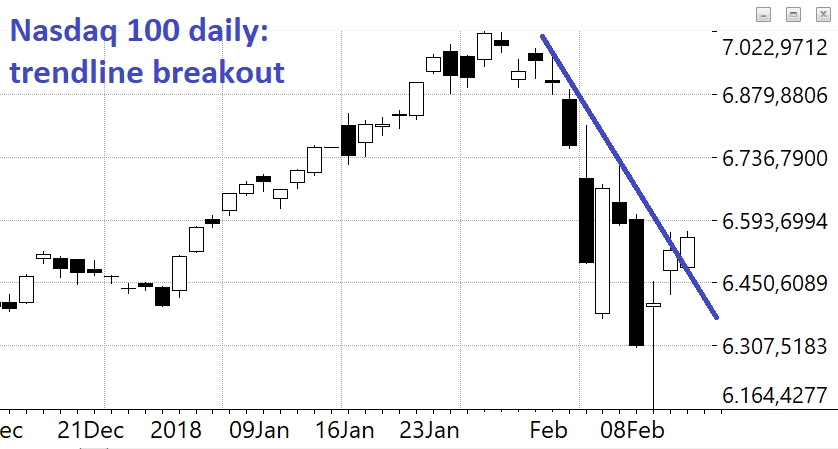

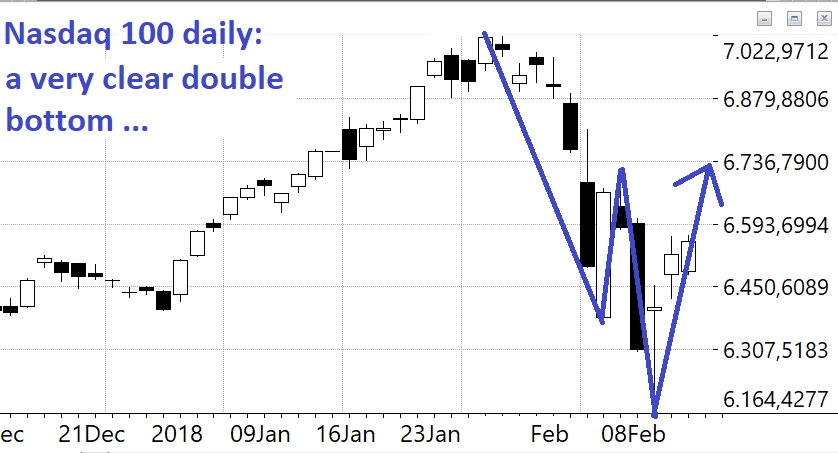

Sometimes markets talk to us and our job is only to listen without adding any degree of complexity. In the current market condition if we keep our analysis at the easiest level, that is at that level at which everybody is forced to agree, we can have a grasp on what is boiling in the big pot of the US stock market. There are two proofs that favor an imminent rise in stock prices: the first is a fresh breakout of a declining trendline on the Nasdaq 100 index and the second one is a double bottom in formation always on the Nasdaq 100 index. Just these two elements show us clearly today what is the direction markets intend to take. We will have a definitive confirmation of this newly born upward trend when we will see a breakout of the 6.716 Nasdaq 100 resistance that is the highest price level reached during the recent turmoil.

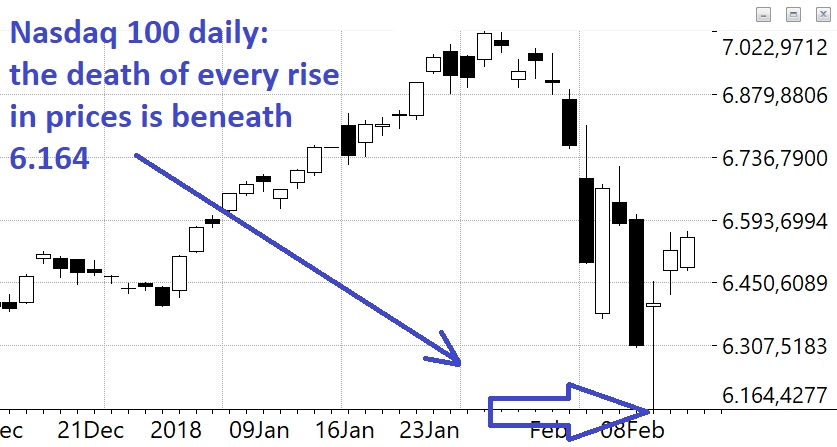

We have to remind in these difficult moments that a downturn of just 10% from the pick does mean nothing in terms of a long term upward trend. It is clear that to have a 50% market collapse you must begin with a 10% fall but up to a 20% decline statistics shows that it is simply a normal market correction.

We also have a point where we will be authorized by classic technical analysis to call this a “normal market correction” with some more negative words: this point is the lowest level reached by prices during last February fall and this support is on Nasdaq 100 index the 6.164 level.

We do not know if an easy analysis will help to detect the future direction of the US stock markets but reality is that if you keep your view of the markets on solid and easy to control basis then you will not follow other people’ ideas and feelings without a clear strategy. Too much information and too much complexity often are the same as no information at all. Keep it simple and you will see that it helps.