A year end series taking a longer perspective in many market indexes, macro related commodities, currency and bonds. Over three weeks these reviews are intended to help create a high level road map for the the next twelve months and beyond. We continue with the Nasdaq 100 (QQQ, NDX).

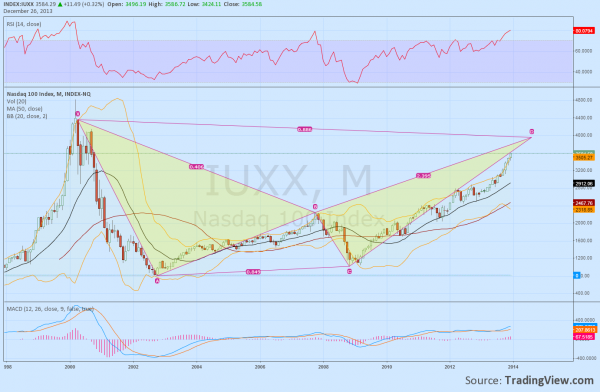

Mention the Nasdaq 100 Index and investors everywhere immediately think of the Dot Com Bubble of 2000. Many have explained how the recent run up Nasdaq stocks is different from then so I will not rehash that here. What is interesting though is that the height of the Nasdaq 100 at the top of that bubble is now playing a very important role. That is the starting point for a bearish Bat harmonic that revealed itself in the monthly chart in late 2010. The target for a move higher, or potential reversal zone, is to 3950. But this pattern can and often does morph into a Crab harmonic, with the only difference being the upside target extends to 6555. That is a long way off and it is best to focus on the 3950 level first. If you look left on the chart you will note some back and forth movement between the current 3600 level and 3800 with a minor top above that at 4100, all as part of the initial bounce on the move lower in 2000. With these levels near the top of the Bat range there is certainly going to be a debate about future price action once it gets there.

It is also worth noting that the last two times the Relative Strength Index (RSI) touched the 80 level, like it is doing now, the Nasdaq 100 has corrected. That does not mean it will happen again this time. It could very easily correct the RSI overbought condition through time, with the Nasdaq 100 slowing its rate of climb or moving sideways. For some potential insight a flip to the weekly chart helps. The weekly chart shows a rising channel since the 2009 low with a few bounces off of both the top and the bottom. That was until this week when it gapped up over the channel. This can also be either very bullish over a prelude to a pullback. Notice that the RSI is extended in this timeframe as well, although not as much as on the monthly chart. Also notice that the previous times the RSI has been extended on this time frame and corrections have occurred, they have been minor.

This time could be different and that would be very bullish. But nothing definitive on the weekly either. Time to move in to the daily chart for clues. The daily chart below shows the price action since the November 2012 low. A choppy trend higher that is accelerating. But the steps along the way show many instances where the bearish viewed reared its head only to be smacked back down. There were expanding wedges that broke to the upside, false break of resistance that then recovered quickly for new highs early in the year, but hey have shifted to more bullish looking consolidation zones that are then broken to the upside for another consolidation. No straight line runs higher in this chart.

Each time the RSI has popped over 70 it has pulled back and then the Nasdaq has moved higher to new highs. With the 20 and 50 day Simple Moving Averages (SMA) nearby there is nothing in this chart that says a big correction is coming or could come. The net result is that the charts favor the upside at least until the 3950 range, but may come with some chop and pullbacks along the way. Beyond hat looks like when it will become more interesting.

Back Tuesday to wrap up the series with the S&P 500.