Last week (see here), I found that the NASDAQ 100 (NDX):

"I will be looking for a low around $13,000+/-200 from where the next leg is higher to ideally $14,200+/-200 kicks in. Due to the extension, it means support has now been raised to the $12,900 level. Below it, on a daily closing basis, the red path becomes much more likely with (red) wave-b down to ideally $12,100 before red wave-c kicks in."

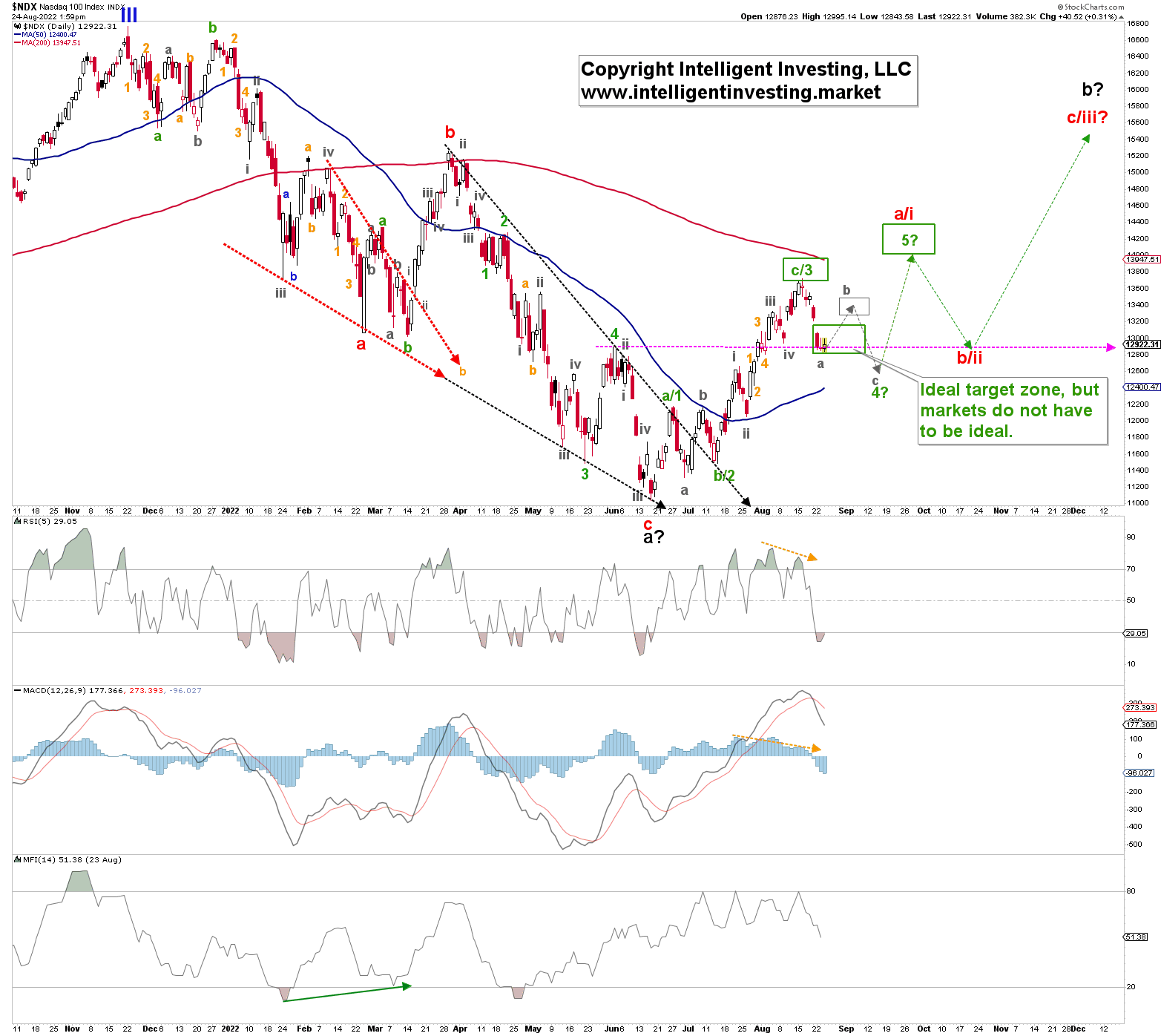

The index has, so far, bottomed in the low- to mid $12,800s this week. See Figure 1 below.

However, the decline from last week's high appears five Elliott Wave Principle (EWP) waves lower. Since (green) wave b/2 was IMHO a running flat, which took almost a month to complete, the rule of alternation tells me that IF this is a wave-4, it will either be a triangle or a zigzag, and it should also take several weeks to complete. The former corrective pattern has an internal 3-3-3 path, whereas the latter is a 5-3-5.

Figure 1. NASDAQ 100 daily candlestick chart with detailed EWP count and technical indicators

I expect a bounce soon with five waves lower about complete: grey wave-b. It should target based on current data, ideally around $13400+/-100. The c-wave should kick in to complete the correction at ideally $12,500+/-100.

Bottom Line

As shared last week, the NDX has only done three waves up from the June low and has already reached the $13,000+/-200 target zone. In this article, I continue with the five waves up bullish possibility.

The Bulls must complete the 4th wave in a zigzag (a-b-c) pattern to accomplish this pattern. Wave-a is about to finish, wave-b should rally the index back to around $13400+/-100, and then wave-c should ideally target around $12,500+/-100. This level is slightly lower than the $12,900 level identified last week. Still, since the current decline has already reached the lower end of the ideal target zone, one must adjust accordingly: anticipate, monitor, and adjust.