US Futures

Dow futures 0.30% at 37760

S&P futures 0.8% at 5022

Nasdaq futures 1.3% at 17341

In Europe

FTSE -2.3% at 7709

Dax -2.3% at 19740

- Volatility is elevated as Trump’s trade tariffs take effect

- China hits back with 84% trade tariffs on US imports

- US treasuries and the USD fall

- Oil plummets to a new 4-year low

Volatility remains elevated as Trump’s tariffs take effect

U.S. stocks are swing from losses to gains of what is expected to be another volatile session as President Trump's reciprocal tariffs took effect today, sparking retaliatory moves from China to Europe

While Trump implemented 104% trade tariffs against China, the world's second-largest economy retaliated by imposing additional tariffs of 84% on all US goods as of April 10, previously announced 34%. Meanwhile, European countries have agreed on the first wave of retaliatory tariffs against the US totaling €22 billion.

U.S. Treasury Secretary Scott Bessant has said that the trump administration could likely reach tariff deals with US allies as he prepares to lead negotiations with over 70 countries in the coming weeks. China remains an outlier owing to its retaliation.

The situation remains fluid, with developments coming in by the hour.

These announcements come as investors sell out of everything American, including US bonds, which typically attract inflows when equities decline. This suggests that investors are moving away even from the traditionally perceived US safe-haven assets, resulting in the sharpest swings in 10-year bond yields in two decades. Disorder in the bond market may force the Federal Reserve to step in sooner, although we're not there yet.

Looking ahead, the FOMC minutes will be released later today. These are likely to be considered stale and play second fiddle to any trade tariff developments.

Corporate news

Apple (NASDAQ:AAPL) is falling 2% premarket, extending losses into a fifth day,, resulting in the share price falling around 25% of its market value. Apple is being hit hard owing to its reliance on China.

Retail is also under pressure amid uncertainty over the impact of tariffs on trade partners under terror rating consumer confidence target Best Buy (NYSE:BBY) and Home Depot (NYSE:HD) I down over 3%.

Auto makers are also falling as the Trump administration's tariffs in dozens of countries came into effect overnight.. Ford (NYSE:F) and General Motors (NYSE:GM) trade down 3% and 2%,, respectively.

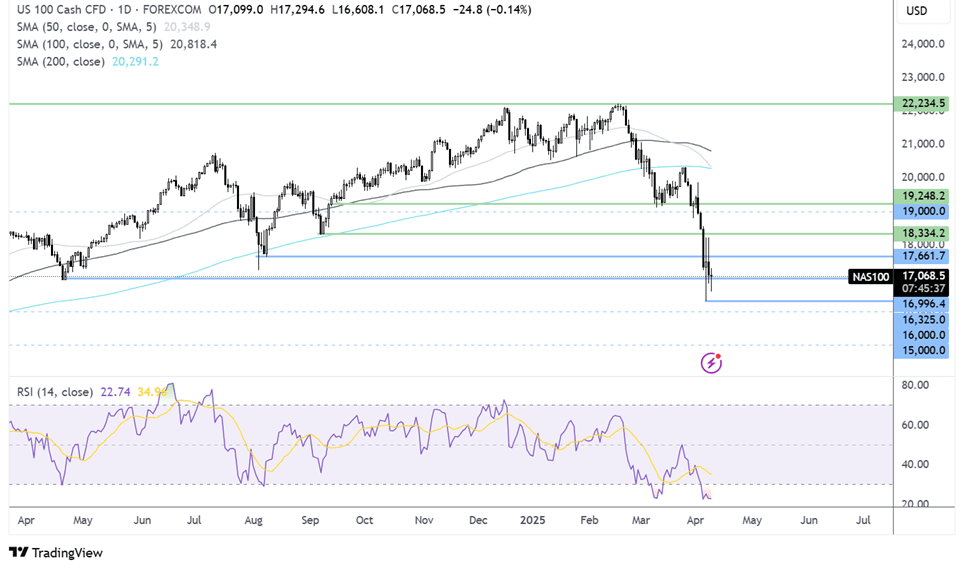

Nasdaq 100 forecast – Technical Analysis.

The Nasdaq 100 trades over 20% lower from its recent high and continues to see heightened volatility, with the price recovering from earlier lows of 16,600 back above 17,000. The RSI remains deeply oversold on multiple time frames, so sellers should be cautious. Should support hold at 17,000, buyers could look towards resistance at 17,650 and 18,350. It would take a rise above 19,250 to negate the downtrend. However, the 50 SMA is crossing below the 100 SMA in a death cross bearish signal, which could point to further losses. A break below 17,000 and 16,325 creates a lower low.

FX Markets – USD Falls, EUR/USD Rises

The US Dollar is falling sharply as the trade war escalates and de-dollarisation takes hold. Falling US stocks, treasuries, and the USD are a worrying combination as recession fears build. The FOMC minutes are due later today.

The EUR/USD is rising by 1% mid-week USD demand as the trade war ramps up. The EUR has benefited from the USD sell-off as investors look for alternatives to park funds.

The GBP/USD is rising above 128 as the pound capitalizes on the US dollar weakness amid the escalating trade war. Bank of England's Financial Policy Committee report highlighted that the shifting global trading arrangements get home financial stability quite depressing growth.

Oil Tanks to a fresh 4-Year Low

Oil prices are tanking to the lowest level in four years, with WTI at $55 per barrel as the trade war ramps up between China and the US. This comes as OPEC+ also decided to ramp up oil production more quickly than expected, raising the risk of oversupply. Data from API showed US crude inventories fell by 1.1 million barrels compared to expectations for a build of 1.4 million.