Why the U.S. dollar still reigns supreme

We recently analyzed Dow performance after lengthy weekly win streaks, but what about the Nasdaq Composite (IXIC)? The tech-rich Nasdaq just wrapped up its longest weekly win streak this side of the millennium. Below is how the index has performed after similar feats of strength, and what we might expect for Nasdaq stocks this spring and beyond.

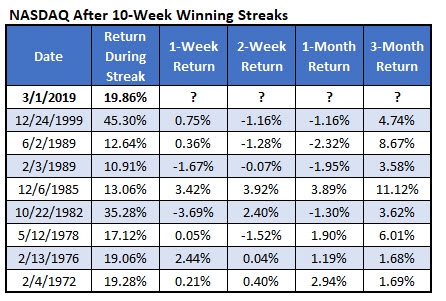

Specifically, the IXIC just notched its 10th consecutive week-over-week gain -- something we haven't seen since the dot-com boom of 1999. That win streak, in fact, was the first of its kind in a decade, per data from Schaeffer's Senior Quantitative Analyst Rocky White, and extended to the 11th week. There were two of these win streaks in 1989, the only year to boast such a record. The longest weekly win streak was in 1972, lasting a whopping 15 weeks. Below are all the 10-week win streaks for Nasdaq since 1971.

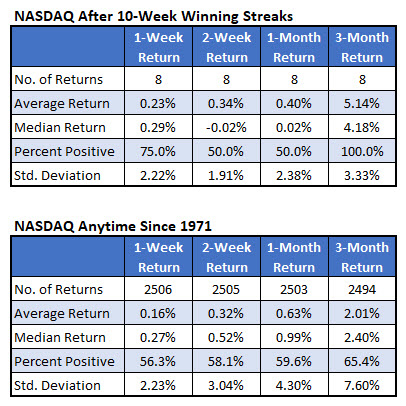

Those streaks extended to an 11th week 75% of the time, with the Nasdaq averaging another one-week gain of 0.23%. That's higher than the index's average one-week anytime gain of just 0.16%, with a win rate of 56.3%.

Two weeks after a 10-week rally, the IXIC was up 0.34%, on average -- in line with the norm -- and higher half the time. One month later, the index was up just 0.4%, on average, with a 50% win rate -- slightly lower than its average anytime returns. However, three months later, the Nasdaq was up an impressive 5.14% -- more than double its average anytime gain of 2.01% -- and was higher every single time.