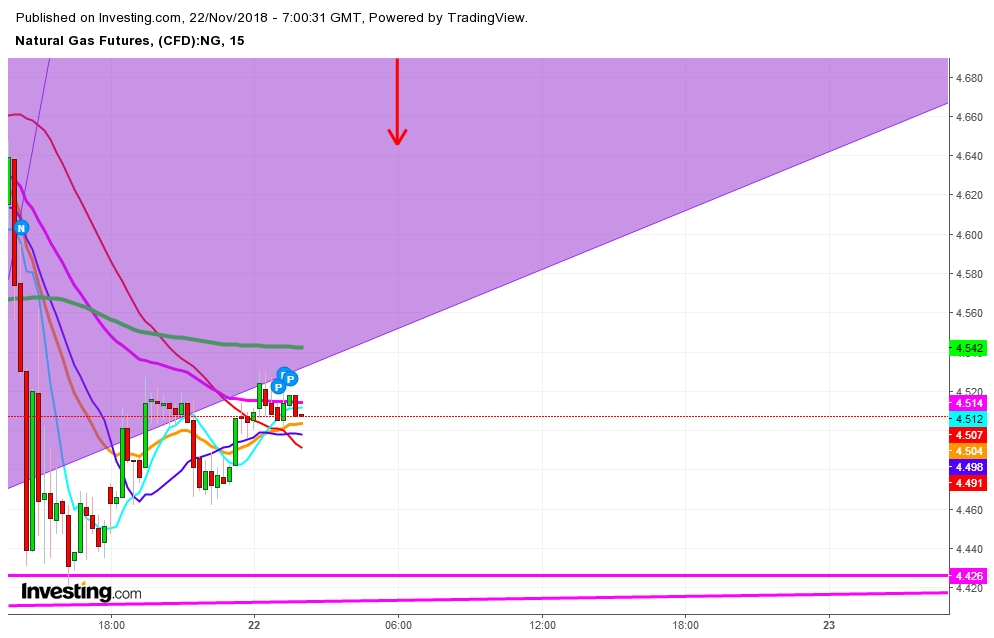

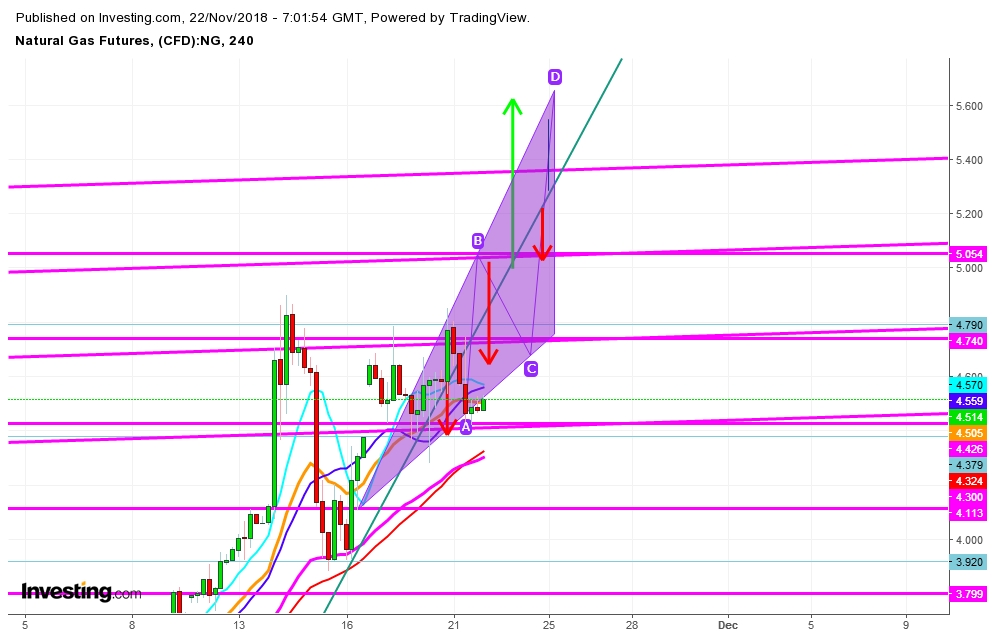

Since my last analysis, on analysis of the movements of Natural Gas futures in different time frames, I find Natural Gas looks ready for a breakout on November 22nd- 23rd, 2018, once they sustain above the level of $4.557 before moving ahead for their next target at $5.157. But the need of the hour is to keep an eye over the movements of Natural Gas futures, as the prevalence of ‘November Factor’ may result in sharp steep indecisive moves at any step upto lower levels at 4.367, from where natural gas bulls will start thrashing bears. On the other hand, announcement of bullish inventory of Natural Gas stockpiles looks too supportive for Natural Gas bulls to make aggressive moves from the current level. Let’s have a look at the movements of Natural Gas futures in the following charts.

Disclaimer: This analysis is only for educational purpose. Readers are requested to kindly consider their own view first, before taking any position.