Nasdaq 100 Index (NQ) March E-mini Futures formed a peak on February 16th when it recorded 13899. The index, which consists of tech majors, succumbed to a combined assault of profit booking and stops being triggered.

The sell off took the index to 13543 where buyers came in to support and it fell again to 13469. Once again on Friday February 19th buyers came in to support the index but the maximum they could do was 13728 and failed to settle above 10 day SMA sitting at 13720, a point which turned out to be a point of breakdown.

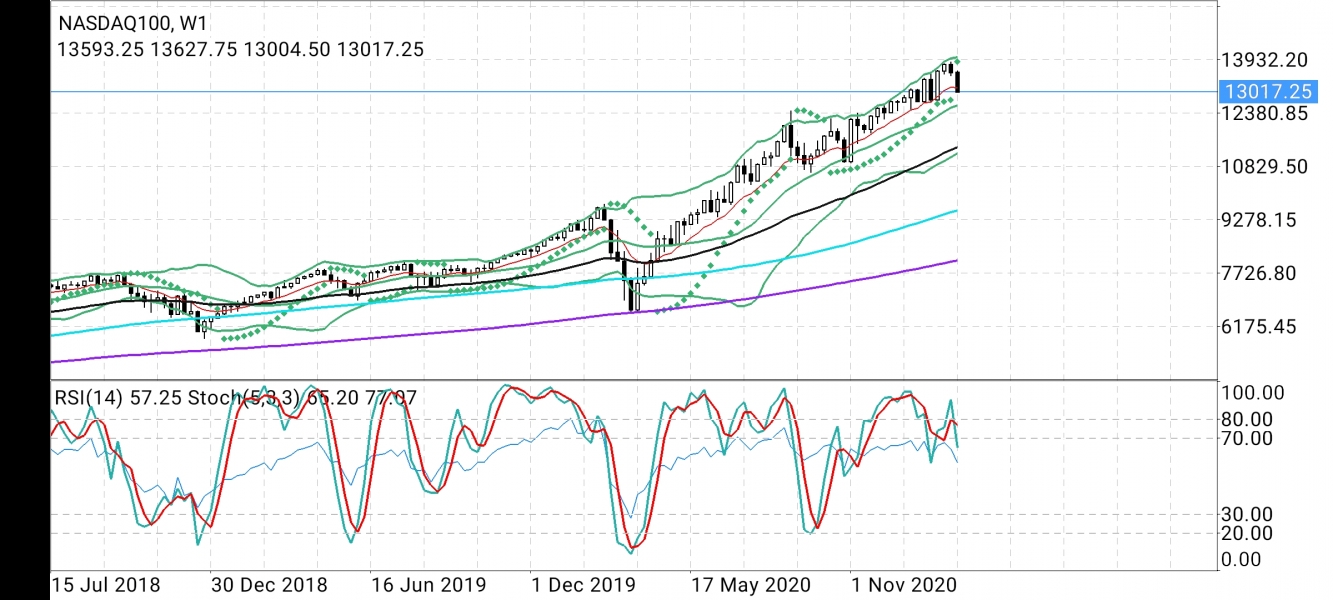

The Nasdaq has been trading with clear weakness at least over the short term. On Tuesday, February 23rd the index broke below the 23.6% Fibonacci level of retracement measured from 10656-13899 which is 13134.

So the picture looks bearish for the short term perspective with prices trading well below 10 Day SMA 13603, 20 Day SMA 13588.

A further sell off pushed the broad tech index below a critical 59 Day Exponential Moving Average 13228, 10 week SMA 13176 and even below 23.6% Fibonacci level 13134

It is very important to understand that on the Daily chart Stochastic RSI has reached oversold levels which can continue in the event of continued selling. However if enough buyers come in for a value trade, 12950 can hold the fall and Nasdaq can show some recovery for 13134 - 13228-13580 and 13680.

This will require strong buying momentum supported with adequate volume.

Failure to hold above 23.6% Fibonacci level 13134 can further expose Nasdaq to deeper correctional moves to 100 Day SMA 12686 and next 38.2% Fibonacci level 12660

Disclaimer: The author has presented own views based on Technical Analysis of chart and price action. This should not be treated as a trading recommendation.