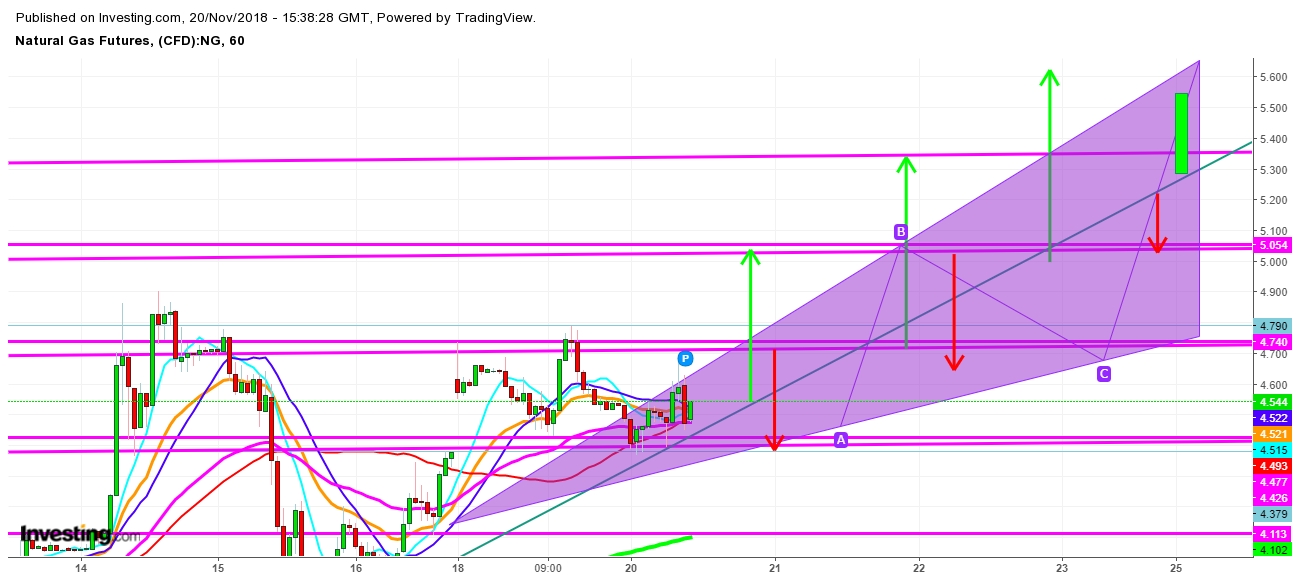

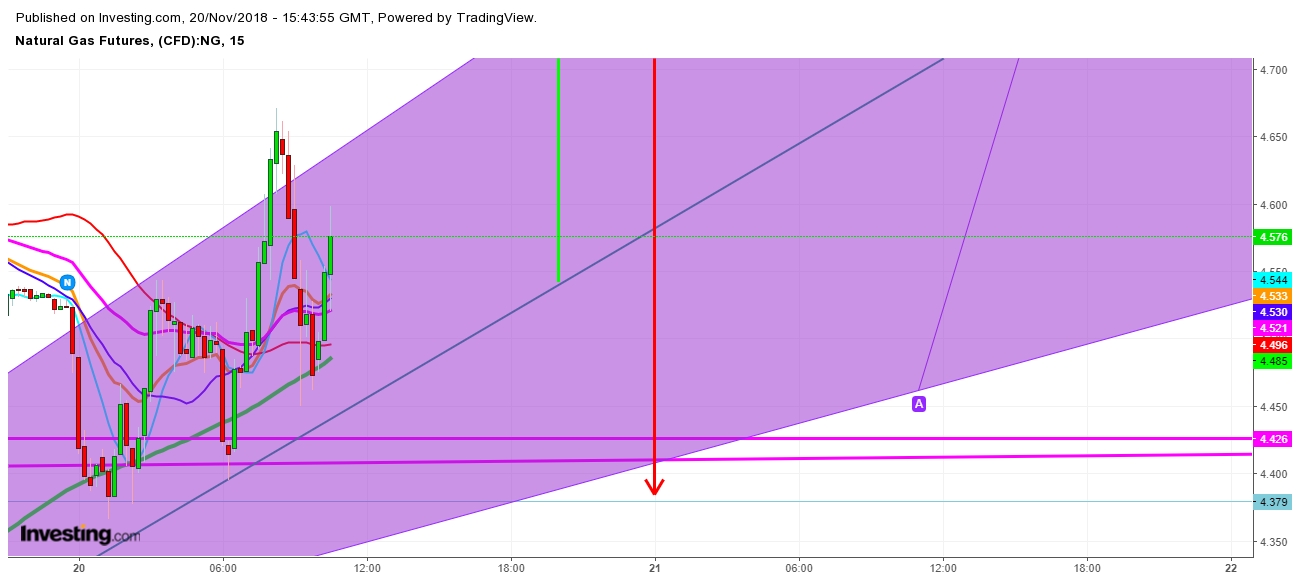

Since my last analysis, I find that natural gas bulls have tried their best to maintain the gap till now despite heavy selling pressure on every upward move; but the presence of natural gas bulls in large numbers above $4.388 is evident enough for an eruptive move on the impending inventory report. Natural gas bulls look too confident to load at every downward move of natural gas futures as they look too confident. I find that amid growing volatility, the bulls have an eye on their target above $5.288. No doubt that the ‘November Factor’ will make the moves too sharp at every step, but bulls’ confidence may find the support of first withdrawal of the season on Wednesday. But long holidays ahead may enhance indecisiveness too. Let’s have a look at the movements of natural gas futures in the following charts.

Disclaimer: This analysis is only for educational purpose. Readers are requested to kindly consider their own view first, before taking any position.