Last week I found:

“The index could still move higher to the 61.80% or the 76.40% retrace levels, without any problem, but the daily RSI5 is already getting overbought, which is all that is required for a B-wave.

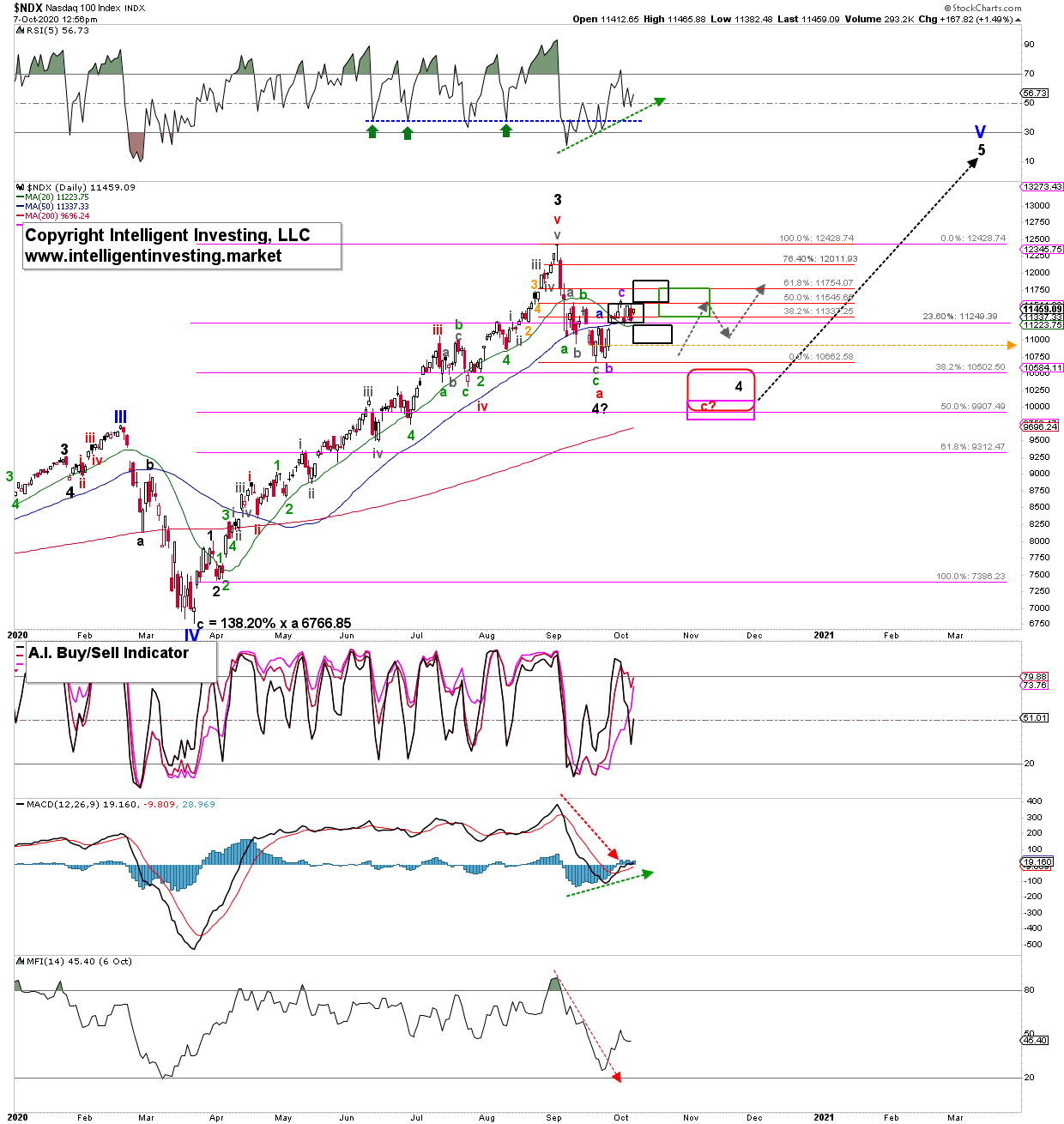

Time to become more cautious, take profits, reduce long-side risk, etc. As long as the next anticipated retrace (grey [down] arrow for possible green wave-b) stays above the orange horizontal support level at 10900 on a closing basis, the grey path can still materialize.

Regardless, … expect near-term downside. So, watch that 10900 level. If [it breaks], I can now narrow down the ideal target red c-wave target zone further, compared to last week, to ideally 9750-10150.”

Almost a week later and the Nasdaq 100 is still trading a bit below last week’s price. Thus, although still, no breakdown below the critical 10900 level has occurred, my warning for lower prices was warranted, especially since the NDX lost almost 2.9% the day after my update. It then gained 2.3% on Monday, lost 1.9% yesterday, and is now trying to add 1.7% back, with about 1.1% from the overnight futures market alone. Does that sound like enough whipsawing for you?

To make matters worse, the index is now where it was in late-August and mid-September. It has, essentially, been stuck in a trading range over the last eight trading days, today included: 11250-11545 (middle black box). But it is still trying to follow the grey path I outlined several weeks ago, with the first up-down pattern complete. Will it succeed?

Figure 1. NDX100 daily candlestick chart with EWP count.

Let’s see. When markets move sideways, the Elliott Wave Principle (EWP) is not the most useful tool to help forecast what is most likely to be next. There are then simply too many options because, remember, markets are stochastic and all about probabilities of possibilities. In such an instance, I prefer to look at breakouts and breakdowns and where the price is in relation to its important Simple Moving Averages: 10-day, 20-day, 50-day and 200-day. And how these are related to each other. Is price above a rising 20d>50d>200d, or below its declining 20d<50d<200d SMA? The former is a bullish setup, and then I prefer, logically, the bullish EWP option, whereas the former has me place my bets on a bearish EWP count.

What does all this mean for today’s market? It is above its 20d, 50d and 200d SMA. That is bullish. But the 20d is below its 50d, so the glass is about two-thirds full. Then, the price will have to close above 11545 to be then able to target ideally 11840 based on simple symmetry (upper black box).

Conversely, a close below 11250 targets 10955. Very close to the critical 10900 level (orange dotted arrow). Until either happens, this market can continue to chop inside the trading range it has been stuck in for almost two weeks now. Of course, always be wary of the false breakouts and breakdowns: there are no guarantees.

Bottom line: Yes, I admit, Elliott Wave is not always the best available tool, especially not in sideways, choppy markets. In such cases, it is better to look at trading ranges and watch for breakouts, breakdowns and where the price is in relation to its moving average to help increase the odds of forecasting the right direction. So watch for a breakout or breakdown, and the associated initial price targets based on simple symmetry.