

Dividend Yields

Utility companies generally distribute dividends. Currently, the dividend yield for NextEra Energy is at 2.65%, lower than 4.67% for Southern Company. Southern Company’s dividend yield is also better than the industry’s 2.92%.

Year-over-Year Earnings Growth

The Zacks Consensus Estimate for current-year earnings for NextEra Energy is pegged at $8.40, reflecting year-over-year growth of 9.09%. The Zacks Consensus Estimate for current-year earnings for Southern Company is pegged at $3.03, reflecting year-over-year decline of 1.30%

Outcome

Our comparative analysis shows that NextEra Energy holds an edge over Southern Company in terms of Price Performance, long-term growth, debt-to-capital ratio and Y/Y earnings growth. However, Southern Company has an edge over NextEra Energy in terms of earnings surprise history, ROE measures and dividend yields. Both companies have wide operations in the United States. Hence, it is quite evident that NextEra Energy is a better utility stock to add to one’s portfolio.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Southern Company (The) (SO): Free Stock Analysis Report

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

Original post

Zacks Investment Research