Two weeks, I showed using the Elliott Wave Principle (EWP) the Nasdaq 100 had reduced its option from four to two.

I concluded:

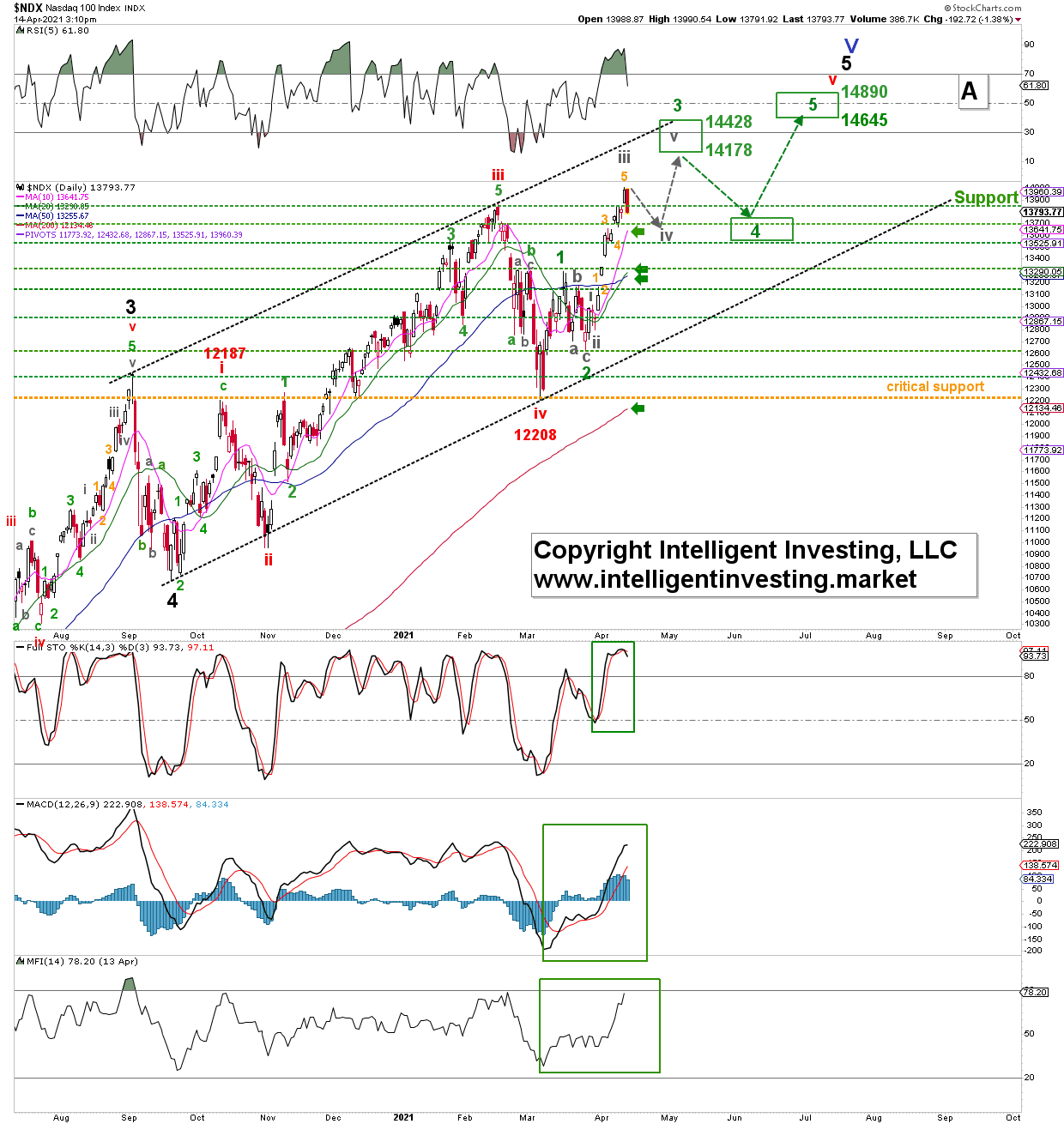

"I prefer to look higher per an EWP impulsive move to NDX 14,178-14,428 for a minor 3rd wave, then a retrace to ideally NDX 13,533-13,733 for a 4th wave, followed by the last move higher – a 5th wave- to ideally NDX 14,645-14,890 to complete the impulse that started March 2020.

So far, so good, as the NDX reached a new all-time high. But it is seeing some red today. So is the preferred EWP count to the high-14,000s still on track?

Figure 1 below says yes, but as long as the index can stay above 13,540 on a closing basis. If not, then that would be a severe warning to the bulls that the decline from yesterday's all-time high is not the grey minute wave-iv, but something else.

Figure 1: NDX100 daily candlestick chart with EWP count and technical indicators.

Hence, for now, I prefer to view the index in a small degree 4th wave, which should last a few days, and to fall back to ideally the 13,540-13,720 zone, which is the 23.60-38.20% retrace of the length of the last grey minute wave-iii, which would be normal 4th wave behavior. From that zone, I then expect a rally to the NDX 14,178-14,428 for minute wave-v of green wave minor 3, as shown already two weeks ago. The up-pointing technical indicators (green boxes) support higher prices as well. Besides, the index is well above its rising 10d, 20d, 50d, and 200d SMA as pointed out by the horizontal small, green arrows, which add weight to the evidence of the index being in a 100% bull run.

Bottom line: The NDX took the "impulse move to the upside" road map a few weeks ago, and my preferred view back then "to look higher per an EWP impulsive move to NDX 14,178-14,428 for a minor 3rd wave, then a retrace to ideally NDX13533-13733 for a 4th wave, followed by the last move higher – a 5th wave- to ideally NDX 14,645-14,890," was so far correct and as such remains my preferred point of view. It would take a close below 13,540 from current levels to put pressure on this impulse pattern. I view the decline that started today as a minute-degree 4th wave. One can see it as some profit-taking after an over 7% gain since my last update and an 11% run since the late-March low.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI