NASDAQ's Primary Uptrend

When we are gauging the primary-term uptrend, it is imperative that we respect it, before prematurely, coming into a conclusion that the trend has been broken or reversed.

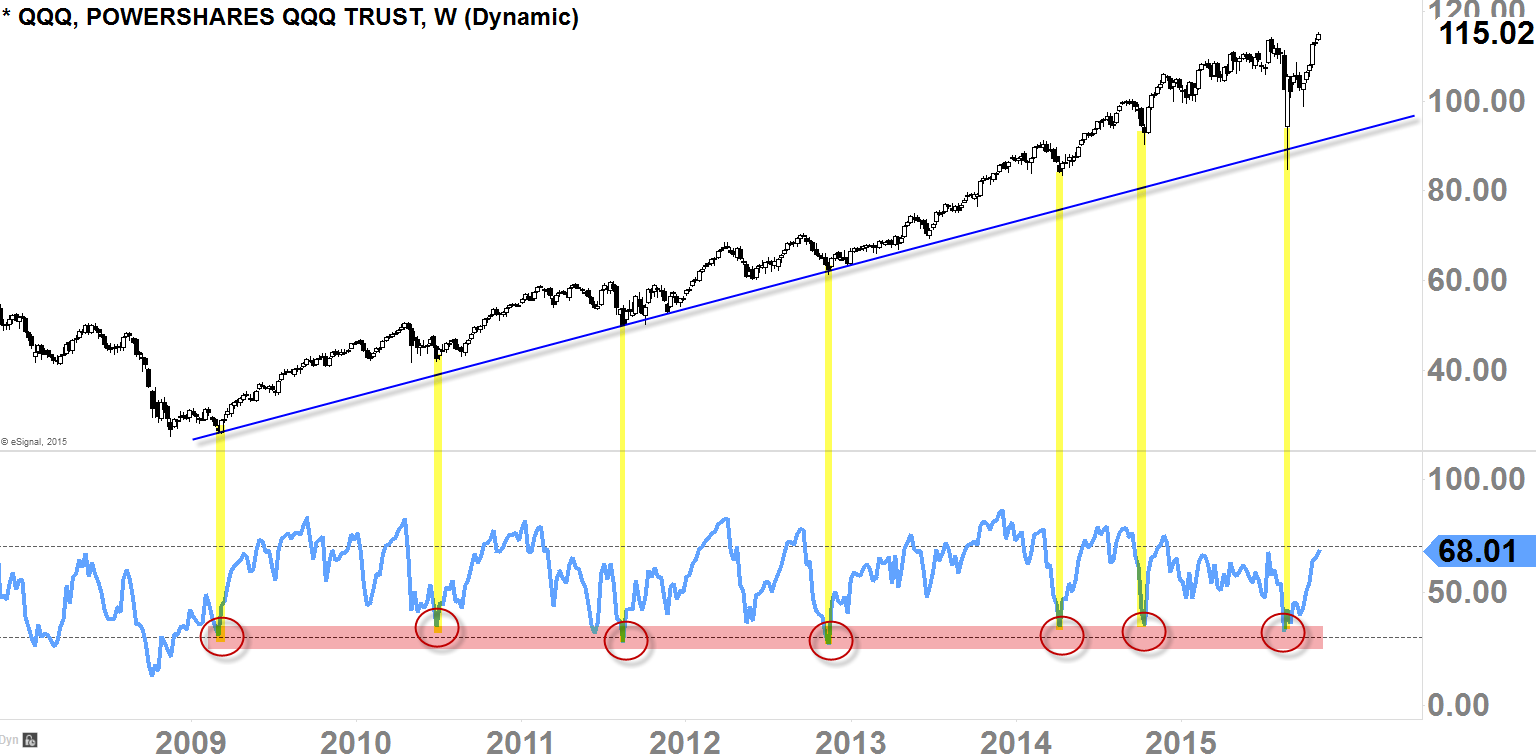

First, we look at the weekly-chart of the PowerShares QQQ Trust Series 1 (O:QQQ) because of the duration (going on 7 years) of this trend we are dealing with. Intermediate-term trend may be broken when the 'correction' occurred, but many times, it will come back down to re-establish primary-term uptrend as you can see in the chart below.

Second, weekly-RSI can be a confirmation tool when it has been hitting the same spot for 7 years. As you can see in the chart below, the market seems to bounce back up every time when it hits the "oversold" status (bottom band of the RSI -- see red circles) and it happened every single time (talking about probabilities!).

We should not assume that the market will bounce just because it's in "oversold' status (hitting the bottom band), but rather, we should wait for the price-action to confirm that bounce, and give the 'benefit of the doubt' to the buyers when it's hitting that "oversold" status.

The market strongly bounced off of that $100ish-level while RSI expands to the upside, once the price-action confirmed the RSI, we can now assume that the trend is resuming back up and the trend is healthy.

Our Holdings

We've been long since late-February on QQQ, but our gains were completely eradicated when the market declined rapidly in late-August. However, as I have shown on the weekly-chart above, we did not panic and we've decided to hold through the decline, because this market was still in a primary-term uptrend—meaning it has high probability of resuming its movement back up.

Once the price-action cleared the $107ish-level on October 15th, we've decided to add to our positions, because that was the level that we've been watching for our "complete reversal zone" as I have been talking about it on my Mid-Week Update videos.

Once we've stayed up strongly, well above the $107ish-level, Q's been strong for a few weeks straight; but some of our minor-term indicators are showing "overbought" status at this level as of yesterday, so we've decided to close half of our positions (mainly the ones that we got into back in late-February).

- Our next target is around $125-$130 on QQQ