What a way to slide into Labor Day weekend and that last gasp of summer feeling. The Nasdaq 100 closed out August at all-time highs. It has gained nearly 500% since the 2009 low. The ‘crash’ during the financial crisis does not even look that bad on the long-term chart. And there does not seem to be an end in sight — yet.

Of course every pundit and ‘expert’ is calling for a pullback; anywhere from 5% next week to a full crash. But the price action just does not warrant it. As for economic conditions, you be the judge. Second-quarter GDP was just revised to 3.0% and Q3 is now expected to print above 3%. Unemployment is near record lows and inflation is non-existent.

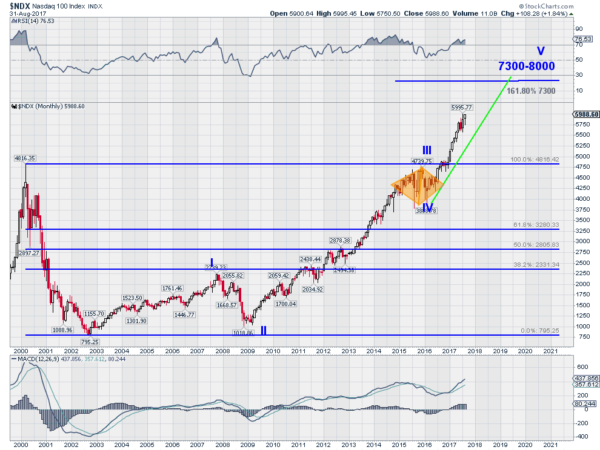

The chat above shows the Nasdaq 100 over the last 18 years. It suggests that there may still be a long way to go in the Index. An Elliott Wave measured off of the low following the Tech bubble shows it in the final up-wave of a long-term movement. I admit that Elliott Wave is not my best tool but it fits with other indications.

The move off of the 2009 low into the Diamond consolidation during 2015 and 2016 suggests a target to near 8000 on the move to the upside. And the break above the 2000 high leaves the 161.8% extension at about 7300. Momentum is bullish as well and strong.

So sit back, enjoy the last days of summer. Toss some burgers on the grill and whistle a happy tune.