Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed higher: Shanghai Comp -0.03%, Hang Seng +0.50%, Nikkei +1.80%

- In Europe 11 out of 13 markets are trading higher: CAC +0.52%, DAX +0.39%, FTSE +0.47%

- Fair Value: S&P +0.52, NASDAQ +3.71, Dow +11.84

- Total Volume: 1.82 million ESM & 848 SPM traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, ADP (NASDAQ:ADP) Employment Report 8:15 AM ET, Richard Clarida Speaks 9:45 AM ET, Raphael Bostic Speaks 9:45 AM ET, PMI Services Index 9:45 AM ET, Michele Bowman Speaks 10:00 AM ET, ISM Non-Mfg Index 10:00 AM ET, EIA Petroleum Status Report 10:30 AM ET, Eric Rosengren Speaks 1:15 PM ET, and Beige Book 2:00 PM ET.

S&P 500 Futures: It Takes Days And Weeks To Knock The S&P Down And Only One To Bring It Back

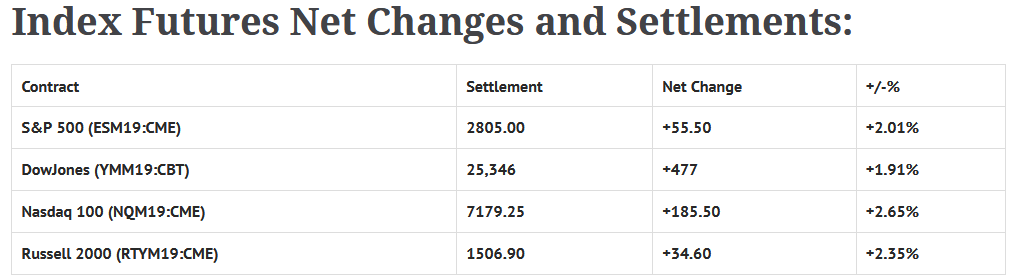

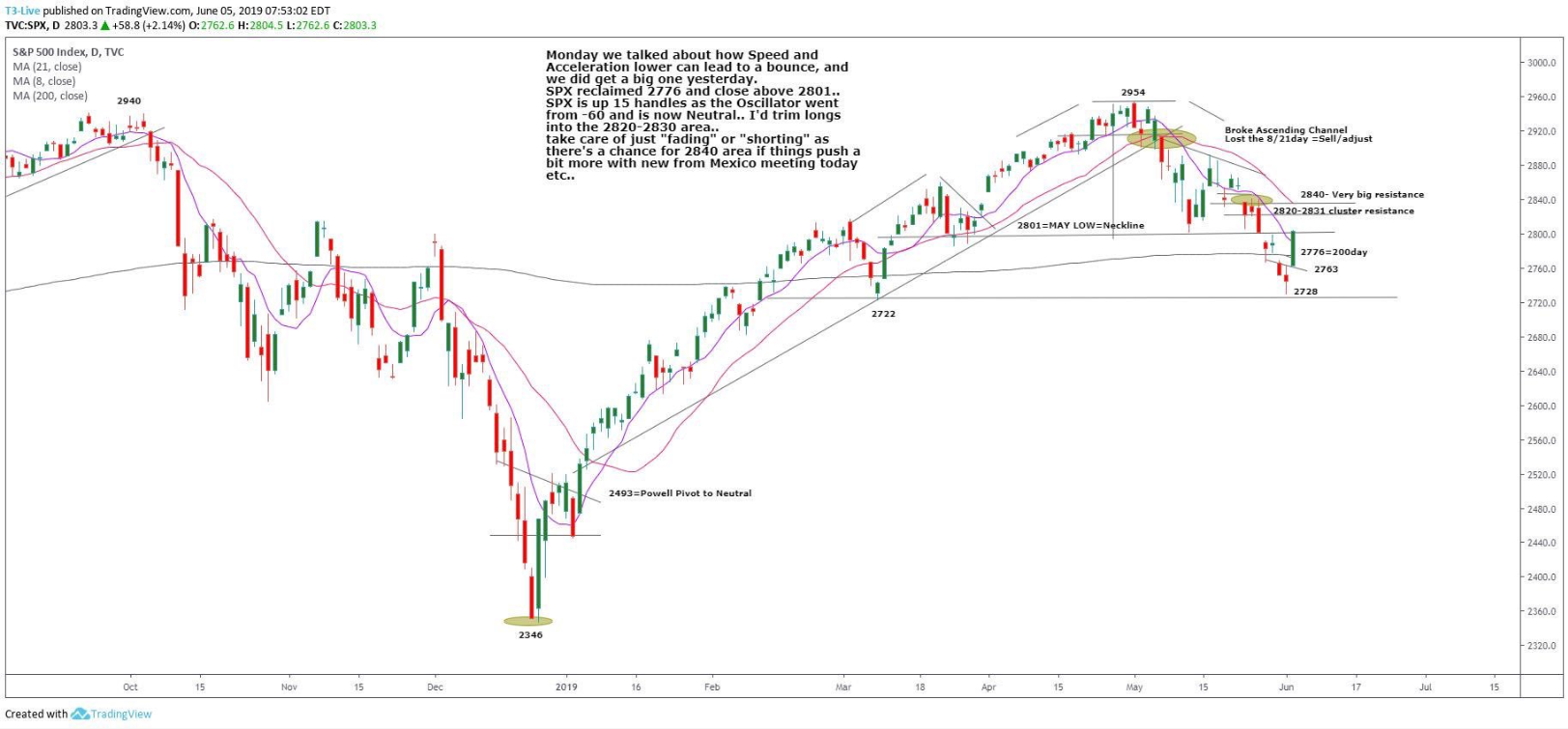

Chart courtesy of Scott Redler @RedDogT3 – $spx futures +15 as markets get some upside follow thru to yesterday’s oversold bounce.

As we all know, it’s all about the news. After six weeks of lower prices, the S&P went charging higher. The Nasdaq was the clear leader. After falling 1.95% on heightened regulation Monday, it closed up 2.65% yesterday.

You had to know when people started talking about a tech bubble that there was going to be a bounce, and with the exception of an early pullback, both the ES and NQ went straight up.

Monday’s late strength followed through into the Globex session, with the S&P 500 futures (ESM19:CME) printing a low at 2744.00, then rallying the rest of the session to open Tuesday’s regular trading hours at 2769.25.

After a quick dip down to 2764.00 just after the 8:30 CT bell, the ES continued to rally on the heels of a bundle of buy programs that seemed to trigger every 15 to 30 minutes. By 11:00 it had rallied all the way up to 2791.75, and would eventually go on to break through 2800.00.

Going into the close, when the cash imbalance reveal showed $494 million to sell, the ES continued to rally, and would go on to print 2803.50 on the 3:00 cash close, and 2805.25 on the 3:15 futures close, up +55.75 handles on the day.

In the end, the overall tone of the ES was strong, making back all of Monday’s losses, and then some. In terms of the days overall trade, total volume was on the high side, with 1.8 million futures contracts traded.