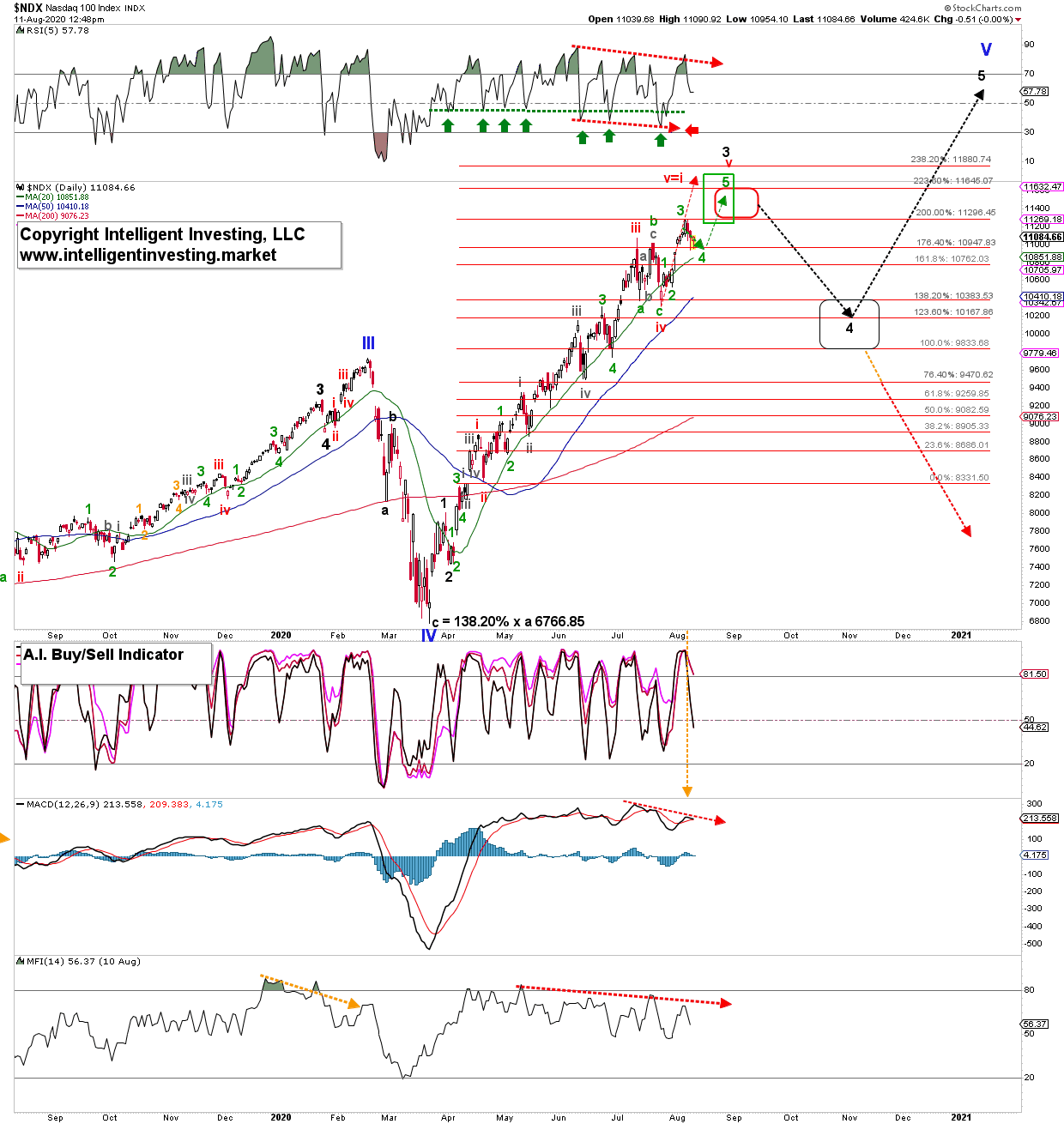

One week ago, I showed, using the Elliott Wave Principle, where I expected the Nasdaq 100 to go:

“… to ideally $11,295, but it can extend to as high as $11,750, for (green) wave-3, [from which] we should expect a brief one- to two-day pullback soon for (green) wave-4 before (green) wave-5 takes hold as shown with the green dotted arrows.”

So far, so good. The Nasdaq 100 topped at $11,282 on Aug. 6, two days after my forecast, and I was only off by 7p (0.06%). Not too shabby an outlook, if I may say so, showing how precise, accurate and reliable the EWP can be.

So far, the current correction since that high has lasted a few days, as I anticipated it would. I, therefore, still view these few down days as green wave-4. Once complete, green wave-5 should get going to ideally $11,400-11,600. See Figure 1 below.

Figure 1.

As stated last week:

“… once this (green) 5th wave completes, it completes a larger five-waves up (red i, ii, iii, iv, and v). This pattern would fit well with the more and more negatively diverging technical indicators (red dotted arrows). The index is moving higher on less momentum, and eventually, the index will catch up with this divergence and start a more significant correction: black wave-4. Once the index reaches the red target zone, I expect it to complete black wave-3. Then, as said, a more significant correction should unfold, ideally back to $10,385-9,825 with the upper end preferred because, in bull markets, the upside surprises and the downside disappoints. From that ideal wave-4 target zone, I anticipate the last black wave-5 up to new ATHs. It will, in turn, complete the impulse up off the March 23 low as well as the entire bull since 2009, possibly since 2002.”

For now, I see no reason to change my point of view unless the Nasdaq 100 continues its decline and for starters closes below $10,760: warning 1. The bull’s 2nd warning – that larger wave-4 has already begun – is on a close below $10,707. Confirmation of a more significant correction unfolding will be on a close below $10,690: warning 3. It is, as usual, “three strikes, and you’re out.” One could, for example, use these price levels as stops if so desired.