NCI Building Systems, Inc. (NYSE:NCS) posted adjusted earnings of 27 cents per share for third-quarter fiscal 2017 (ended Jul 30, 2017), down 18.2% from 33 cents recorded in the prior-year quarter. Earnings also missed the Zacks Consensus Estimate of 31 cents.

Including one-time items, the company reported earnings per share of 25 cents compared with 32 cents a share recorded in the prior-year quarter.

Operational Update

Sales inched up 1.5% year over year to $469.4 million in the quarter. The figure, however, fell short of the Zacks Consensus Estimate of $492 million. Revenues came within the company’s guided range of $480-$505 million. The year-over-year growth was due to continued commercial discipline in the pass-through of higher costs in a rising steel price environment.

Cost of sales increased 6% year over year to $354 million from $334 million in the year-ago quarter. Gross profit decreased 10% year over year to $115 million. Consequently, gross margin contracted 320 basis points (bps) to 24.5% in the quarter, due to lower plant utilization levels and a less favorable material cost environment.

Engineering, selling, general and administrative expenses were down 5% to $76.3 million. The company reported adjusted operating income of $36.5 million, which declined around 19% from $45.1 million recorded in the year-ago quarter. Operating margin came in at 7.8%, contracting 200 bps year over year.

Segment Performance

Revenues at the Building Systems segment climbed 3.8% to $182 million from $175.5 million generated in the year-earlier quarter. The segment reported adjusted operating income of $15.9 million, down18.9% from $19.6 million in the year-ago quarter.

The Coatings division reported revenues of $28.7 million, down 6.5% year over year. Operating profit plunged 24% year over year to $6.6 million.

The Metal Component segment’s revenues inched up 0.9% year over year to $258.5 million. On an adjusted basis, operating profit dropped 6.3% year over year to $35.4 million.

Financial Update

NCI Building ended the reported quarter with cash and cash equivalents of $45.9 million as of Jul 30, 2017, compared with $65.4 million at the end of Oct 30, 2016. Cash used in operations were $0.9 million for the nine-month period ended Jul 30, 2017, versus cash inflow of $40.6 million recorded in the prior-year period.

Long-term debt was $387 million as of Jul 30, 2017, compared with $396 million as of Oct 30, 2016.

NCI Building’s consolidated backlog advanced 4.2% year over year to $580.7 million at the end of the reported quarter.

Outlook

For fiscal 2017, NCI Building trimmed its revenue guidance range to $1.75-$1.78 billion from the previous range of $1.80-$1.86 billion. The company also slashed the adjusted EBITDA guidance range from $180-$200 million to $162-$176 million for the fiscal. The downward revisions reflect the dismal market activity, which is expected to continue into the fiscal fourth quarter, particularly in the legacy Components segment and the impact of Hurricane Harvey.

NCI Building's two ongoing cost-saving initiatives in manufacturing consolidation and ESG&A are expected to generate $30-$40 million savings by the end of 2018, of which $12 million was realized in fiscal 2016. During fiscal 2017, these two initiatives will generate an incremental $10 million of cost savings. .

For the fiscal fourth quarter, NCI Building estimates revenues to be in the range of $470-$500 million and adjusted EBITDA to be in the range of $48-$62 million. The fiscal fourth-quarter EBITDA range includes an estimated impact of $3-$8 million related to potential temporary disruptions from Hurricane Harvey.

NCI Building expects growth trends in quoting and order activity across all markets. The company remains focused on maintaining its commercial discipline, controlling costs and improving manufacturing efficiencies which will likely drive year-over-year earnings growth.

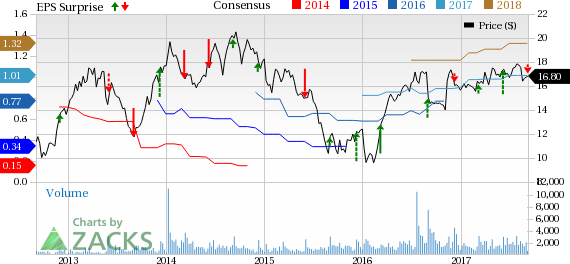

Share Price Performance

Year to date, NCI Building has outperformed its industry with respect to price performance. The stock has gained around 7.3%, while the industry recorded growth of 5.7%.

Zacks Rank & Key Picks

NCI Building currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the same sector are Owens Corning (NYSE:OC) , MasTec, Inc. (NYSE:MTZ) and NVR, Inc. (NYSE:NVR) . All three stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Owens Corning has expected long-term earnings growth rate of 14.8%.

MasTec has expected long-term earnings growth rate of 14%.

NVR, Inc. has expected long-term earnings growth rate of 14.9%.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

NCI Building Systems, Inc. (NCS): Free Stock Analysis Report

Owens Corning Inc (OC): Free Stock Analysis Report

MasTec, Inc. (MTZ): Free Stock Analysis Report

NVR, Inc. (NVR): Free Stock Analysis Report

Original post