I know I should not have to explain why a move higher in the stock market is good. But lets start with the first point and work our way to that. The Nasdaq 100 was the last major index to move up to new highs. But in fact, the Nasdaq 100 ETF (O:QQQ) still has not broken above its high mark of 120.50 from 2000. Close but not quite there.

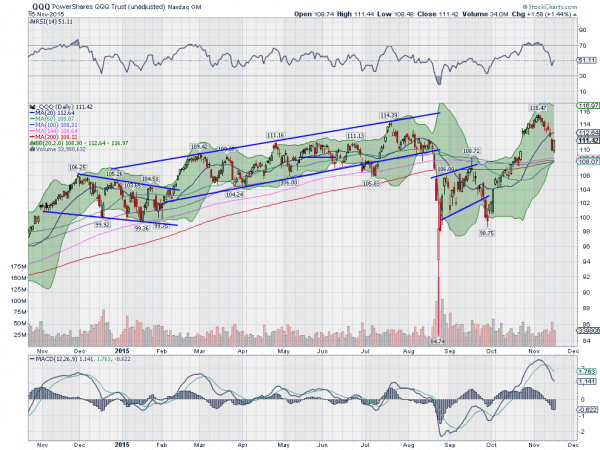

It looked well on its way when the August pullback occurred, stalling the QQQ just 6 points shy. Then the massive move off of the September low got it back to 5 points away. The chart below shows the heart break. But it also shows why the short term looks positive. And that could mean good things for that long-time ago all-time high.

There are just three things to focus on in this chart. The first is a Japanese candlestick pattern called a 'Piercing Line'. Friday last week had a long red-down candle and Monday retraced over half of that to the upside. That's the Piercing Line and it is a reversal pattern. Confirmation Tuesday by a higher close would signal a reversal to the upside. This would solidify a higher low to go along with the higher high from earlier in November, an uptrend.

The second is that this possible reversal is happening as the index has filled the gap from the move higher in October. Gaps getting filled can often provide support for a change to the upside. Finally look at the RSI. This momentum indicator pulled back when the market dropped over the first half of November, but held in bullish territory and is now reversing higher.

These three indications signal it's time to watch for a move back to new 14-year and, possibly, all-time highs in the QQQ. Tuesday confirmation is the key.