Technology has become a durable and leading global economy and stock market sector.

And due to a concoction of mixed economic data, overheated inflation, and rising interest rates, technology stocks have been caught in the cross-hairs of a bear market.

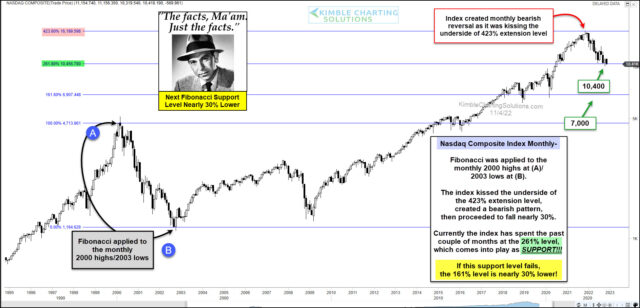

The chart below looks at the NASDAQ Composite on a long-term, monthly timeframe with key Fibonacci levels.

As you can see, the NASDAQ rallied as high as the 423% Fibonacci extension level before reversing lower. That reversal has sent the NASDAQ sputtering down to an important/strong price support level at the 261% Fibonacci level (10,400).

If this key Fibonacci support level fails to hold, prices could fall considerably. The next Fibonacci support level is at the 161% level, near $7,000.

In my humble opinion, tech stocks are at a critical crossroads. Stay tuned.