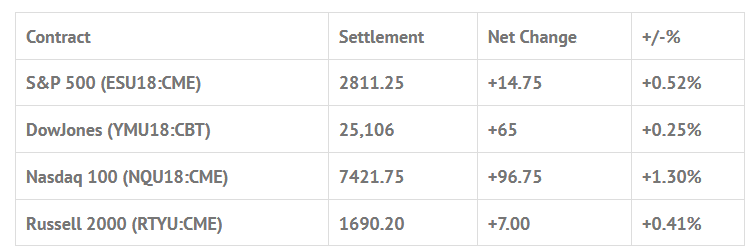

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 6 out of 11 markets closed lower: Shanghai Comp -0.35%, Hang Seng -0.23%, Nikkei +0.43%

- In Europe 8 out of 13 markets are trading higher: CAC +0.53%, DAX +0.73%, FTSE +0.65%

- Fair Value: S&P +1.36, NASDAQ +14.33, Dow -21.93

- Total Volume: 1.03mil ESU & 282 SPU traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, Housing Starts 8:30 AM ET, Jerome Powell Speaks 10:00 AM ET, EIA Petroleum Status Report 10:30 AM ET, and Beige Book 2:00 PM ET.

S&P 500 Futures: Netflix (NASDAQ:NFLX) Drop And Amazon (NASDAQ:AMZN) Prime Day Sale Rip

With the exception of Nikkei, which has been skyrocketing, the major Asian markets closed weak yesterday, and at midday most of the European markets were trading lower. On Globex, the S&P 500 futures (ESU18:CME) trading range was 2798.75 to 2801.50, with 157,000 contracts traded. The first print off the 8:30 CT futures open was 2891.00.

As we have always said, we like writing about the markets, but this is going to be short and sweet. The weakness on the close and slight weakness overnight came from Netflix, which was down over $61.00 on its lows, but the ever forgiving Nasdaq had something else on its mind. A day after Amazon Prime Day kicked off and the website and app crashed, things were working much more smoothly, as was its stock that was up over $27.00, pulling Netflix back up and the rest of the tech sector with it. In turn, this pushed the ES up to 2814.00, up +17.50 handles at 12:15 CT, with literally no pullback larger than 2 to 3 handles (if that).

After a pullback down to 2810.50 (3.5 handle pullback), the ES made a new high by1 tick at 2814.25. The ES had another ‘little pullback’ and traded 2810.00 before pushing up to 2815.75 near the close, even as the MOC came out to over $1 billion to sell.

The 3:00 print on the cash close was 2812.00 before the 3:15 settlement marked at 2811.25, up +15.50 handles, or +0.55%.

In the end, all I can say is Amazon, Amazon, Amazon. As it rose it overpowered the losses in Netflix and took the rest of the indices for the ride. In terms of the ES’s overall tone, the drop on Globex presented a perfect buying opportunity. Goldman is calling for 2823 vs the S&P cash as the next resistance level. In terms of the days overall trade, just over 1 million ES contracts traded, but the MiM again showed over $1 billion for sale. While we still think higher, all this MOC selling is a bit spooky.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.