Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed lower: Shanghai Comp -0.96%, Hang Seng -0.49%, Nikkei -0.01%

- In Europe 9 out of 13 markets are trading higher: CAC +0.29%, DAX +1.14%, FTSE +0.24%

- Fair Value: S&P +0.28, NASDAQ +3.27, Dow +3.67

- Total Volume: 2.29 million ESM & 487 SPM traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes the 8-Week Bill Settlement, Charles Evans Speaks 7:00 AM ET, John Williams (NYSE:WMB) Speaks 8:30 AM ET, Redbook 8:55 AM ET, Charles Evans Speaks 9:45 AM ET, Jerome Powell Speaks 9:55 AM ET, Factory Orders 10:00 AM ET, Lael Brainard Speaks 3:45 PM ET, and Robert Kaplan Speaks 6:45 PM ET.

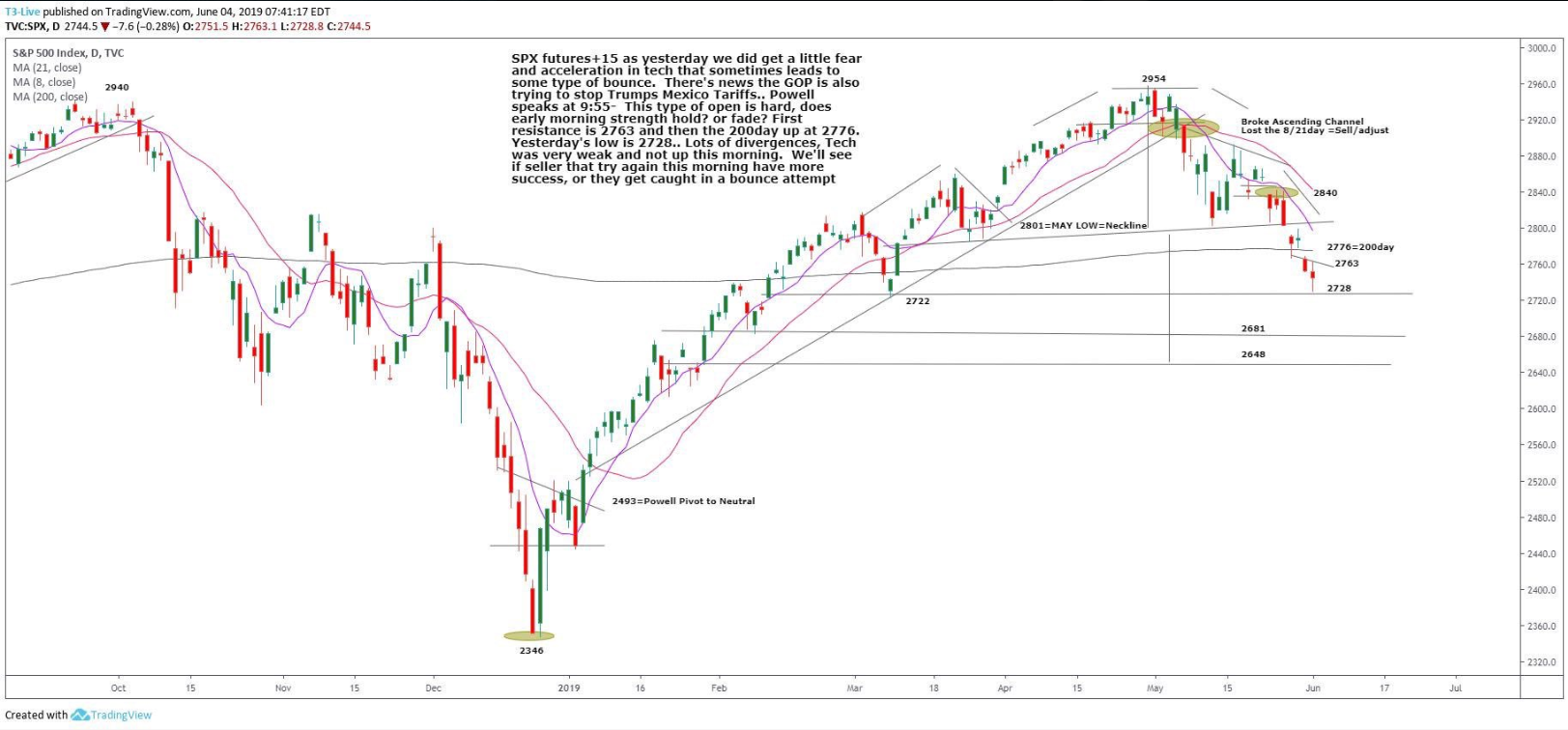

S&P 500 Futures: Market Leader Nasdaq Falls

Chart courtesy of Scott Redler @RedDogT3 – $spx futures +15. We’ll see they type of bounce today as tech will be important.

The S&P 500 futures (ESM19:CME) gapped lower Sunday night to open the Globex session at 2741.00, down -11.50 handles from Friday’s close. It would then go down to print a low at 2731.25, and rally to print a high of 2752.00, then open Monday’s regular trading hours at 2751.00.

The morning trade consisted of wide, heavy, algo driven swings. The ES first traded up to 2759.75 after the 8:30 CT bell, then down to 2738.00, then back up through the opening range to a new high at 2763.75, all in the first 90 minutes of trading.

Once the new high was in, the ES turned around and set its sights on the Globex low, but stopped short, only making it down to 2735.00. Volume dropped significantly, but the selling pressure was still strong.

At 12:30, James Bullard announced that an interest rate cut could be warranted to help lift inflation, and the ES reacted in kind, spiking up to 2756.75. After that, the futures pulled back to make a new RTH low by one tick, then ran back up to 2753.00, before going down to make another new low at 2728.75.

Going into the close, when the MiM came out showing $543M to buy, the ES was trading at 2735.75. It would then go on to rally, printing 2743.75 on the 3:00 cash close, and 2750.25 on the 3:15 futures close, down -2.50 handles on the day.

In the end, the overall tone of the ES was pretty weak. In terms of the days overall trade, total volume was high, with 2.2 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.