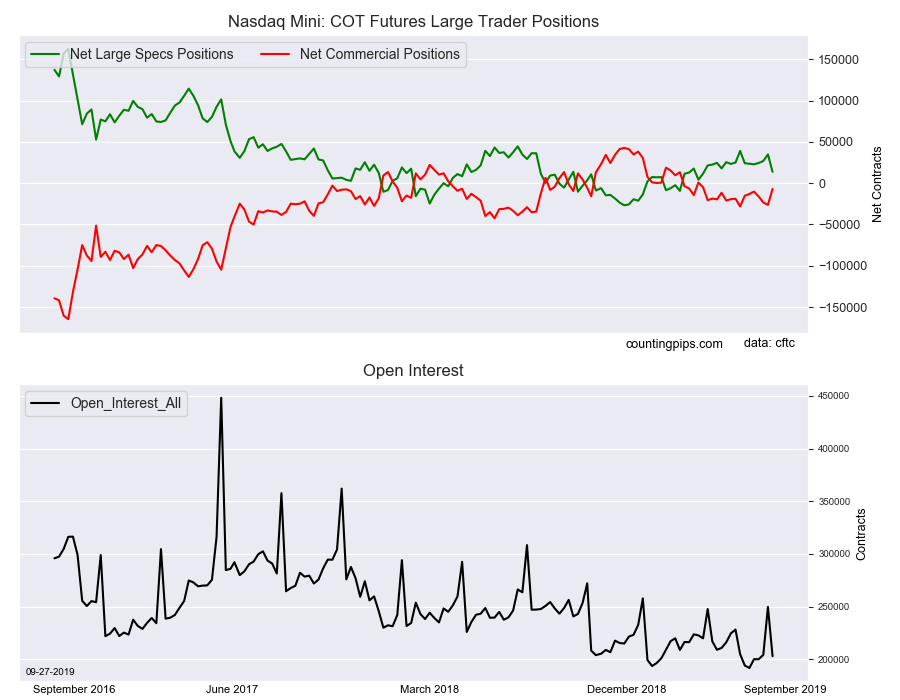

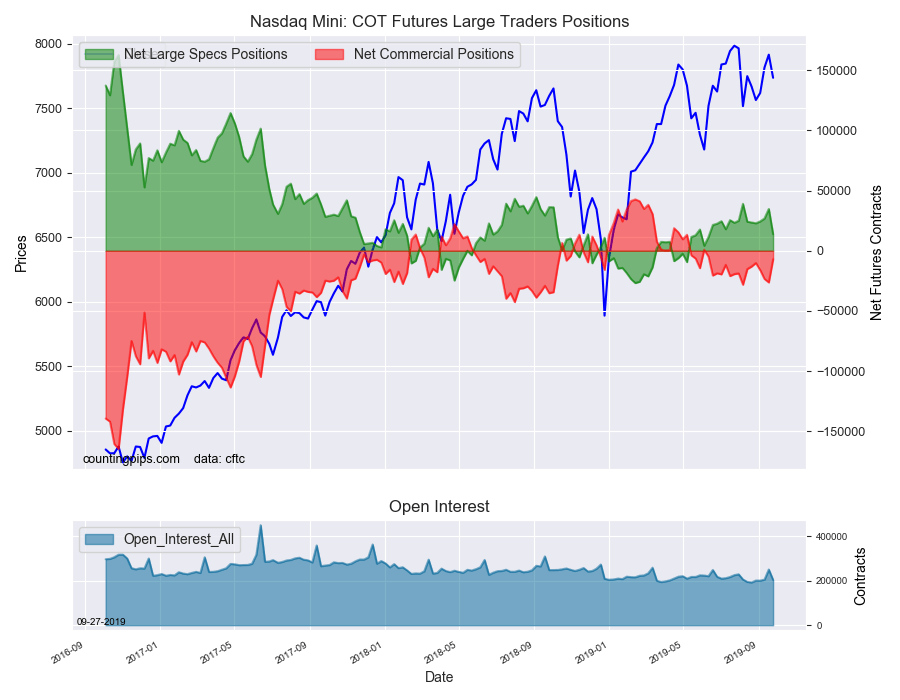

Nasdaq Mini Non-Commercial Speculator Positions:

Large stock market speculators strongly reduced their bullish net positions in the Nasdaq Mini futures markets last week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Nasdaq Mini futures, traded by large speculators and hedge funds, totaled a net position of 13,779 contracts in the data reported through Tuesday September 24th. This was a weekly change of -21,014 net contracts from the previous week which had a total of 34,793 net contracts.

The week’s net position was the result of the gross bullish position (longs) dropping by -11,752 contracts (to a weekly total of 69,740 contracts) while the gross bearish position (shorts) gained by 9,262 contracts for the week (to a total of 55,961 contracts).

Nasdaq Mini speculators sharply dropped their bullish bets last week following three straight weeks of gains. The week’s decline was the largest one-week fall since December of 2018 and brings the overall bullish level to the least bullish point in fifteen weeks. The speculative Nasdaq standing, despite last week’s drop, remains in an overall bullish position for the twentieth consecutive week, dating back to May.

Nasdaq Mini Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -7,021 contracts on the week. This was a weekly boost of 19,251 contracts from the total net of -26,272 contracts reported the previous week.

ONEQ ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the ONEQ ETF, which tracks the price of Nasdaq Index, closed at approximately $7735.25 which was a decrease of $-179.25 from the previous close of $7914.50, according to unofficial market data.